W-2 (Wage And Tax Statements) Guide

ADVERTISEMENT

W-2 (Wage and Tax Statements) Guide

As you review your Form W-2 Statement for 2016, consider the following:

1. Comparing your Form W-2 and your final paycheck/advice statement:

The Federal Taxable Wages reported in Box 1 (Wages, Tips, and Other Compensation) on the

Form W-2 is generally the same amount that is reported as the Federal Taxable Gross on your

final paycheck/advice statement for calendar year 2016.

2. Explaining Form W-2 wage reporting differences:

Social Security Wages (Box 3) and Medicare Wages (Box 5) are in many instances different

from the amount reported for Federal Taxable Wages (Box 1). The difference, for the most part,

represents before tax contributions to the following:

• 414(h) State Pension Plans

• 403(b) Tax Sheltered Annuities (TSA)

• 457(b) Deferred Compensation

• In addition these amounts may be different because the maximum Social Security

Taxable Wage is capped at $118,500.00. There is no cap on the taxable Medicare wages.

3. Reporting deductions for the Health Care Spending Account:

The total amount deducted for the health care spending account is reported as a year-to-date

amount on your final paycheck/advice statement for the calendar year. This deduction is not

reported on the Form W-2 even though the total amount is excluded from boxes 1, 3 and 5.

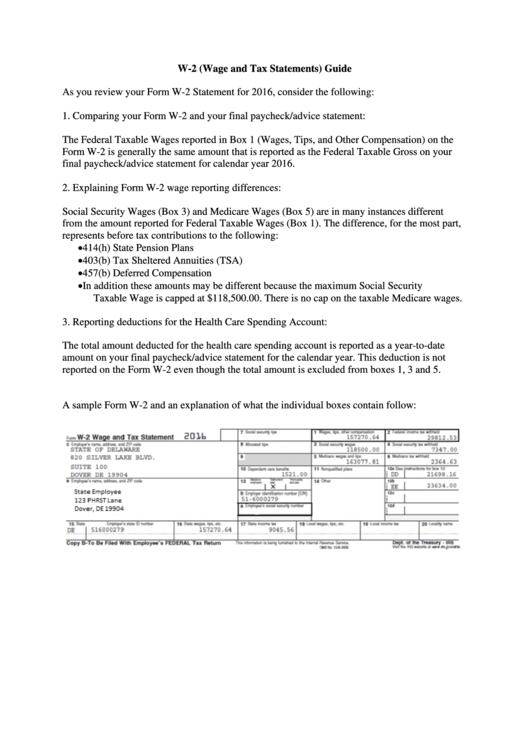

A sample Form W-2 and an explanation of what the individual boxes contain follow:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3