Form It-Estate - Estate Tax Return - 2017

ADVERTISEMENT

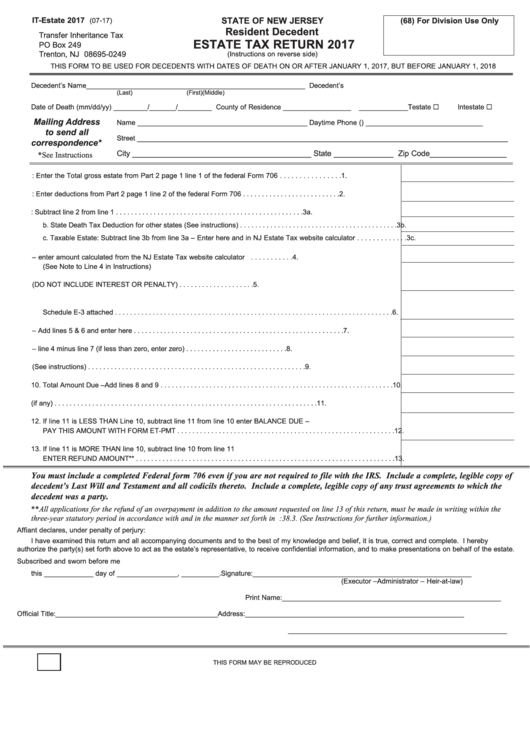

IT-Estate 2017

STATE OF NEW JERSEY

(07-17)

(68) For Division Use Only

Resident Decedent

Transfer Inheritance Tax

ESTATE TAX RETURN 2017

PO Box 249

Trenton, NJ 08695-0249

(Instructions on reverse side)

THIS FORM TO BE USED FOR DECEDENTS WITH DATES OF DEATH ON OR AFTER JANUARY 1, 2017, BUT BEFORE JANUARY 1, 2018

Decedent’s Name__________________________________________________________ Decedent’s S.S. No. ____________________________________

(Last)

(First)

(Middle)

Testate ¨

Intestate ¨

Date of Death (mm/dd/yy) _________/_______/_________ County of Residence __________________ _____________

Mailing Address

Name _____________________________________________ Daytime Phone (

) _______________________________

to send all

_______________________________________________________________________________________

Street

correspondence*

*See Instructions

City __________________________________________ State ______________ Zip Code__________________

1. GROSS ESTATE: Enter the Total gross estate from Part 2 page 1 line 1 of the federal Form 706 . . . . . . . . . . . . . . . . 1.

2. DEDUCTIONS: Enter deductions from Part 2 page 1 line 2 of the federal Form 706 . . . . . . . . . . . . . . . . . . . . . . . . . . 2.

3. a. Tentative Taxable Estate: Subtract line 2 from line 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3a.

b. State Death Tax Deduction for other states (See instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3b.

c. Taxable Estate: Subtract line 3b from line 3a – Enter here and in NJ Estate Tax website calculator . . . . . . . . . . . . . 3c.

4. Tentative New Jersey Estate Tax – enter amount calculated from the NJ Estate Tax website calculator . . . . . . . . . . . 4.

(See Note to Line 4 in Instructions)

5. Credit for New Jersey Inheritance Tax Paid (DO NOT INCLUDE INTEREST OR PENALTY) . . . . . . . . . . . . . . . . . . . . 5.

6. Enter the portion of the tax attributable to property located outside of New Jersey from line 4 of

Schedule E-3 attached . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6.

7. Total Credits – Add lines 5 & 6 and enter here . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7.

8. Net New Jersey Estate Tax Due – line 4 minus line 7 (if less than zero, enter zero) . . . . . . . . . . . . . . . . . . . . . . . . . . . 8.

9. Interest and Penalty Due (See instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9.

10. Total Amount Due – Add lines 8 and 9 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10.

11. Payment on Account (if any) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11.

12. If line 11 is LESS THAN Line 10, subtract line 11 from line 10 enter BALANCE DUE –

PAY THIS AMOUNT WITH FORM ET-PMT . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12.

13. If line 11 is MORE THAN line 10, subtract line 10 from line 11

ENTER REFUND AMOUNT** . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13.

You must include a completed Federal form 706 even if you are not required to file with the IRS. Include a complete, legible copy of

decedent’s Last Will and Testament and all codicils thereto. Include a complete, legible copy of any trust agreements to which the

decedent was a party.

**All applications for the refund of an overpayment in addition to the amount requested on line 13 of this return, must be made in writing within the

three-year statutory period in accordance with and in the manner set forth in R.S. 54:38.3. (See Instructions for further information.)

Affiant declares, under penalty of perjury:

I have examined this return and all accompanying documents and to the best of my knowledge and belief, it is true, correct and complete. I hereby

authorize the party(s) set forth above to act as the estate’s representative, to receive confidential information, and to make presentations on behalf of the estate.

Subscribed and sworn before me

this _____________ day of ________________, __________.

Signature:

__________________________________________________________

(Executor – Administrator – Heir-at-law)

Print Name: __________________________________________________________

Official Title:

___________________________________________

Address:

__________________________________________________________

__________________________________________________________

THIS FORM MAY BE REPRODUCED

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11