Form Sc Sch.tc-49 - Alternative Fuels Research And Development Credit

ADVERTISEMENT

1350

1350

STATE OF SOUTH CAROLINA

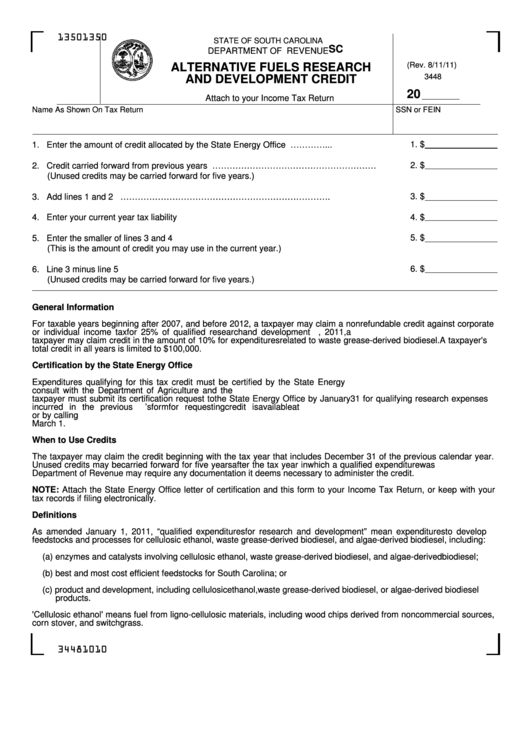

SC SCH.TC-49

DEPARTMENT OF REVENUE

(Rev. 8/11/11)

ALTERNATIVE FUELS RESEARCH

3448

AND DEVELOPMENT CREDIT

20

Attach to your Income Tax Return

Name As Shown On Tax Return

SSN or FEIN

1. $

1. Enter the amount of credit allocated by the State Energy Office ..............................…………...

2. Credit carried forward from previous years ............…………………………………………………

2. $

(Unused credits may be carried forward for five years.)

3. $

3. Add lines 1 and 2 ...............................……………………………………………………………….

4. $

4. Enter your current year tax liability ............................................................................................

5. $

5. Enter the smaller of lines 3 and 4 ..............................................................................................

(This is the amount of credit you may use in the current year.)

6. $

6. Line 3 minus line 5 ....................................................................................................................

(Unused credits may be carried forward for five years.)

General Information

For taxable years beginning after 2007, and before 2012, a taxpayer may claim a nonrefundable credit against corporate

or individual income tax for 25% of qualified research and development expenditures. Effective January 1, 2011, a

taxpayer may claim credit in the amount of 10% for expenditures related to waste grease-derived biodiesel. A taxpayer's

total credit in all years is limited to $100,000.

Certification by the State Energy Office

Expenditures qualifying for this tax credit must be certified by the State Energy Office. The State Energy Office may

consult with the Department of Agriculture and the S.C. Institute for Energy Studies on standards for certification. A

taxpayer must submit its certification request to the State Energy Office by January 31 for qualifying research expenses

incurred in the previous calendar year. The State Energy Office’s form for requesting credit is available at

or by calling 803-737-8030. The State Energy Office will notify the taxpayer of the credit amount by

March 1.

When to Use Credits

The taxpayer may claim the credit beginning with the tax year that includes December 31 of the previous calendar year.

Unused credits may be carried forward for five years after the tax year in which a qualified expenditure was made. The

Department of Revenue may require any documentation it deems necessary to administer the credit.

NOTE: Attach the State Energy Office letter of certification and this form to your Income Tax Return, or keep with your

tax records if filing electronically.

Definitions

As amended January 1, 2011, “qualified expenditures for research and development” mean expenditures to develop

feedstocks and processes for cellulosic ethanol, waste grease-derived biodiesel, and algae-derived biodiesel, including:

(a) enzymes and catalysts involving cellulosic ethanol, waste grease-derived biodiesel, and algae-derived biodiesel;

(b) best and most cost efficient feedstocks for South Carolina; or

(c) product and development, including cellulosic ethanol, waste grease-derived biodiesel, or algae-derived biodiesel

products.

'Cellulosic ethanol' means fuel from ligno-cellulosic materials, including wood chips derived from noncommercial sources,

corn stover, and switchgrass.

34481010

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1