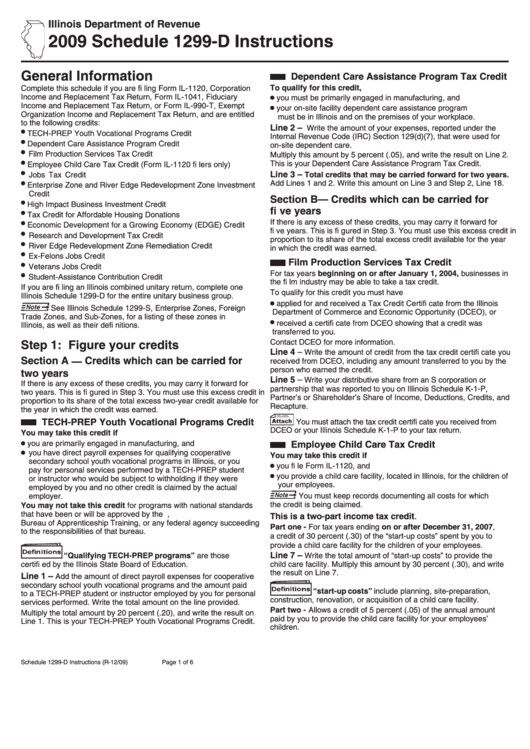

Schedule 1299-D Instructions - Illinois Department Of Revenue - 2009

ADVERTISEMENT

Illinois Department of Revenue

2009 Schedule 1299-D Instructions

General Information

Dependent Care Assistance Program Tax Credit

To qualify for this credit,

Complete this schedule if you are fi ling Form IL-1120, Corporation

•

Income and Replacement Tax Return, Form IL-1041, Fiduciary

you must be primarily engaged in manufacturing, and

Income and Replacement Tax Return, or Form IL-990-T, Exempt

•

your on-site facility dependent care assistance program

Organization Income and Replacement Tax Return, and are entitled

must be in Illinois and on the premises of your workplace.

to the following credits:

Line 2 –

Write the amount of your expenses, reported under the

•

TECH-PREP Youth Vocational Programs Credit

Internal Revenue Code (IRC) Section 129(d)(7), that were used for

•

Dependent Care Assistance Program Credit

on-site dependent care.

•

Film Production Services Tax Credit

Multiply this amount by 5 percent (.05), and write the result on Line 2.

•

This is your Dependent Care Assistance Program Tax Credit.

Employee Child Care Tax Credit (Form IL-1120 fi lers only)

•

Line 3 –

Jobs Tax Credit

Total credits that may be carried forward for two years.

•

Add Lines 1 and 2. Write this amount on Line 3 and Step 2, Line 18.

Enterprise Zone and River Edge Redevelopment Zone Investment

Credit

Section B — Credits which can be carried for

•

High Impact Business Investment Credit

fi ve years

•

Tax Credit for Affordable Housing Donations

•

If there is any excess of these credits, you may carry it forward for

Economic Development for a Growing Economy (EDGE) Credit

fi ve years. This is fi gured in Step 3. You must use this excess credit in

•

Research and Development Tax Credit

proportion to its share of the total excess credit available for the year

•

River Edge Redevelopment Zone Remediation Credit

in which the credit was earned.

•

Ex-Felons Jobs Credit

Film Production Services Tax Credit

•

Veterans Jobs Credit

For tax years beginning on or after January 1, 2004, businesses in

•

Student-Assistance Contribution Credit

the fi lm industry may be able to take a tax credit.

If you are fi ling an Illinois combined unitary return, complete one

To qualify for this credit you must have

Illinois Schedule 1299-D for the entire unitary business group.

•

applied for and received a Tax Credit Certifi cate from the Illinois

See Illinois Schedule 1299-S, Enterprise Zones, Foreign

Department of Commerce and Economic Opportunity (DCEO), or

Trade Zones, and Sub-Zones, for a listing of these zones in

•

received a certifi cate from DCEO showing that a credit was

Illinois, as well as their defi nitions.

transferred to you.

Contact DCEO for more information.

Step 1: Figure your credits

Line 4 –

Write the amount of credit from the tax credit certifi cate you

Section A — Credits which can be carried for

received from DCEO, including any amount transferred to you by the

person who earned the credit.

two years

Line 5 –

Write your distributive share from an S corporation or

If there is any excess of these credits, you may carry it forward for

partnership that was reported to you on Illinois Schedule K-1-P,

two years. This is fi gured in Step 3. You must use this excess credit in

Partner’s or Shareholder’s Share of Income, Deductions, Credits, and

proportion to its share of the total excess two-year credit available for

Recapture.

the year in which the credit was earned.

TECH-PREP Youth Vocational Programs Credit

You must attach the tax credit certifi cate you received from

DCEO or your Illinois Schedule K-1-P to your tax return.

You may take this credit if

•

you are primarily engaged in manufacturing, and

Employee Child Care Tax Credit

•

you have direct payroll expenses for qualifying cooperative

You may take this credit if

secondary school youth vocational programs in Illinois, or you

•

you fi le Form IL-1120, and

pay for personal services performed by a TECH-PREP student

•

you provide a child care facility, located in Illinois, for the children of

or instructor who would be subject to withholding if they were

your employees.

employed by you and no other credit is claimed by the actual

employer.

You must keep records documenting all costs for which

the credit is being claimed.

You may not take this credit for programs with national standards

that have been or will be approved by the U.S. Department of Labor,

This is a two-part income tax credit.

Bureau of Apprenticeship Training, or any federal agency succeeding

Part one - For tax years ending on or after December 31, 2007,

to the responsibilities of that bureau.

a credit of 30 percent (.30) of the “start-up costs” spent by you to

provide a child care facility for the children of your employees.

Line 7 –

“Qualifying TECH-PREP programs” are those

Write the total amount of “start-up costs” to provide the

certifi ed by the Illinois State Board of Education.

child care facility. Multiply this amount by 30 percent (.30), and write

the result on Line 7.

Line 1 –

Add the amount of direct payroll expenses for cooperative

secondary school youth vocational programs and the amount paid

“start-up costs” include planning, site-preparation,

to a TECH-PREP student or instructor employed by you for personal

construction, renovation, or acquisition of a child care facility.

services performed. Write the total amount on the line provided.

Part two - Allows a credit of 5 percent (.05) of the annual amount

Multiply the total amount by 20 percent (.20), and write the result on

paid by you to provide the child care facility for your employees’

Line 1. This is your TECH-PREP Youth Vocational Programs Credit.

children.

Schedule 1299-D Instructions (R-12/09)

Page 1 of 6

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6