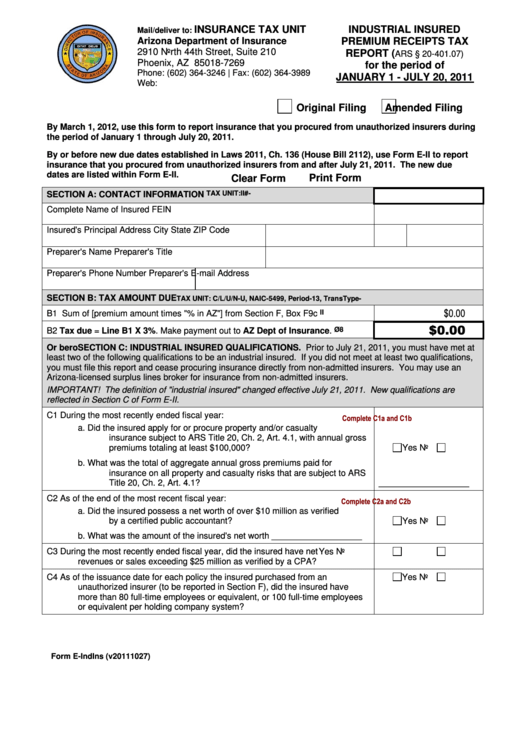

INSURANCE TAX UNIT

INDUSTRIAL INSURED

Mail/deliver to:

Arizona Department of Insurance

PREMIUM RECEIPTS TAX

2910 North 44th Street, Suite 210

REPORT (

ARS § 20-401.07)

Phoenix, AZ 85018-7269

for the period of

Phone: (602) 364-3246 | Fax: (602) 364-3989

JANUARY 1 - JULY 20, 2011

Web:

Original Filing

Amended Filing

By March 1, 2012, use this form to report insurance that you procured from unauthorized insurers during

the period of January 1 through July 20, 2011.

By or before new due dates established in Laws 2011, Ch. 136 (House Bill 2112), use Form E-II to report

insurance that you procured from unauthorized insurers from and after July 21, 2011. The new due

dates are listed within Form E-II.

Print Form

Clear Form

TAX UNIT:II#-

SECTION A: CONTACT INFORMATION

Complete Name of Insured

FEIN

Insured's Principal Address

City

State

ZIP Code

Preparer's Name

Preparer's Title

Preparer's Phone Number

Preparer's E-mail Address

SECTION B: TAX AMOUNT DUE

TAX UNIT: C/L/U/N-U, NAIC-5499, Period-13, TransType-

$0.00

II

B1

Sum of [premium amount times "% in AZ"] from Section F, Box F9c

$0.00

Ø8

B2

Tax due = Line B1 X 3%. Make payment out to AZ Dept of Insurance.

Or beroSECTION C: INDUSTRIAL INSURED QUALIFICATIONS. Prior to July 21, 2011, you must have met at

least two of the following qualifications to be an industrial insured. If you did not meet at least two qualifications,

you must file this report and cease procuring insurance directly from non-admitted insurers. You may use an

Arizona-licensed surplus lines broker for insurance from non-admitted insurers.

IMPORTANT! The definition of "industrial insured" changed effective July 21, 2011. New qualifications are

reflected in Section C of Form E-II.

C1

During the most recently ended fiscal year:

Complete C1a and C1b

a.

Did the insured apply for or procure property and/or casualty

insurance subject to ARS Title 20, Ch. 2, Art. 4.1, with annual gross

premiums totaling at least $100,000?

Yes

No

b.

What was the total of aggregate annual gross premiums paid for

insurance on all property and casualty risks that are subject to ARS

Title 20, Ch. 2, Art. 4.1?

___________________

C2

As of the end of the most recent fiscal year:

Complete C2a and C2b

a.

Did the insured possess a net worth of over $10 million as verified

by a certified public accountant?

Yes

No

b.

What was the amount of the insured's net worth

___________________

C3

During the most recently ended fiscal year, did the insured have net

Yes

No

revenues or sales exceeding $25 million as verified by a CPA?

C4

As of the issuance date for each policy the insured purchased from an

Yes

No

unauthorized insurer (to be reported in Section F), did the insured have

more than 80 full-time employees or equivalent, or 100 full-time employees

or equivalent per holding company system?

Form E-IndIns (v20111027)

1

1 2

2 3

3 4

4 5

5