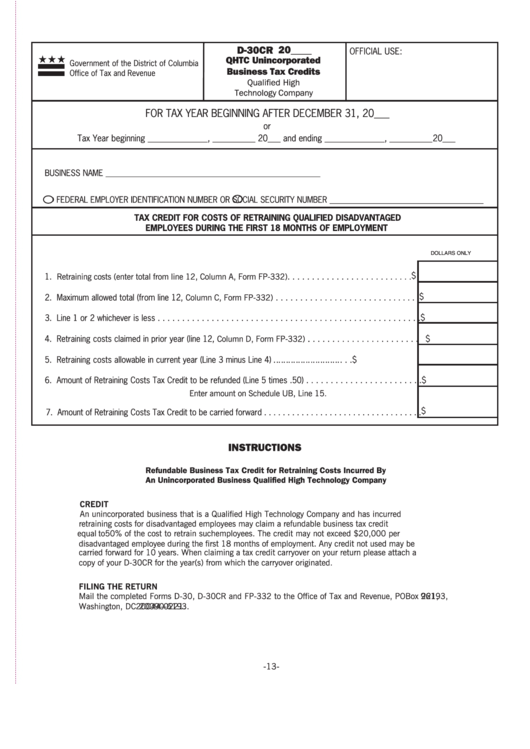

Form D-30cr - Qhtc Unincorporated Business Tax Credits

ADVERTISEMENT

D-30CR

20____

OFFICIAL USE:

QHTC Unincorporated

Government of the District of Columbia

Business Tax Credits

Office of Tax and Revenue

Qualified High

Technology Company

FOR TAX YEAR BEGINNING AFTER DECEMBER 31, 20___

or

Tax Year beginning ______________, __________ 20___ and ending ______________, __________

20___

BUSINESS NAME _____________________________________________________

FEDERAL EMPLOYER IDENTIFICATION NUMBER OR

SOCIAL SECURITY NUMBER ______________________________________

TAX CREDIT FOR COSTS OF RETRAINING QUALIFIED DISADVANTAGED

EMPLOYEES DURING THE FIRST 18 MONTHS OF EMPLOYMENT

DOLLARS ONLY

1. Retraining costs (enter total from line 12, Column A, Form FP-332) . . . . . . . . . . . . . . . . . . . . . . . . . . $

2. Maximum allowed total (from line 12, Column C, Form FP-332) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $

3. Line 1 or 2 whichever is less . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $

4. Retraining costs claimed in prior year (line 12, Column D, Form FP-332)

.

.

. . . . . . . . . . . . . . . . . . . . . . $

5. Retraining costs allowable in current year (Line 3 minus Line 4)

. . . . . . . . . . . . . . . . $

. . . . . . . . . . . . . .

6. Amount of Retraining Costs Tax Credit to be refunded (Line 5 times .50) . . . . . . . . . . . . . . . . . . . . . . . . $

Enter amount on Schedule UB, Line 15.

7. Amount of Retraining Costs Tax Credit to be carried forward . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $

INSTRUCTIONS

Refundable Business Tax Credit for Retraining Costs Incurred By

An Unincorporated Business Qualified High Technology Company

CREDIT

An unincorporated business that is a Qualified High Technology Company and has incurred

retraining costs for disadvantaged employees may claim a refundable business tax credit

equal to 50% of the cost to retrain such employees. The credit may not exceed $20,000 per

disadvantaged employee during the first 18 months of employment. Any credit not used may be

carried forward for 10 years. When claiming a tax credit carryover on your return please attach a

copy of your D-30CR for the year(s) from which the carryover originated.

FILING THE RETURN

Mail the completed Forms D-30, D-30CR and FP-332 to the Office of Tax and Revenue, PO Box 221,

96193,

Washington, DC 20044-0221.

20090-6193.

-13-

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1