OGE Form 450, 5 CFR Part 2634, Subpart I

U .S. Office of Government Ethics ( anuary

17)

Form Approved

(Replaces June 2015 edition)

OMB No. 3209-0006

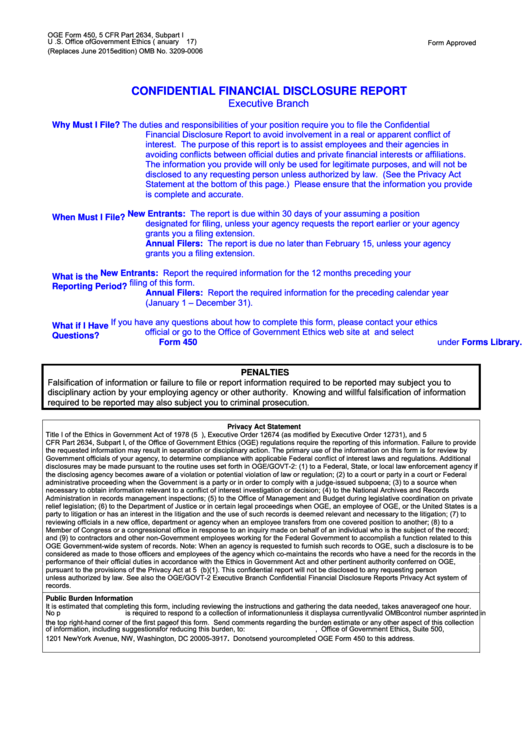

CONFIDENTIAL FINANCIAL DISCLOSURE REPORT

Executive Branch

The duties and responsibilities of your position require you to file the Confidential

Why Must I File?

Financial Disclosure Report to avoid involvement in a real or apparent conflict of

interest. The purpose of this report is to assist employees and their agencies in

avoiding conflicts between official duties and private financial interests or affiliations.

The information you provide will only be used for legitimate purposes, and will not be

disclosed to any requesting person unless authorized by law. (See the Privacy Act

Statement at the bottom of this page.) Please ensure that the information you provide

is complete and accurate.

New Entrants: The report is due within 30 days of your assuming a position

When Must I File?

designated for filing, unless your agency requests the report earlier or your agency

grants you a filing extension.

Annual Filers: The report is due no later than February 15, unless your agency

grants you a filing extension.

New Entrants: Report the required information for the 12 months preceding your

What is the

filing of this form.

Reporting Period?

Annual Filers: Report the required information for the preceding calendar year

(January 1 – December 31).

If you have any questions about how to complete this form, please contact your ethics

What if I Have

official or go to the Office of Government Ethics web site at

and select

Questions?

under Forms Library.

Form 450

PENALTIES

Falsification of information or failure to file or report information required to be reported may subject you to

disciplinary action by your employing agency or other authority. Knowing and willful falsification of information

required to be reported may also subject you to criminal prosecution.

Privacy Act Statement

Title I of the Ethics in Government Act of 1978 (5 U.S.C. app. 101), Executive Order 12674 (as modified by Executive Order 12731), and 5

CFR Part 2634, Subpart I, of the Office of Government Ethics (OGE) regulations require the reporting of this information. Failure to provide

the requested information may result in separation or disciplinary action. The primary use of the information on this form is for review by

Government officials of your agency, to determine compliance with applicable Federal conflict of interest laws and regulations. Additional

disclosures may be made pursuant to the routine uses set forth in OGE/GOVT-2: (1) to a Federal, State, or local law enforcement agency if

the disclosing agency becomes aware of a violation or potential violation of law or regulation; (2) to a court or party in a court or Federal

administrative proceeding when the Government is a party or in order to comply with a judge-issued subpoena; (3) to a source when

necessary to obtain information relevant to a conflict of interest investigation or decision; (4) to the National Archives and Records

Administration in records management inspections; (5) to the Office of Management and Budget during legislative coordination on private

relief legislation; (6) to the Department of Justice or in certain legal proceedings when OGE, an employee of OGE, or the United States is a

party to litigation or has an interest in the litigation and the use of such records is deemed relevant and necessary to the litigation; (7) to

reviewing officials in a new office, department or agency when an employee transfers from one covered position to another; (8) to a

Member of Congress or a congressional office in response to an inquiry made on behalf of an individual who is the subject of the record;

and (9) to contractors and other non-Government employees working for the Federal Government to accomplish a function related to this

OGE Government-wide system of records. Note: When an agency is requested to furnish such records to OGE, such a disclosure is to be

considered as made to those officers and employees of the agency which co-maintains the records who have a need for the records in the

performance of their official duties in accordance with the Ethics in Government Act and other pertinent authority conferred on OGE,

pursuant to the provisions of the Privacy Act at 5 U.S.C. 552a(b)(1). This confidential report will not be disclosed to any requesting person

unless authorized by law. See also the OGE/GOVT-2 Executive Branch Confidential Financial Disclosure Reports Privacy Act system of

records.

Public Burden Information

It is estimated that completing this form, including reviewing the instructions and gathering the data needed, takes an average of one hour.

No p

is required to respond to a collection of information unless it displays a currently valid OMB control number as printed in

the top right-hand corner of the first page of this form. Send comments regarding the burden estimate or any other aspect of this collection

of information, including suggestions for reducing this burden, to:

, U.S. Office of Government Ethics, Suite 500,

1201 New York Avenue, NW, Washington, DC 20005-3917. Do not send your completed OGE Form 450 to this address.

1

1 2

2 3

3 4

4 5

5 6

6 7

7