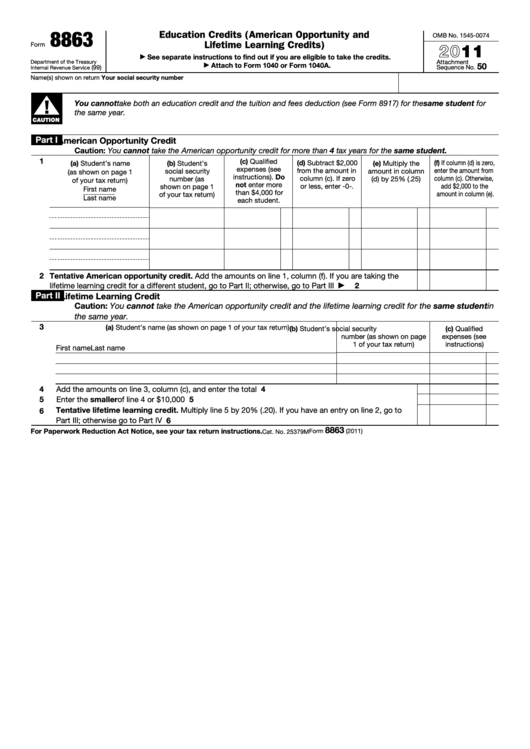

Education Credits (American Opportunity and

8863

OMB No. 1545-0074

Lifetime Learning Credits)

Form

2011

▶

See separate instructions to find out if you are eligible to take the credits.

Department of the Treasury

Attachment

▶

Attach to Form 1040 or Form 1040A.

50

(99)

Sequence No.

Internal Revenue Service

Name(s) shown on return

Your social security number

▲

!

You cannot take both an education credit and the tuition and fees deduction (see Form 8917) for the same student for

the same year.

CAUTION

Part I

American Opportunity Credit

Caution: You cannot take the American opportunity credit for more than 4 tax years for the same student.

1

(c) Qualified

(f) If column (d) is zero,

(a) Student’s name

(d) Subtract $2,000

(b) Student’s

(e) Multiply the

expenses (see

enter the amount from

from the amount in

social security

amount in column

(as shown on page 1

instructions). Do

column (c). Otherwise,

column (c). If zero

number (as

(d) by 25% (.25)

of your tax return)

not enter more

or less, enter -0-.

add $2,000 to the

shown on page 1

First name

than $4,000 for

amount in column (e).

of your tax return)

Last name

each student.

2 Tentative American opportunity credit. Add the amounts on line 1, column (f). If you are taking the

lifetime learning credit for a different student, go to Part II; otherwise, go to Part III

.

.

.

.

.

.

▶

2

Part II

Lifetime Learning Credit

Caution: You cannot take the American opportunity credit and the lifetime learning credit for the same student in

the same year.

3

(a) Student’s name (as shown on page 1 of your tax return)

(b) Student’s social security

(c) Qualified

number (as shown on page

expenses (see

1 of your tax return)

instructions)

First name

Last name

Add the amounts on line 3, column (c), and enter the total .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

4

4

Enter the smaller of line 4 or $10,000

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

5

5

Tentative lifetime learning credit. Multiply line 5 by 20% (.20). If you have an entry on line 2, go to

6

Part III; otherwise go to Part IV .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

6

8863

Form

(2011)

For Paperwork Reduction Act Notice, see your tax return instructions.

Cat. No. 25379M

1

1 2

2