Instructions For Form W-12 - Irs Paid Preparer Tax Identification Number (Ptin) Application And Renewal - 2013

ADVERTISEMENT

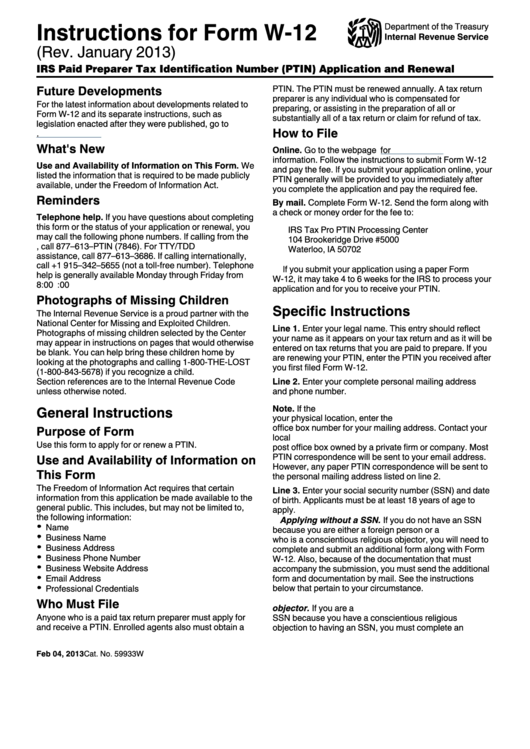

Instructions for Form W-12

Department of the Treasury

Internal Revenue Service

(Rev. January 2013)

IRS Paid Preparer Tax Identification Number (PTIN) Application and Renewal

Future Developments

PTIN. The PTIN must be renewed annually. A tax return

preparer is any individual who is compensated for

For the latest information about developments related to

preparing, or assisting in the preparation of all or

Form W-12 and its separate instructions, such as

substantially all of a tax return or claim for refund of tax.

legislation enacted after they were published, go to

How to File

What's New

Online. Go to the webpage

for

information. Follow the instructions to submit Form W-12

Use and Availability of Information on This Form. We

and pay the fee. If you submit your application online, your

listed the information that is required to be made publicly

PTIN generally will be provided to you immediately after

available, under the Freedom of Information Act.

you complete the application and pay the required fee.

Reminders

By mail. Complete Form W-12. Send the form along with

a check or money order for the fee to:

Telephone help. If you have questions about completing

this form or the status of your application or renewal, you

IRS Tax Pro PTIN Processing Center

may call the following phone numbers. If calling from the

104 Brookeridge Drive #5000

U.S., call 877–613–PTIN (7846). For TTY/TDD

Waterloo, IA 50702

assistance, call 877–613–3686. If calling internationally,

call +1 915–342–5655 (not a toll-free number). Telephone

If you submit your application using a paper Form

help is generally available Monday through Friday from

W-12, it may take 4 to 6 weeks for the IRS to process your

8:00 a.m. to 5:00 p.m. Central time.

application and for you to receive your PTIN.

Photographs of Missing Children

Specific Instructions

The Internal Revenue Service is a proud partner with the

National Center for Missing and Exploited Children.

Line 1. Enter your legal name. This entry should reflect

Photographs of missing children selected by the Center

your name as it appears on your tax return and as it will be

may appear in instructions on pages that would otherwise

entered on tax returns that you are paid to prepare. If you

be blank. You can help bring these children home by

are renewing your PTIN, enter the PTIN you received after

looking at the photographs and calling 1-800-THE-LOST

you first filed Form W-12.

(1-800-843-5678) if you recognize a child.

Section references are to the Internal Revenue Code

Line 2. Enter your complete personal mailing address

unless otherwise noted.

and phone number.

General Instructions

Note. If the U.S. Postal Service will not deliver mail to

your physical location, enter the U.S. Postal Service post

office box number for your mailing address. Contact your

Purpose of Form

local U.S. Post Office for more information. Do not use a

Use this form to apply for or renew a PTIN.

post office box owned by a private firm or company. Most

PTIN correspondence will be sent to your email address.

Use and Availability of Information on

However, any paper PTIN correspondence will be sent to

This Form

the personal mailing address listed on line 2.

The Freedom of Information Act requires that certain

Line 3. Enter your social security number (SSN) and date

information from this application be made available to the

of birth. Applicants must be at least 18 years of age to

general public. This includes, but may not be limited to,

apply.

the following information:

Applying without a SSN. If you do not have an SSN

Name

because you are either a foreign person or a U.S. citizen

Business Name

who is a conscientious religious objector, you will need to

Business Address

complete and submit an additional form along with Form

Business Phone Number

W-12. Also, because of the documentation that must

Business Website Address

accompany the submission, you must send the additional

Email Address

form and documentation by mail. See the instructions

below that pertain to your circumstance.

Professional Credentials

U.S. citizen who is a conscientious religious

Who Must File

objector. If you are a U.S. citizen who does not have an

Anyone who is a paid tax return preparer must apply for

SSN because you have a conscientious religious

and receive a PTIN. Enrolled agents also must obtain a

objection to having an SSN, you must complete an

Feb 04, 2013

Cat. No. 59933W

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4