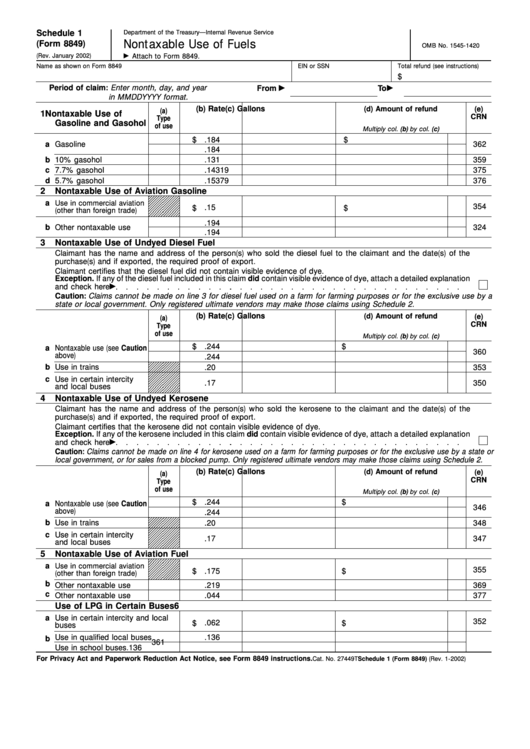

Schedule 1

Department of the Treasury—Internal Revenue Service

(Form 8849)

Nontaxable Use of Fuels

OMB No. 1545-1420

(Rev. January 2002)

Attach to Form 8849.

Name as shown on Form 8849

EIN or SSN

Total refund (see instructions)

$

Period of claim: Enter month, day, and year

From

To

in MMDDYYYY for mat.

(b) Rate

(c) Gallons

(d) Amount of refund

(e)

(a)

1

Nontaxable Use of

CRN

Type

Gasoline and Gasohol

of use

Multiply col. (b) by col. (c)

$

.184

$

a

Gasoline

362

.184

b

10% gasohol

.131

359

c

7.7% gasohol

.14319

375

d

5.7% gasohol

.15379

376

2

Nontaxable Use of Aviation Gasoline

a

Use in commercial aviation

354

.15

$

$

(other than foreign trade)

.194

b

Other nontaxable use

324

.194

3

Nontaxable Use of Undyed Diesel Fuel

Claimant has the name and address of the person(s) who sold the diesel fuel to the claimant and the date(s) of the

purchase(s) and if exported, the required proof of export.

Claimant certifies that the diesel fuel did not contain visible evidence of dye.

Exception. If any of the diesel fuel included in this claim did contain visible evidence of dye, attach a detailed explanation

and check here

Caution: Claims cannot be made on line 3 for diesel fuel used on a farm for farming purposes or for the exclusive use by a

state or local gover nment. Only registered ultimate vendors may make those claims using Schedule 2.

(b) Rate

(c) Gallons

(d) Amount of refund

(e)

(a)

CRN

Type

of use

Multiply col. (b) by col. (c)

$

.244

$

a

Nontaxable use (see Caution

360

above)

.244

b

Use in trains

353

.20

c

Use in certain intercity

.17

350

and local buses

4

Nontaxable Use of Undyed Kerosene

Claimant has the name and address of the person(s) who sold the kerosene to the claimant and the date(s) of the

purchase(s) and if exported, the required proof of export.

Claimant certifies that the kerosene did not contain visible evidence of dye.

Exception. If any of the kerosene included in this claim did contain visible evidence of dye, attach a detailed explanation

and check here

Caution: Claims cannot be made on line 4 for kerosene used on a farm for farming purposes or for the exclusive use by a state or

local government, or for sales from a blocked pump. Only registered ultimate vendors may make those claims using Schedule 2.

(b) Rate

(c) Gallons

(d) Amount of refund

(e)

(a)

CRN

Type

of use

Multiply col. (b) by col. (c)

$

.244

$

a

Nontaxable use (see Caution

346

above)

.244

b

Use in trains

.20

348

c

Use in certain intercity

.17

347

and local buses

5

Nontaxable Use of Aviation Fuel

a

Use in commercial aviation

355

.175

$

$

(other than foreign trade)

b

Other nontaxable use

.219

369

c

Other nontaxable use

.044

377

6

Use of LPG in Certain Buses

a

Use in certain intercity and local

352

.062

$

$

buses

Use in qualified local buses

.136

b

361

Use in school buses

.136

For Privacy Act and Paperwork Reduction Act Notice, see Form 8849 instructions.

Cat. No. 27449T

Schedule 1 (Form 8849) (Rev. 1-2002)

1

1 2

2