Ri-71.3 - Certificate Of Withholding Due

ADVERTISEMENT

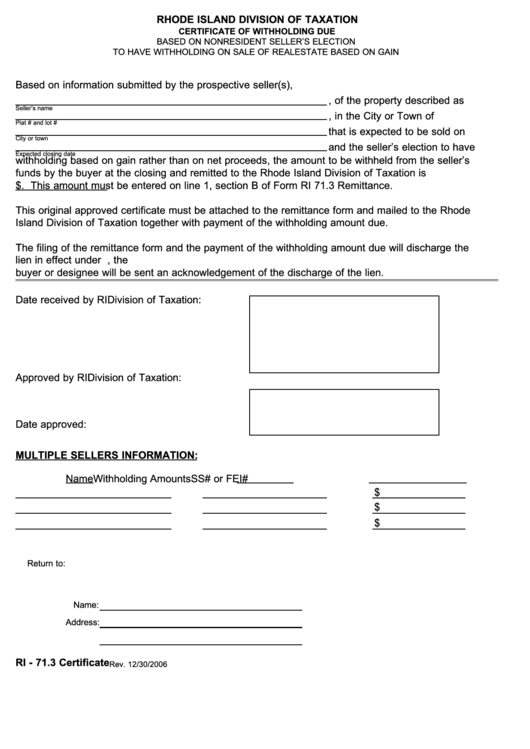

RHODE ISLAND DIVISION OF TAXATION

CERTIFICATE OF WITHHOLDING DUE

BASED ON NONRESIDENT SELLER’S ELECTION

TO HAVE WITHHOLDING ON SALE OF REAL ESTATE BASED ON GAIN

Based on information submitted by the prospective seller(s),

, of the property described as

Seller’s name

, in the City or Town of

Plat # and lot #

that is expected to be sold on

City or town

and the seller’s election to have

Expected closing date

withholding based on gain rather than on net proceeds, the amount to be withheld from the seller’s

funds by the buyer at the closing and remitted to the Rhode Island Division of Taxation is

$

. This amount must be entered on line 1, section B of Form RI 71.3 Remittance.

This original approved certificate must be attached to the remittance form and mailed to the Rhode

Island Division of Taxation together with payment of the withholding amount due.

The filing of the remittance form and the payment of the withholding amount due will discharge the

lien in effect under R.I.G.L. 44-30-71.3. By following the instructions on the remittance form, the

buyer or designee will be sent an acknowledgement of the discharge of the lien.

Date received by RI Division of Taxation:

Approved by RI Division of Taxation:

Date approved:

MULTIPLE SELLERS INFORMATION:

Name

SS# or FEI#

Withholding Amounts

$

$

$

Return to:

Name:

Address:

RI - 71.3 Certificate

Rev. 12/30/2006

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1