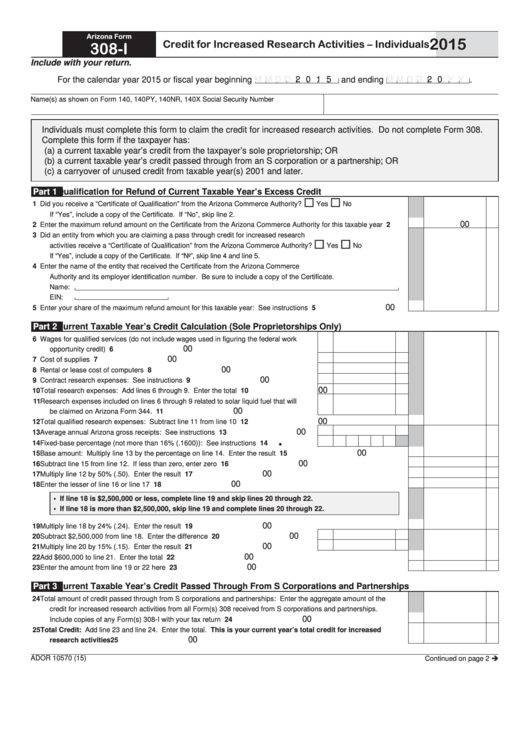

Arizona Form

2015

Credit for Increased Research Activities – Individuals

308-I

Include with your return.

M M D D

2 0 1 5 and ending

M M D D

2 0

Y Y

For the calendar year 2015 or fiscal year beginning

.

Name(s) as shown on Form 140, 140PY, 140NR, 140X

Social Security Number

Individuals must complete this form to claim the credit for increased research activities. Do not complete Form 308.

Complete this form if the taxpayer has:

(a) a current taxable year’s credit from the taxpayer’s sole proprietorship; OR

(b) a current taxable year’s credit passed through from an S corporation or a partnership; OR

(c) a carryover of unused credit from taxable year(s) 2001 and later.

Qualification for Refund of Current Taxable Year’s Excess Credit

Part 1

1

Did you receive a “Certificate of Qualification” from the Arizona Commerce Authority?..............

Yes

No

If “Yes”, include a copy of the Certificate. If “No”, skip line 2.

00

2

Enter the maximum refund amount on the Certificate from the Arizona Commerce Authority for this taxable year ....

2

3

Did an entity from which you are claiming a pass through credit for increased research

activities receive a “Certificate of Qualification” from the Arizona Commerce Authority? .............

Yes

No

If “Yes”, include a copy of the Certificate. If “No”, skip line 4 and line 5.

4

Enter the name of the entity that received the Certificate from the Arizona Commerce

Authority and its employer identification number. Be sure to include a copy of the Certificate.

Name:

EIN:

00

5

Enter your share of the maximum refund amount for this taxable year: See instructions ..........................................

5

Current Taxable Year’s Credit Calculation (Sole Proprietorships Only)

Part 2

6

Wages for qualified services (do not include wages used in figuring the federal work

00

opportunity credit) ...........................................................................................................

6

00

7

Cost of supplies ..............................................................................................................

7

00

8

Rental or lease cost of computers ..................................................................................

8

00

9

Contract research expenses: See instructions ..............................................................

9

00

10

Total research expenses: Add lines 6 through 9. Enter the total ..................................

10

11

Research expenses included on lines 6 through 9 related to solar liquid fuel that will

00

be claimed on Arizona Form 344. ...................................................................................

11

00

12

Total qualified research expenses: Subtract line 11 from line 10 ................................................................................

12

00

13

Average annual Arizona gross receipts: See instructions .............................................

13

14

Fixed-base percentage (not more than 16% (.1600)): See instructions ........................

14

00

15

Base amount: Multiply line 13 by the percentage on line 14. Enter the result ...........................................................

15

00

16

Subtract line 15 from line 12. If less than zero, enter zero .........................................................................................

16

00

17

Multiply line 12 by 50% (.50). Enter the result ............................................................................................................

17

00

18

Enter the lesser of line 16 or line 17 ............................................................................................................................

18

• If line 18 is $2,500,000 or less, complete line 19 and skip lines 20 through 22.

• If line 18 is more than $2,500,000, skip line 19 and complete lines 20 through 22.

00

19

Multiply line 18 by 24% (.24). Enter the result ............................................................................................................

19

00

20

Subtract $2,500,000 from line 18. Enter the difference .................................................

20

00

21

Multiply line 20 by 15% (.15). Enter the result ...............................................................

21

00

22

Add $600,000 to line 21. Enter the total .....................................................................................................................

22

00

23

Enter the amount from line 19 or 22 here ....................................................................................................................

23

Current Taxable Year’s Credit Passed Through From S Corporations and Partnerships

Part 3

24

Total amount of credit passed through from S corporations and partnerships: Enter the aggregate amount of the

credit for increased research activities from all Form(s) 308 received from S corporations and partnerships.

00

Include copies of any Form(s) 308-I with your tax return ............................................................................................

24

25

Total Credit: Add line 23 and line 24. Enter the total. This is your current year’s total credit for increased

00

research activities .....................................................................................................................................................

25

Continued on page 2

ADOR 10570 (15)

1

1 2

2 3

3