Instructions For Form It-2105 - Estimated Tax Payment Voucher For Individuals - 2017

ADVERTISEMENT

See

updated information

for this form on our website

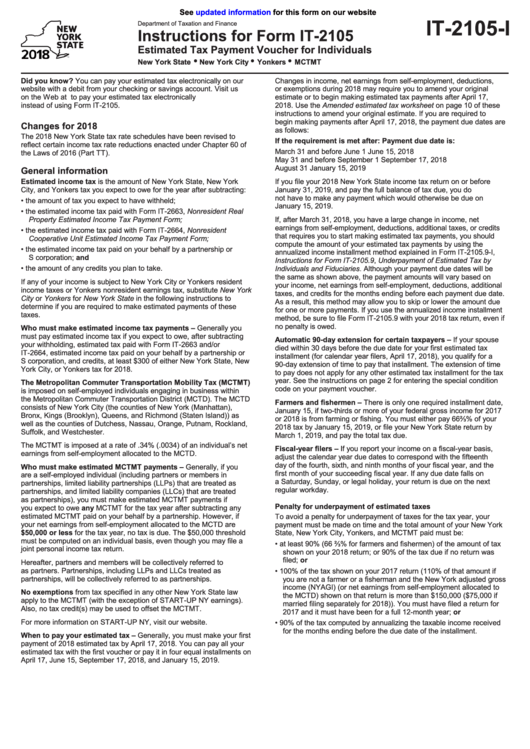

IT-2105-I

Department of Taxation and Finance

Instructions for Form IT-2105

Estimated Tax Payment Voucher for Individuals

•

•

•

New York State

New York City

Yonkers

MCTMT

Did you know? You can pay your estimated tax electronically on our

Changes in income, net earnings from self-employment, deductions,

website with a debit from your checking or savings account. Visit us

or exemptions during 2018 may require you to amend your original

on the Web at to pay your estimated tax electronically

estimate or to begin making estimated tax payments after April 17,

instead of using Form IT-2105.

2018. Use the Amended estimated tax worksheet on page 10 of these

instructions to amend your original estimate. If you are required to

begin making payments after April 17, 2018, the payment due dates are

Changes for 2018

as follows:

The 2018 New York State tax rate schedules have been revised to

If the requirement is met after:

Payment due date is:

reflect certain income tax rate reductions enacted under Chapter 60 of

March 31 and before June 1

June 15, 2018

the Laws of 2016 (Part TT).

May 31 and before September 1

September 17, 2018

August 31

January 15, 2019

General information

Estimated income tax is the amount of New York State, New York

If you file your 2018 New York State income tax return on or before

City, and Yonkers tax you expect to owe for the year after subtracting:

January 31, 2019, and pay the full balance of tax due, you do

not have to make any payment which would otherwise be due on

• the amount of tax you expect to have withheld;

January 15, 2019.

• the estimated income tax paid with Form IT-2663, Nonresident Real

Property Estimated Income Tax Payment Form;

If, after March 31, 2018, you have a large change in income, net

earnings from self-employment, deductions, additional taxes, or credits

• the estimated income tax paid with Form IT-2664, Nonresident

that requires you to start making estimated tax payments, you should

Cooperative Unit Estimated Income Tax Payment Form;

compute the amount of your estimated tax payments by using the

• the estimated income tax paid on your behalf by a partnership or

annualized income installment method explained in Form IT-2105.9-I,

S corporation; and

Instructions for Form IT‑2105.9, Underpayment of Estimated Tax by

• the amount of any credits you plan to take.

Individuals and Fiduciaries. Although your payment due dates will be

the same as shown above, the payment amounts will vary based on

If any of your income is subject to New York City or Yonkers resident

your income, net earnings from self-employment, deductions, additional

income taxes or Yonkers nonresident earnings tax, substitute New York

taxes, and credits for the months ending before each payment due date.

City or Yonkers for New York State in the following instructions to

As a result, this method may allow you to skip or lower the amount due

determine if you are required to make estimated payments of these

for one or more payments. If you use the annualized income installment

taxes.

method, be sure to file Form IT-2105.9 with your 2018 tax return, even if

no penalty is owed.

Who must make estimated income tax payments – Generally you

must pay estimated income tax if you expect to owe, after subtracting

Automatic 90-day extension for certain taxpayers – If your spouse

your withholding, estimated tax paid with Form IT-2663 and/or

died within 30 days before the due date for your first estimated tax

IT-2664, estimated income tax paid on your behalf by a partnership or

installment (for calendar year filers, April 17, 2018), you qualify for a

S corporation, and credits, at least $300 of either New York State, New

90-day extension of time to pay that installment. The extension of time

York City, or Yonkers tax for 2018.

to pay does not apply for any other estimated tax installment for the tax

year. See the instructions on page 2 for entering the special condition

The Metropolitan Commuter Transportation Mobility Tax (MCTMT)

code on your payment voucher.

is imposed on self-employed individuals engaging in business within

the Metropolitan Commuter Transportation District (MCTD). The MCTD

Farmers and fishermen – There is only one required installment date,

consists of New York City (the counties of New York (Manhattan),

January 15, if two-thirds or more of your federal gross income for 2017

Bronx, Kings (Brooklyn), Queens, and Richmond (Staten Island)) as

or 2018 is from farming or fishing. You must either pay 66⅔% of your

well as the counties of Dutchess, Nassau, Orange, Putnam, Rockland,

2018 tax by January 15, 2019, or file your New York State return by

Suffolk, and Westchester.

March 1, 2019, and pay the total tax due.

The MCTMT is imposed at a rate of .34% (.0034) of an individual’s net

Fiscal-year filers – If you report your income on a fiscal-year basis,

earnings from self-employment allocated to the MCTD.

adjust the calendar year due dates to correspond with the fifteenth

day of the fourth, sixth, and ninth months of your fiscal year, and the

Who must make estimated MCTMT payments – Generally, if you

first month of your succeeding fiscal year. If any due date falls on

are a self-employed individual (including partners or members in

a Saturday, Sunday, or legal holiday, your return is due on the next

partnerships, limited liability partnerships (LLPs) that are treated as

regular workday.

partnerships, and limited liability companies (LLCs) that are treated

as partnerships), you must make estimated MCTMT payments if

Penalty for underpayment of estimated taxes

you expect to owe any MCTMT for the tax year after subtracting any

estimated MCTMT paid on your behalf by a partnership. However, if

To avoid a penalty for underpayment of taxes for the tax year, your

your net earnings from self-employment allocated to the MCTD are

payment must be made on time and the total amount of your New York

$50,000 or less for the tax year, no tax is due. The $50,000 threshold

State, New York City, Yonkers, and MCTMT paid must be:

must be computed on an individual basis, even though you may file a

• at least 90% (66 ⅔% for farmers and fishermen) of the amount of tax

joint personal income tax return.

shown on your 2018 return; or 90% of the tax due if no return was

filed; or

Hereafter, partners and members will be collectively referred to

as partners. Partnerships, including LLPs and LLCs treated as

• 100% of the tax shown on your 2017 return (110% of that amount if

partnerships, will be collectively referred to as partnerships.

you are not a farmer or a fisherman and the New York adjusted gross

income (NYAGI) (or net earnings from self-employment allocated to

No exemptions from tax specified in any other New York State law

the MCTD) shown on that return is more than $150,000 ($75,000 if

apply to the MCTMT (with the exception of START-UP NY earnings).

married filing separately for 2018)). You must have filed a return for

Also, no tax credit(s) may be used to offset the MCTMT.

2017 and it must have been for a full 12-month year; or

For more information on START-UP NY, visit our website.

• 90% of the tax computed by annualizing the taxable income received

for the months ending before the due date of the installment.

When to pay your estimated tax – Generally, you must make your first

payment of 2018 estimated tax by April 17, 2018. You can pay all your

estimated tax with the first voucher or pay it in four equal installments on

April 17, June 15, September 17, 2018, and January 15, 2019.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10