Form Cit-1 - New Mexico Corporate Income And Franchise Tax Return - 2003

ADVERTISEMENT

*36080200*

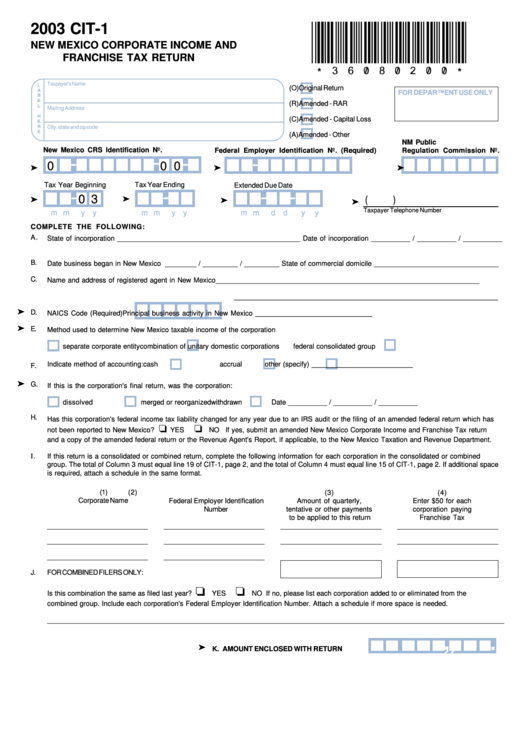

2003 CIT-1

NEW MEXICO CORPORATE INCOME AND

FRANCHISE TAX RETURN

Taxpayer's Name

L

(O)

Original Return

A

FOR DEPARTMENT USE ONLY

B

E

(R)

Amended - RAR

L

Mailing Address

H

(C)

Amended - Capital Loss

E

R

City, state and zip code

E

(A)

Amended - Other

NM Public

New Mexico CRS Identification No.

Federal Employer Identification No. (Required)

Regulation Commission No.

-

-

-

-

0

0 0

➤

➤

➤

Tax Year Ending

Tax Year Beginning

Extended Due Date

-

-

-

-

0 3

➤

➤

➤

(

)

➤

Taxpayer Telephone Number

m m

y y

m m

y y

m m

d d

y

y

COMPLETE THE FOLLOWING:

A.

State of incorporation _______________________________________________ Date of incorporation __________ / __________ / __________

B.

Date business began in New Mexico ________ / _________ / _________ State of commercial domicile ________________________________

C.

Name and address of registered agent in New Mexico

___________________________________________________________________

___________________________________________________________________

➤

D.

NAICS Code (Required)

Principal business activity in New Mexico ______________________________

➤

E.

Method used to determine New Mexico taxable income of the corporation

separate corporate entity

combination of unitary domestic corporations

federal consolidated group

F.

Indicate method of accounting:

cash

accrual

other (specify) __________________________

➤

G.

If this is the corporation's final return, was the corporation:

dissolved

merged or reorganized

withdrawn

Date __________ / __________ / __________

H.

Has this corporation's federal income tax liability changed for any year due to an IRS audit or the filing of an amended federal return which has

❏

❏

not been reported to New Mexico?

YES

NO If yes, submit an amended New Mexico Corporate Income and Franchise Tax return

and a copy of the amended federal return or the Revenue Agent's Report, if applicable, to the New Mexico Taxation and Revenue Department.

I.

If this return is a consolidated or combined return, complete the following information for each corporation in the consolidated or combined

group. The total of Column 3 must equal line 19 of CIT-1, page 2, and the total of Column 4 must equal line 15 of CIT-1, page 2. If additional space

is required, attach a schedule in the same format.

(1)

(2)

(3)

(4)

Corporate Name

Federal Employer Identification

Amount of quarterly,

Enter $50 for each

Number

tentative or other payments

corporation paying

to be applied to this return

Franchise Tax

J.

FOR COMBINED FILERS ONLY:

❏

❏

Is this combination the same as filed last year?

YES

NO If no, please list each corporation added to or eliminated from the

combined group. Include each corporation's Federal Employer Identification Number. Attach a schedule if more space is needed.

___________________________________________________________________________________________________________________________

,

,

.

➤

K. AMOUNT ENCLOSED WITH RETURN

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2