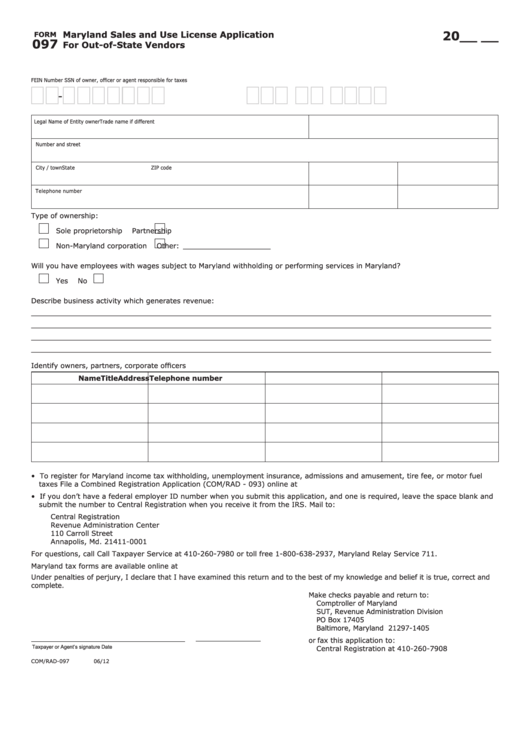

20__ __

Maryland Sales and Use License Application

FORM

097

For Out-of-State Vendors

FEIN Number

SSN of owner, officer or agent responsible for taxes

-

Legal Name of Entity owner

Trade name if different

Number and street

City / town

State

ZIP code

Telephone number

Type of ownership:

Sole proprietorship

Partnership

Non-Maryland corporation

Other: ____________________

Will you have employees with wages subject to Maryland withholding or performing services in Maryland?

Yes

No

Describe business activity which generates revenue:

_________________________________________________________________________________________________________

_________________________________________________________________________________________________________

_________________________________________________________________________________________________________

_________________________________________________________________________________________________________

Identify owners, partners, corporate officers

Name

Title

Address

Telephone number

• To register for Maryland income tax withholding, unemployment insurance, admissions and amusement, tire fee, or motor fuel

taxes File a Combined Registration Application (COM/RAD - 093) online at

• If you don’t have a federal employer ID number when you submit this application, and one is required, leave the space blank and

submit the number to Central Registration when you receive it from the IRS. Mail to:

Central Registration

Revenue Administration Center

110 Carroll Street

Annapolis, Md. 21411-0001

For questions, call Call Taxpayer Service at 410-260-7980 or toll free 1-800-638-2937, Maryland Relay Service 711.

Maryland tax forms are available online at .

Under penalties of perjury, I declare that I have examined this return and to the best of my knowledge and belief it is true, correct and

complete.

Make checks payable and return to:

Comptroller of Maryland

SUT, Revenue Administration Division

PO Box 17405

Baltimore, Maryland 21297-1405

or fax this application to:

Taxpayer or Agent’s signature

Date

Central Registration at 410-260-7908

COM/RAD-097

06/12

1

1