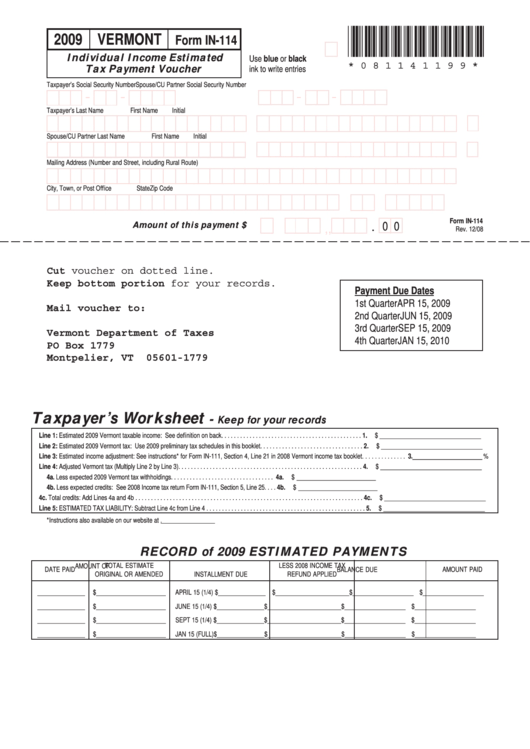

Form In-114 - Individual Income Estimated Tax Payment Voucher - 2009

ADVERTISEMENT

*081141199*

2009

VERMONT

Form IN-114

Individual Income Estimated

Use blue or black

* 0 8 1 1 4 1 1 9 9 *

Tax Payment Voucher

ink to write entries

Taxpayer’s Social Security Number

Spouse/CU Partner Social Security Number

-

-

-

-

Taxpayer’s Last Name

First Name

Initial

Spouse/CU Partner Last Name

First Name

Initial

Mailing Address (Number and Street, including Rural Route)

City, Town, or Post Office

State

Zip Code

Form IN-114

Amount of this payment $

. 0 0

,

,

Rev. 12/08

Cut voucher on dotted line.

Keep bottom portion for your records.

Payment Due Dates

1st Quarter

APR 15, 2009

Mail voucher to:

2nd Quarter

JUN 15, 2009

3rd Quarter

SEP 15, 2009

Vermont Department of Taxes

4th Quarter

JAN 15, 2010

PO Box 1779

Montpelier, VT

05601-1779

Taxpayer’s Worksheet

-

Keep for your records

Line 1: Estimated 2009 Vermont taxable income: See definition on back . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1.

$ ________________________________

Line 2: Estimated 2009 Vermont tax: Use 2009 preliminary tax schedules in this booklet . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2.

$ ________________________________

Line 3: Estimated income adjustment: See instructions* for Form IN-111, Section 4, Line 21 in 2008 Vermont income tax booklet . . . . . . . . . . . . . . 3. ______________________ %

Line 4: Adjusted Vermont tax (Multiply Line 2 by Line 3) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4.

$ ________________________________

4a. Less expected 2009 Vermont tax withholdings . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4a.

$ _________________________

4b. Less expected credits: See 2008 Income tax return Form IN-111, Section 5, Line 25 . . . . 4b.

$ _________________________

4c. Total credits: Add Lines 4a and 4b . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4c.

$ ________________________________

Line 5: ESTIMATED TAX LIABILITY: Subtract Line 4c from Line 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5.

$ ________________________________

*Instructions also available on our website at

RECORD of 2009 ESTIMATED PAYMENTS

TOTAL ESTIMATE

AMOUNT OF

LESS 2008 INCOME TAX

DATE PAID

BALANCE DUE

AMOUNT PAID

ORIGINAL OR AMENDED

INSTALLMENT DUE

REFUND APPLIED

_______________

$______________________

APRIL 15 (1/4) $_______________ $_______________________

$___________________ $___________________

_______________

$______________________

JUNE 15 (1/4) $_______________

$_______________________

$___________________ $___________________

_______________

$______________________

SEPT 15 (1/4) $_______________

$_______________________

$___________________ $___________________

_______________

$______________________

JAN 15 (FULL)$_______________

$_______________________

$___________________ $___________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1