Instructions For Filing City Of Madeira Tax Return - 2008-2010

ADVERTISEMENT

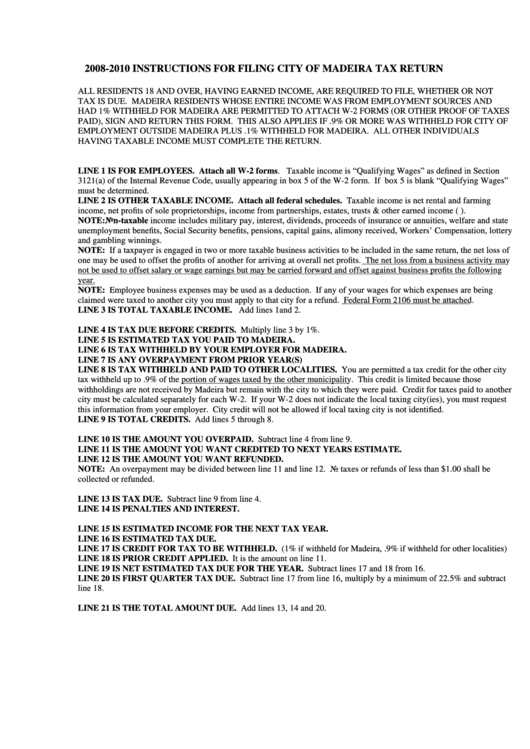

2008-2010 INSTRUCTIONS FOR FILING CITY OF MADEIRA TAX RETURN

ALL RESIDENTS 18 AND OVER, HAVING EARNED INCOME, ARE REQUIRED TO FILE, WHETHER OR NOT

TAX IS DUE. MADEIRA RESIDENTS WHOSE ENTIRE INCOME WAS FROM EMPLOYMENT SOURCES AND

HAD 1% WITHHELD FOR MADEIRA ARE PERMITTED TO ATTACH W-2 FORMS (OR OTHER PROOF OF TAXES

PAID), SIGN AND RETURN THIS FORM. THIS ALSO APPLIES IF .9% OR MORE WAS WITHHELD FOR CITY OF

EMPLOYMENT OUTSIDE MADEIRA PLUS .1% WITHHELD FOR MADEIRA. ALL OTHER INDIVIDUALS

HAVING TAXABLE INCOME MUST COMPLETE THE RETURN.

LINE 1 IS FOR EMPLOYEES. Attach all W-2 forms. Taxable income is “Qualifying Wages” as defined in Section

3121(a) of the Internal Revenue Code, usually appearing in box 5 of the W-2 form. If box 5 is blank “Qualifying Wages”

must be determined.

LINE 2 IS OTHER TAXABLE INCOME. Attach all federal schedules. Taxable income is net rental and farming

income, net profits of sole proprietorships, income from partnerships, estates, trusts & other earned income (e.g. 1099 MISC).

NOTE: Non-taxable income includes military pay, interest, dividends, proceeds of insurance or annuities, welfare and state

unemployment benefits, Social Security benefits, pensions, capital gains, alimony received, Workers’ Compensation, lottery

and gambling winnings.

NOTE: If a taxpayer is engaged in two or more taxable business activities to be included in the same return, the net loss of

one may be used to offset the profits of another for arriving at overall net profits. The net loss from a business activity may

not be used to offset salary or wage earnings but may be carried forward and offset against business profits the following

year.

NOTE: Employee business expenses may be used as a deduction. If any of your wages for which expenses are being

claimed were taxed to another city you must apply to that city for a refund. Federal Form 2106 must be attached.

LINE 3 IS TOTAL TAXABLE INCOME. Add lines 1and 2.

LINE 4 IS TAX DUE BEFORE CREDITS. Multiply line 3 by 1%.

LINE 5 IS ESTIMATED TAX YOU PAID TO MADEIRA.

LINE 6 IS TAX WITHHELD BY YOUR EMPLOYER FOR MADEIRA.

LINE 7 IS ANY OVERPAYMENT FROM PRIOR YEAR(S)

LINE 8 IS TAX WITHHELD AND PAID TO OTHER LOCALITIES. You are permitted a tax credit for the other city

tax withheld up to .9% of the portion of wages taxed by the other municipality. This credit is limited because those

withholdings are not received by Madeira but remain with the city to which they were paid. Credit for taxes paid to another

city must be calculated separately for each W-2. If your W-2 does not indicate the local taxing city(ies), you must request

this information from your employer. City credit will not be allowed if local taxing city is not identified.

LINE 9 IS TOTAL CREDITS. Add lines 5 through 8.

LINE 10 IS THE AMOUNT YOU OVERPAID. Subtract line 4 from line 9.

LINE 11 IS THE AMOUNT YOU WANT CREDITED TO NEXT YEARS ESTIMATE.

LINE 12 IS THE AMOUNT YOU WANT REFUNDED.

NOTE: An overpayment may be divided between line 11 and line 12. No taxes or refunds of less than $1.00 shall be

collected or refunded.

LINE 13 IS TAX DUE. Subtract line 9 from line 4.

LINE 14 IS PENALTIES AND INTEREST.

LINE 15 IS ESTIMATED INCOME FOR THE NEXT TAX YEAR.

LINE 16 IS ESTIMATED TAX DUE.

LINE 17 IS CREDIT FOR TAX TO BE WITHHELD. (1% if withheld for Madeira, .9% if withheld for other localities)

LINE 18 IS PRIOR CREDIT APPLIED. It is the amount on line 11.

LINE 19 IS NET ESTIMATED TAX DUE FOR THE YEAR. Subtract lines 17 and 18 from 16.

LINE 20 IS FIRST QUARTER TAX DUE. Subtract line 17 from line 16, multiply by a minimum of 22.5% and subtract

line 18.

LINE 21 IS THE TOTAL AMOUNT DUE. Add lines 13, 14 and 20.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2