Business Declaration Of Estimated Tax - Newark City - 2009

ADVERTISEMENT

REV 6/2008

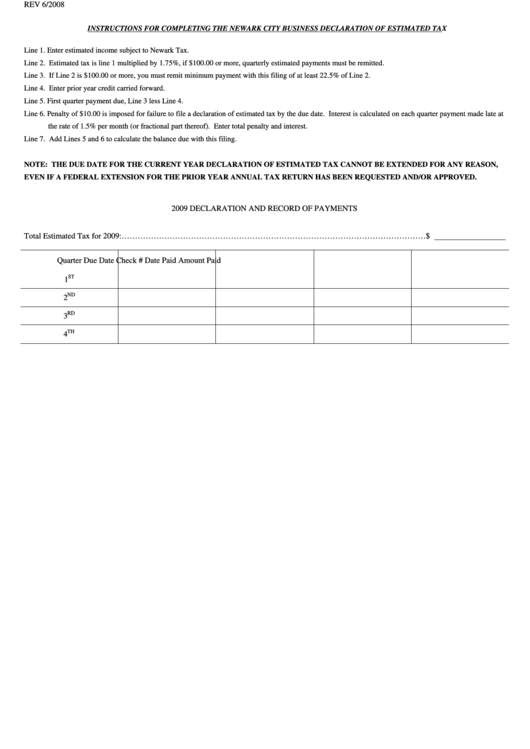

INSTRUCTIONS FOR COMPLETING THE NEWARK CITY BUSINESS DECLARATION OF ESTIMATED TAX

Line 1. Enter estimated income subject to Newark Tax.

Line 2. Estimated tax is line 1 multiplied by 1.75%, if $100.00 or more, quarterly estimated payments must be remitted.

Line 3. If Line 2 is $100.00 or more, you must remit minimum payment with this filing of at least 22.5% of Line 2.

Line 4. Enter prior year credit carried forward.

Line 5. First quarter payment due, Line 3 less Line 4.

Line 6. Penalty of $10.00 is imposed for failure to file a declaration of estimated tax by the due date. Interest is calculated on each quarter payment made late at

the rate of 1.5% per month (or fractional part thereof). Enter total penalty and interest.

Line 7. Add Lines 5 and 6 to calculate the balance due with this filing.

NOTE: THE DUE DATE FOR THE CURRENT YEAR DECLARATION OF ESTIMATED TAX CANNOT BE EXTENDED FOR ANY REASON,

EVEN IF A FEDERAL EXTENSION FOR THE PRIOR YEAR ANNUAL TAX RETURN HAS BEEN REQUESTED AND/OR APPROVED.

2009 DECLARATION AND RECORD OF PAYMENTS

Total Estimated Tax for 2009:……………………………………………………………………………………………………$

Quarter

Due Date

Check #

Date Paid

Amount Paid

ST

1

ND

2

RD

3

TH

4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2