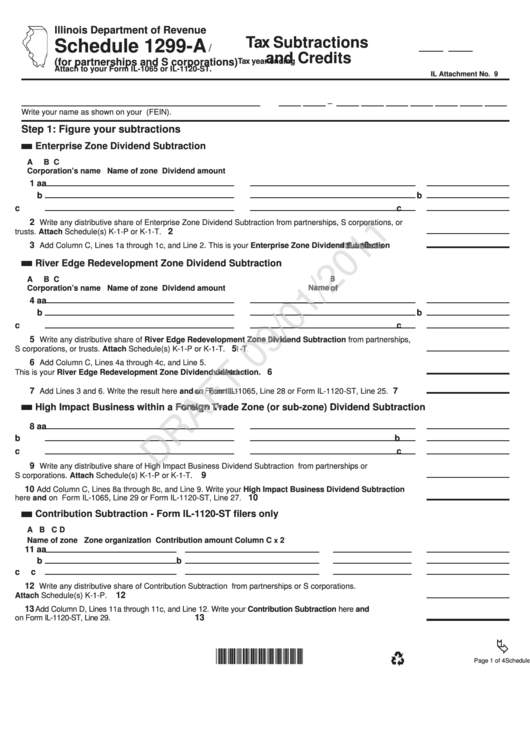

Schedule 1299-A - Tax Subtractions And Credits

ADVERTISEMENT

Illinois Department of Revenue

Tax Subtractions

Schedule 1299-A

/

and Credits

(for partnerships and S corporations)

Tax year ending

Attach to your Form IL-1065 or IL-1120-ST.

IL Attachment No. 9

–

Write your name as shown on your return.

Write your federal employer identification number (FEIN).

Step 1: Figure your subtractions

Enterprise Zone Dividend Subtraction

A

B

C

Corporation’s name

Name of zone

Dividend amount

1 a

a

b

b

c

c

2

Write any distributive share of Enterprise Zone Dividend Subtraction from partnerships, S corporations, or

Write any distributive share of Enterprise Zone Dividend Subtraction from partnerships, S corporations, or

Write any distributive share of Enterprise Zone Dividend Subtraction from partnerships, S corporations, or

2

trusts. Attach Schedule(s) K-1-P or K-1-T.

3

3

Add Column C, Lines 1a through 1c, and Line 2. This is your Enterprise Zone Dividend Subtraction

Dividend

Dividend

Subtraction

Subtraction

River Edge Redevelopment Zone Dividend Subtraction

A

B

B

B

C

Corporation’s name

Name of zone

Name

Name

of

of

Dividend amount

4 a

a

b

b

c

c

5

Write any distributive share of River Edge Redevelopment Zone Dividend Subtraction from partnerships,

Redevelopment

Redevelopment

Zone

Zone

Dividend

Dividend

5

S corporations, or trusts. Attach Schedule(s) K-1-P or K-1-T.

Schedule(s) K-1-P or K-1-T.

Schedule(s) K-1-P or K-1-T.

6

Add Column C, Lines 4a through 4c, and Line 5.

6

This is your River Edge Redevelopment Zone Dividend Subtraction.

Dividend

Dividend

Subtraction.

Subtraction.

Subtraction.

Subtraction.

7

7

Add Lines 3 and 6. Write the result here and on Form IL-1065, Line 28 or Form IL-1120-ST, Line 25.

on

on

F

F

orm IL-1065, Line 28 or Form IL-1120-ST, Line 25.

orm IL-1065, Line 28 or Form IL-1120-ST, Line 25.

High Impact Business within a Foreign Trade Zone (or sub-zone) Dividend Subtraction

Foreign

Foreign

T

T

Trade

T

T rade

T

rade

rade

8 a

a

b

b

c

c

9

Write any distributive share of High Impact Business Dividend Subtraction from partnerships or

Write any distributive share of High Impact Business Dividend Subtraction

Write any distributive share of High Impact Business Dividend Subtraction

9

S corporations. Attach Schedule(s) K-1-P or K-1-T.

10

Add Column C, Lines 8a through 8c, and Line 9. Write your High Impact Business Dividend Subtraction

10

here and on Form IL-1065, Line 29 or Form IL-1120-ST, Line 27.

Contribution Subtraction - Form IL-1120-ST filers only

A

B

C

D

Name of zone

Zone organization

Contribution amount

Column C

2

x

11 a

a

b

b

c

c

12

W rite any distributive share of Contribution Subtraction from partnerships or S corporations.

12

Attach Schedule(s) K-1-P.

13

A dd Column D, Lines 11a through 11c, and Line 12. Write your Contribution Subtraction here and

13

on Form IL-1120-ST, Line 29.

*134001110*

Schedule 1299-A (R-12/11)

Page 1 of 4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4