Form Nh 706 - New Hampshire Estate Tax Return

ADVERTISEMENT

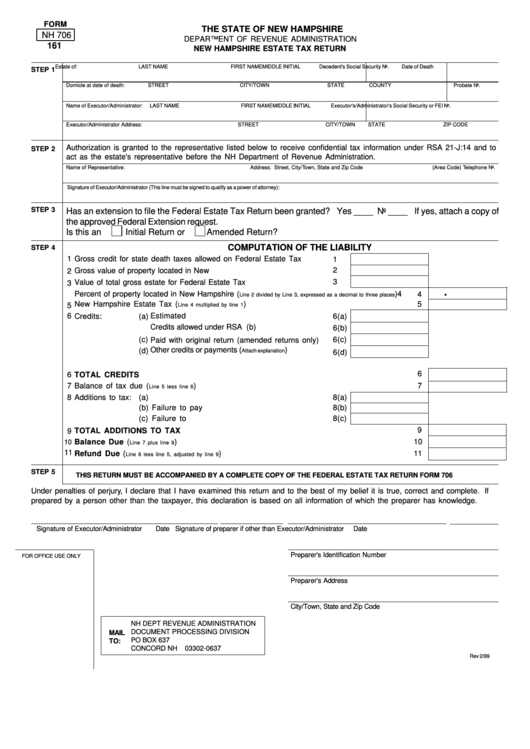

FORM

THE STATE OF NEW HAMPSHIRE

NH 706

DEPARTMENT OF REVENUE ADMINISTRATION

161

NEW HAMPSHIRE ESTATE TAX RETURN

Estate of:

LAST NAME

FIRST NAME

MIDDLE INITIAL

Decedent's Social Security No.

Date of Death

STEP 1

Domicle at date of death:

STREET

CITY/TOWN

STATE

COUNTY

Probate No.

Name of Executor/Administrator:

LAST NAME

FIRST NAME

MIDDLE INITIAL

Executor's/Administrator's Social Security or FEI No.

Executor/Administrator Address:

STREET

CITY/TOWN

STATE

ZIP CODE

Authorization is granted to the representative listed below to receive confidential tax information under RSA 21-J:14 and to

STEP 2

act as the estate's representative before the NH Department of Revenue Administration.

Name of Representative:

Address: Street, City/Town, State and Zip Code

(Area Code) Telephone No.

Signature of Executor/Administrator (This line must be signed to qualify as a power of attorney):

STEP 3

Has an extension to file the Federal Estate Tax Return been granted? Yes ____ No ____ If yes, attach a copy of

the approved Federal Extension request.

Is this an

Initial Return or

Amended Return?

COMPUTATION OF THE LIABILITY

STEP 4

1

Gross credit for state death taxes allowed on Federal Estate Tax Return...

1

Gross value of property located in New Hampshire........................................

2

2

Value of total gross estate for Federal Estate Tax purposes..........................

3

3

.

4

Percent of property located in New Hampshire (

).........

4

Line 2 divided by Line 3, expressed as a decimal to three places

New Hampshire Estate Tax (

).............................................................................

5

5

Line 4 multiplied by line 1

6

Estimated tax.........................................................

Credits:

(a)

6(a)

(b)

Credits allowed under RSA 86.....................................

6(b)

(c)

6(c)

Paid with original return (amended returns only).....

Other credits or payments (

).....................

(d)

Attach explanation

6(d)

6

6

TOTAL CREDITS..........................................................................................................................

7

Balance of tax due (

)....................................................................................................

7

Line 5 less line 6

8

Additions to tax:

(a)

Interest..................................................................

8(a)

(b)

Failure to pay.........................................................

8(b)

(c)

Failure to file..........................................................

8(c)

9

TOTAL ADDITIONS TO TAX........................................................................................................

9

Balance Due (

)...........................................................................................................

10

10

Line 7 plus line 9

11

Refund Due (

).........................................................................................

11

Line 6 less line 5, adjusted by line 9

STEP 5

THIS RETURN MUST BE ACCOMPANIED BY A COMPLETE COPY OF THE FEDERAL ESTATE TAX RETURN FORM 706

Under penalties of perjury, I declare that I have examined this return and to the best of my belief it is true, correct and complete. If

prepared by a person other than the taxpayer, this declaration is based on all information of which the preparer has knowledge.

Signature of Executor/Administrator

Date

Signature of preparer if other than Executor/Administrator

Date

Preparer's Identification Number

FOR OFFICE USE ONLY

Preparer's Address

City/Town, State and Zip Code

NH DEPT REVENUE ADMINISTRATION

DOCUMENT PROCESSING DIVISION

MAIL

PO BOX 637

TO:

CONCORD NH

03302-0637

Rev 2/99

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1