2220

OMB No. 1545-0123

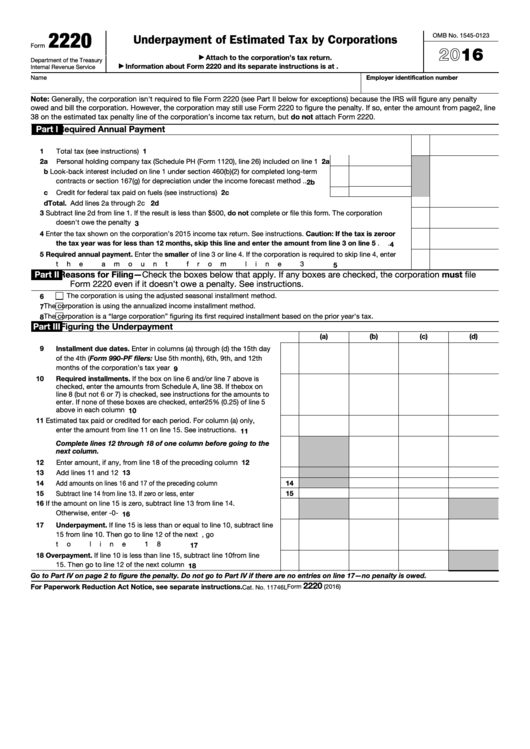

Underpayment of Estimated Tax by Corporations

Form

2016

Attach to the corporation’s tax return.

▶

Department of the Treasury

Information about Form 2220 and its separate instructions is at

Internal Revenue Service

▶

Employer identification number

Name

Note: Generally, the corporation isn't required to file Form 2220 (see Part II below for exceptions) because the IRS will figure any penalty

owed and bill the corporation. However, the corporation may still use Form 2220 to figure the penalty. If so, enter the amount from page 2, line

38 on the estimated tax penalty line of the corporation’s income tax return, but do not attach Form 2220.

Part I

Required Annual Payment

1

Total tax (see instructions)

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

1

2a

2a

Personal holding company tax (Schedule PH (Form 1120), line 26) included on line 1

b

Look-back interest included on line 1 under section 460(b)(2) for completed long-term

contracts or section 167(g) for depreciation under the income forecast method .

.

2b

c

2c

Credit for federal tax paid on fuels (see instructions) .

.

.

.

.

.

.

.

.

.

d

Total. Add lines 2a through 2c .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

2d

3

Subtract line 2d from line 1. If the result is less than $500, do not complete or file this form. The corporation

doesn't owe the penalty .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

3

4

Enter the tax shown on the corporation’s 2015 income tax return. See instructions. Caution: If the tax is zero or

the tax year was for less than 12 months, skip this line and enter the amount from line 3 on line 5

.

.

4

5

Required annual payment. Enter the smaller of line 3 or line 4. If the corporation is required to skip line 4, enter

the amount from line 3

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

5

Part II

Reasons for Filing—Check the boxes below that apply. If any boxes are checked, the corporation must file

Form 2220 even if it doesn't owe a penalty. See instructions.

The corporation is using the adjusted seasonal installment method.

6

The corporation is using the annualized income installment method.

7

The corporation is a “large corporation” figuring its first required installment based on the prior year's tax.

8

Part III

Figuring the Underpayment

(a)

(b)

(c)

(d)

9

Installment due dates. Enter in columns (a) through (d) the 15th day

of the 4th (Form 990-PF filers: Use 5th month), 6th, 9th, and 12th

months of the corporation’s tax year

.

.

.

.

.

.

.

.

.

.

9

10

Required installments. If the box on line 6 and/or line 7 above is

checked, enter the amounts from Schedule A, line 38. If the box on

line 8 (but not 6 or 7) is checked, see instructions for the amounts to

enter. If none of these boxes are checked, enter 25% (0.25) of line 5

above in each column

.

.

.

.

.

.

.

.

.

.

.

.

.

.

10

11

Estimated tax paid or credited for each period. For column (a) only,

enter the amount from line 11 on line 15. See instructions. .

.

.

.

11

Complete lines 12 through 18 of one column before going to the

next column.

12

Enter amount, if any, from line 18 of the preceding column .

.

.

.

12

13

13

Add lines 11 and 12 .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

14

Add amounts on lines 16 and 17 of the preceding column .

.

.

.

.

.

14

15

Subtract line 14 from line 13. If zero or less, enter -0- .

.

.

.

.

.

.

15

16

If the amount on line 15 is zero, subtract line 13 from line 14.

Otherwise, enter -0- .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

16

17

Underpayment. If line 15 is less than or equal to line 10, subtract line

15 from line 10. Then go to line 12 of the next column. Otherwise, go

to line 18

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

17

18

Overpayment. If line 10 is less than line 15, subtract line 10 from line

15. Then go to line 12 of the next column .

.

.

.

.

.

.

.

.

18

Go to Part IV on page 2 to figure the penalty. Do not go to Part IV if there are no entries on line 17—no penalty is owed.

2220

For Paperwork Reduction Act Notice, see separate instructions.

Form

(2016)

Cat. No. 11746L

1

1 2

2 3

3 4

4