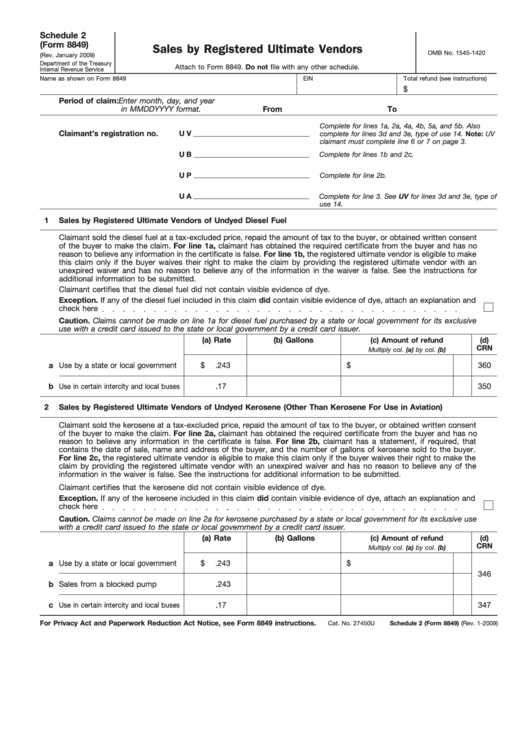

Schedule 2

(Form 8849)

Sales by Registered Ultimate Vendors

OMB No. 1545-1420

(Rev. January 2009)

Department of the Treasury

Attach to Form 8849. Do not file with any other schedule.

Internal Revenue Service

Name as shown on Form 8849

EIN

Total refund (see instructions)

$

Period of claim: Enter month, day, and year

in MMDDYYYY format.

From

To

Complete for lines 1a, 2a, 4a, 4b, 5a, and 5b. Also

Claimant’s registration no.

U V

complete for lines 3d and 3e, type of use 14. Note: UV

claimant must complete line 6 or 7 on page 3.

U B

Complete for lines 1b and 2c.

U P

Complete for line 2b.

U A

Complete for line 3. See UV for lines 3d and 3e, type of

use 14.

1

Sales by Registered Ultimate Vendors of Undyed Diesel Fuel

Claimant sold the diesel fuel at a tax-excluded price, repaid the amount of tax to the buyer, or obtained written consent

of the buyer to make the claim. For line 1a, claimant has obtained the required certificate from the buyer and has no

reason to believe any information in the certificate is false. For line 1b, the registered ultimate vendor is eligible to make

this claim only if the buyer waives their right to make the claim by providing the registered ultimate vendor with an

unexpired waiver and has no reason to believe any of the information in the waiver is false. See the instructions for

additional information to be submitted.

Claimant certifies that the diesel fuel did not contain visible evidence of dye.

Exception. If any of the diesel fuel included in this claim did contain visible evidence of dye, attach an explanation and

check here

Caution. Claims cannot be made on line 1a for diesel fuel purchased by a state or local government for its exclusive

use with a credit card issued to the state or local government by a credit card issuer.

(a) Rate

(b) Gallons

(c) Amount of refund

(d)

CRN

Multiply col. (a) by col. (b)

a

Use by a state or local government

$

.243

$

360

b

.17

350

Use in certain intercity and local buses

2

Sales by Registered Ultimate Vendors of Undyed Kerosene (Other Than Kerosene For Use in Aviation)

Claimant sold the kerosene at a tax-excluded price, repaid the amount of tax to the buyer, or obtained written consent

of the buyer to make the claim. For line 2a, claimant has obtained the required certificate from the buyer and has no

reason to believe any information in the certificate is false. For line 2b, claimant has a statement, if required, that

contains the date of sale, name and address of the buyer, and the number of gallons of kerosene sold to the buyer.

For line 2c, the registered ultimate vendor is eligible to make this claim only if the buyer waives their right to make the

claim by providing the registered ultimate vendor with an unexpired waiver and has no reason to believe any of the

information in the waiver is false. See the instructions for additional information to be submitted.

Claimant certifies that the kerosene did not contain visible evidence of dye.

Exception. If any of the kerosene included in this claim did contain visible evidence of dye, attach an explanation and

check here

Caution. Claims cannot be made on line 2a for kerosene purchased by a state or local government for its exclusive use

with a credit card issued to the state or local government by a credit card issuer.

(a) Rate

(b) Gallons

(c) Amount of refund

(d)

CRN

Multiply col. (a) by col. (b)

a

Use by a state or local government

$

.243

$

346

b

Sales from a blocked pump

.243

c

.17

347

Use in certain intercity and local buses

For Privacy Act and Paperwork Reduction Act Notice, see Form 8849 instructions.

Cat. No. 27450U

Schedule 2 (Form 8849) (Rev. 1-2009)

1

1 2

2 3

3 4

4 5

5