Instructions For Form 8038-Tc - Information Return For Tax Credit Bonds And Specified Tax Credit Bonds

ADVERTISEMENT

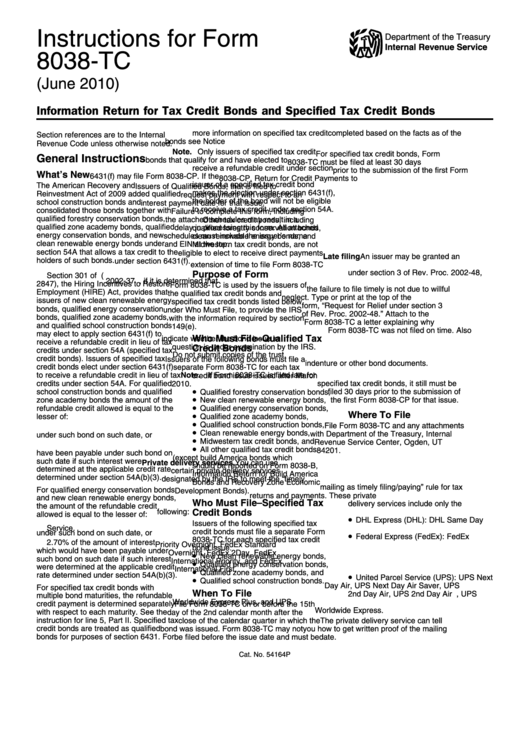

Instructions for Form

Department of the Treasury

Internal Revenue Service

8038-TC

(June 2010)

Information Return for Tax Credit Bonds and Specified Tax Credit Bonds

more information on specified tax credit

completed based on the facts as of the

Section references are to the Internal

bonds see Notice 2010-35.

issue date.

Revenue Code unless otherwise noted.

Note. Only issuers of specified tax credit

For specified tax credit bonds, Form

General Instructions

bonds that qualify for and have elected to

8038-TC must be filed at least 30 days

receive a refundable credit under section

prior to the submission of the first Form

What’s New

6431(f) may file Form 8038-CP. If the

8038-CP, Return for Credit Payments to

issuer of a specified tax credit bond

The American Recovery and

Issuers of Qualified Bonds, that is filed to

makes the election under section 6431(f),

Reinvestment Act of 2009 added qualified

request payment with respect to an

the holder of the bond will not be eligible

school construction bonds and

interest payment date for that issue.

to receive a tax credit under section 54A.

consolidated those bonds together with

Failure to complete this form, including

qualified forestry conservation bonds,

the attached schedules may result in a

Other tax credit bonds, including

qualified zone academy bonds, qualified

delay in processing this form. All attached

qualified forestry conservation bonds,

energy conservation bonds, and new

schedules must include the issuer’s name

clean renewable energy bonds, and

clean renewable energy bonds under

and EIN at the top.

Midwestern tax credit bonds, are not

section 54A that allows a tax credit to the

eligible to elect to receive direct payments

Late filing An issuer may be granted an

holders of such bonds.

under section 6431(f).

extension of time to file Form 8038-TC

under section 3 of Rev. Proc. 2002-48,

Purpose of Form

Section 301 of P.L. 111-147 (H.R.

2002-37 I.R.B. 531, if it is determined that

2847), the Hiring Incentives to Restore

Form 8038-TC is used by the issuers of

the failure to file timely is not due to willful

Employment (HIRE) Act, provides that

the qualified tax credit bonds and

neglect. Type or print at the top of the

issuers of new clean renewable energy

specified tax credit bonds listed below

form, “Request for Relief under section 3

bonds, qualified energy conservation

under Who Must File, to provide the IRS

of Rev. Proc. 2002-48.” Attach to the

bonds, qualified zone academy bonds,

with the information required by section

Form 8038-TC a letter explaining why

and qualified school construction bonds

149(e).

Form 8038-TC was not filed on time. Also

may elect to apply section 6431(f) to

Who Must File–Qualified Tax

indicate whether the bond issue in

receive a refundable credit in lieu of tax

question is under examination by the IRS.

Credit Bonds

credits under section 54A (specified tax

Do not submit copies of the trust

credit bonds). Issuers of specified tax

Issuers of the following bonds must file a

indenture or other bond documents.

credit bonds elect under section 6431(f)

separate Form 8038-TC for each tax

Note. If Form 8038-TC is filed late for

to receive a refundable credit in lieu of tax

credit bond issue issued after March

credits under section 54A. For qualified

specified tax credit bonds, it still must be

2010.

•

school construction bonds and qualified

filed 30 days prior to the submission of

Qualified forestry conservation bonds,

•

zone academy bonds the amount of the

the first Form 8038-CP for that issue.

New clean renewable energy bonds,

•

refundable credit allowed is equal to the

Qualified energy conservation bonds,

Where To File

•

lesser of:

Qualified zone academy bonds,

•

Qualified school construction bonds,

File Form 8038-TC and any attachments

1. the amount of interest payable

•

Clean renewable energy bonds,

with Department of the Treasury, Internal

under such bond on such date, or

•

Midwestern tax credit bonds, and

Revenue Service Center, Ogden, UT

2. the amount of interest which would

•

All other qualified tax credit bonds

84201.

have been payable under such bond on

(except build America bonds which

such date if such interest were

Private delivery services. You can use

should be reported on Form 8038-B,

determined at the applicable credit rate

certain private delivery services

Information Return for Build America

determined under section 54A(b)(3).

designated by the IRS to meet the “timely

Bonds and Recovery Zone Economic

mailing as timely filing/paying” rule for tax

For qualified energy conservation bonds

Development Bonds).

returns and payments. These private

and new clean renewable energy bonds,

Who Must File–Specified Tax

delivery services include only the

the amount of the refundable credit

Credit Bonds

following:

allowed is equal to the lesser of:

•

DHL Express (DHL): DHL Same Day

Issuers of the following specified tax

1. the amount of interest payable

Service.

credit bonds must file a separate Form

under such bond on such date, or

•

Federal Express (FedEx): FedEx

8038-TC for each specified tax credit

2. 70% of the amount of interest

Priority Overnight, FedEx Standard

bond issue.

which would have been payable under

Overnight, FedEx 2Day, FedEx

•

New clean renewable energy bonds,

such bond on such date if such interest

International Priority, and FedEx

•

Qualified energy conservation bonds,

were determined at the applicable credit

International First.

•

Qualified zone academy bonds, and

rate determined under section 54A(b)(3).

•

United Parcel Service (UPS): UPS Next

•

Qualified school construction bonds.

Day Air, UPS Next Day Air Saver, UPS

For specified tax credit bonds with

When To File

2nd Day Air, UPS 2nd Day Air A.M., UPS

multiple bond maturities, the refundable

Worldwide Express Plus, and UPS

credit payment is determined separately

File Form 8038-TC on or before the 15th

Worldwide Express.

with respect to each maturity. See the

day of the 2nd calendar month after the

instruction for line 5, Part II. Specified tax

close of the calendar quarter in which the

The private delivery service can tell

credit bonds are treated as qualified

bond was issued. Form 8038-TC may not

you how to get written proof of the mailing

bonds for purposes of section 6431. For

be filed before the issue date and must be

date.

Cat. No. 54164P

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6