8050

Direct Deposit of Corporate Tax Refund

Form

OMB No. 1545-0123

(November 2016)

Attach to Form 1120 or 1120S.

▶

Department of the Treasury

Information about Form 8050 and its instructions is at

▶

Internal Revenue Service

Name of corporation (as shown on tax return)

Employer identification number

Phone number (optional)

1.

Routing number (must be nine digits). The first two digits must be between 01 and 12 or 21 through 32.

3. Type of account (one box

must be checked):

2.

Account number (include hyphens but omit spaces and special symbols):

Checking

Savings

General Instructions

How To File

the information. We need it to ensure that

you are complying with these laws and to

Section references are to the Internal Revenue

Attach Form 8050 to the corporation’s Form

allow us to figure and collect the right

Code unless otherwise noted.

1120 or 1120S after Schedule N (Form 1120),

amount of tax.

if applicable. To ensure that the corporation’s

Purpose of Form

You are not required to provide the

tax return is correctly processed, see

information requested on a form that is

Assembling the Return in the instructions for

File Form 8050 to request that the IRS deposit

subject to the Paperwork Reduction Act

Form 1120 or 1120S.

a corporate income tax refund (including a

unless the form displays a valid OMB control

Specific Instructions

refund of $1 million or more) directly into an

number. Books or records relating to a form

account at any U.S. bank or other financial

or its instructions must be retained as long as

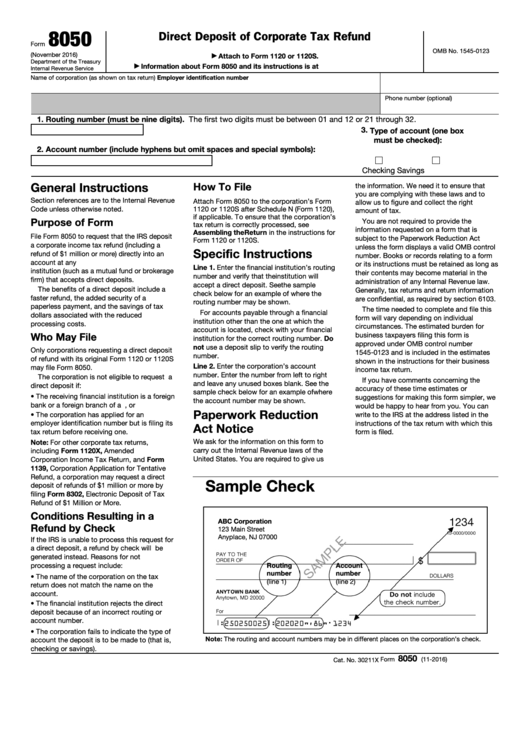

Line 1. Enter the financial institution’s routing

institution (such as a mutual fund or brokerage

their contents may become material in the

number and verify that the institution will

firm) that accepts direct deposits.

administration of any Internal Revenue law.

accept a direct deposit. See the sample

The benefits of a direct deposit include a

Generally, tax returns and return information

check below for an example of where the

faster refund, the added security of a

are confidential, as required by section 6103.

routing number may be shown.

paperless payment, and the savings of tax

The time needed to complete and file this

For accounts payable through a financial

dollars associated with the reduced

form will vary depending on individual

institution other than the one at which the

processing costs.

circumstances. The estimated burden for

account is located, check with your financial

Who May File

business taxpayers filing this form is

institution for the correct routing number. Do

approved under OMB control number

not use a deposit slip to verify the routing

Only corporations requesting a direct deposit

1545-0123 and is included in the estimates

number.

of refund with its original Form 1120 or 1120S

shown in the instructions for their business

Line 2. Enter the corporation’s account

may file Form 8050.

income tax return.

number. Enter the number from left to right

The corporation is not eligible to request a

If you have comments concerning the

and leave any unused boxes blank. See the

direct deposit if:

accuracy of these time estimates or

sample check below for an example of where

• The receiving financial institution is a foreign

suggestions for making this form simpler, we

the account number may be shown.

bank or a foreign branch of a U.S. bank, or

would be happy to hear from you. You can

Paperwork Reduction

• The corporation has applied for an

write to the IRS at the address listed in the

employer identification number but is filing its

instructions of the tax return with which this

Act Notice

tax return before receiving one.

form is filed.

We ask for the information on this form to

Note: For other corporate tax returns,

carry out the Internal Revenue laws of the

including Form 1120X, Amended U.S.

United States. You are required to give us

Corporation Income Tax Return, and Form

1139, Corporation Application for Tentative

Refund, a corporation may request a direct

Sample Check

deposit of refunds of $1 million or more by

filing Form 8302, Electronic Deposit of Tax

Refund of $1 Million or More.

Conditions Resulting in a

ABC Corporation

Refund by Check

123 Main Street

Anyplace, NJ 07000

If the IRS is unable to process this request for

a direct deposit, a refund by check will be

generated instead. Reasons for not

processing a request include:

Routing

Account

number

number

• The name of the corporation on the tax

(line 1)

(line 2)

return does not match the name on the

account.

• The financial institution rejects the direct

deposit because of an incorrect routing or

account number.

• The corporation fails to indicate the type of

Note: The routing and account numbers may be in different places on the corporation’s check.

account the deposit is to be made to (that is,

checking or savings).

8050

Form

(11-2016)

Cat. No. 30211X

1

1