Instructions For Form 5498-Esa - Coverdell Esa Contribution Information - 2018

ADVERTISEMENT

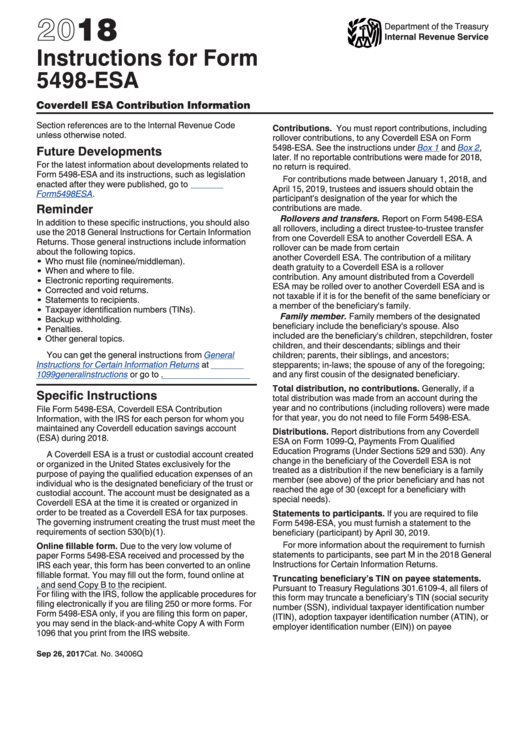

2018

Department of the Treasury

Internal Revenue Service

Instructions for Form

5498-ESA

Coverdell ESA Contribution Information

Section references are to the Internal Revenue Code

Contributions. You must report contributions, including

unless otherwise noted.

rollover contributions, to any Coverdell ESA on Form

5498-ESA. See the instructions under

Box 1

and

Box

2,

Future Developments

later. If no reportable contributions were made for 2018,

For the latest information about developments related to

no return is required.

Form 5498-ESA and its instructions, such as legislation

For contributions made between January 1, 2018, and

enacted after they were published, go to

IRS.gov/

April 15, 2019, trustees and issuers should obtain the

Form5498ESA.

participant's designation of the year for which the

Reminder

contributions are made.

Rollovers and transfers. Report on Form 5498-ESA

In addition to these specific instructions, you should also

all rollovers, including a direct trustee-to-trustee transfer

use the 2018 General Instructions for Certain Information

from one Coverdell ESA to another Coverdell ESA. A

Returns. Those general instructions include information

rollover can be made from certain U.S. Savings Bonds or

about the following topics.

another Coverdell ESA. The contribution of a military

Who must file (nominee/middleman).

death gratuity to a Coverdell ESA is a rollover

When and where to file.

contribution. Any amount distributed from a Coverdell

Electronic reporting requirements.

ESA may be rolled over to another Coverdell ESA and is

Corrected and void returns.

not taxable if it is for the benefit of the same beneficiary or

Statements to recipients.

a member of the beneficiary's family.

Taxpayer identification numbers (TINs).

Family member. Family members of the designated

Backup withholding.

beneficiary include the beneficiary's spouse. Also

Penalties.

included are the beneficiary's children, stepchildren, foster

Other general topics.

children, and their descendants; siblings and their

You can get the general instructions from

General

children; parents, their siblings, and ancestors;

Instructions for Certain Information Returns

at

IRS.gov/

stepparents; in-laws; the spouse of any of the foregoing;

1099generalinstructions

or go to IRS.gov/Form5498ESA.

and any first cousin of the designated beneficiary.

Total distribution, no contributions. Generally, if a

Specific Instructions

total distribution was made from an account during the

year and no contributions (including rollovers) were made

File Form 5498-ESA, Coverdell ESA Contribution

for that year, you do not need to file Form 5498-ESA.

Information, with the IRS for each person for whom you

maintained any Coverdell education savings account

Distributions. Report distributions from any Coverdell

(ESA) during 2018.

ESA on Form 1099-Q, Payments From Qualified

Education Programs (Under Sections 529 and 530). Any

A Coverdell ESA is a trust or custodial account created

change in the beneficiary of the Coverdell ESA is not

or organized in the United States exclusively for the

treated as a distribution if the new beneficiary is a family

purpose of paying the qualified education expenses of an

member (see above) of the prior beneficiary and has not

individual who is the designated beneficiary of the trust or

reached the age of 30 (except for a beneficiary with

custodial account. The account must be designated as a

special needs).

Coverdell ESA at the time it is created or organized in

order to be treated as a Coverdell ESA for tax purposes.

Statements to participants. If you are required to file

The governing instrument creating the trust must meet the

Form 5498-ESA, you must furnish a statement to the

requirements of section 530(b)(1).

beneficiary (participant) by April 30, 2019.

For more information about the requirement to furnish

Online fillable form. Due to the very low volume of

statements to participants, see part M in the 2018 General

paper Forms 5498-ESA received and processed by the

Instructions for Certain Information Returns.

IRS each year, this form has been converted to an online

fillable format. You may fill out the form, found online at

Truncating beneficiary’s TIN on payee statements.

IRS.gov/Form5498ESA, and send Copy B to the recipient.

Pursuant to Treasury Regulations 301.6109-4, all filers of

For filing with the IRS, follow the applicable procedures for

this form may truncate a beneficiary’s TIN (social security

filing electronically if you are filing 250 or more forms. For

number (SSN), individual taxpayer identification number

Form 5498-ESA only, if you are filing this form on paper,

(ITIN), adoption taxpayer identification number (ATIN), or

you may send in the black-and-white Copy A with Form

employer identification number (EIN)) on payee

1096 that you print from the IRS website.

Sep 26, 2017

Cat. No. 34006Q

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2