Form 11-C(V),

Payment Voucher

Purpose of Form

Box 2. Enter the amount paid with Form 11-C.

Box 3. Enter the same year and month you entered on

Complete Form 11-C(V), Payment Voucher, and file it

the “Return for period from” line at the top of Form 11-C.

with Form 11-C, Occupational Tax and Registration

For example, if your return is for the full period that begins

Return for Wagering. We will use Form 11-C(V) to credit

July 1, 2017, enter 201707.

your payment more promptly and accurately, and to

improve our service to you.

Box 4. Enter your name and address as shown on Form

11-C.

If you have your return prepared by a third party,

provide Form 11-C(V) to the return preparer.

• Enclose your check or money order made payable to

“United States Treasury.” Be sure to enter your EIN,

Specific Instructions

“Form 11-C,” and the tax period on your check or money

Box 1. If you don’t have an EIN, apply for one online. Go

order. Don’t send cash. Don’t staple Form 11-C(V) or your

to the IRS website at You also may

payment to Form 11-C (or to each other).

apply for an EIN by faxing or mailing Form SS-4,

• Detach Form 11-C(V) and send it with your payment

Application for Employer Identification Number, to the

and Form 11-C. See Where to file, earlier.

IRS.

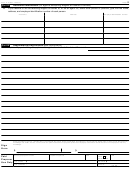

Detach Here and Mail With Your Payment and Form 11-C.

▼

▼

11-C(V)

Payment Voucher

OMB No. 1545-0236

(Rev. December 2017)

Department of the Treasury

Don’t staple or attach this voucher to your payment or Form 11-C.

▶

Internal Revenue Service

1 Enter your employer identification

Dollars

Cents

2

Enter the amount of your payment.

▶

number.

Make your check or money order payable to “United States Treasury”

3 Enter year and month as shown on Form 11-C.

4 Enter your business name (individual name if sole proprietor).

Y

Y

Y

Y

M

M

Enter your address.

Send Form 11-C, this voucher, and payment to:

Department of the Treasury

Enter your city or town, state or province, country, and ZIP or foreign postal code.

Internal Revenue Service

Ogden, UT 84201-0101

1

1 2

2 3

3 4

4 5

5 6

6