Page 3

Check appropriate box for each question in each section

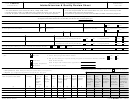

Yes No Unsure Part VI - Health Care Coverage - Last year, did you, your spouse, or dependent(s)

1. (B) Have health care coverage?

2. (B) Receive one or more of these forms? (Check the box)

Form 1095-B

Form 1095-C

3. (A) Have coverage through the Marketplace (Exchange)? [Provide Form 1095-A]

3a. (A) If yes, were advance credit payments made to help you pay your health care premiums?

3b. (A) If yes, Is everyone listed on your Form 1095-A being claimed on this tax return?

4. (B) Have an exemption granted by the Marketplace?

Visit or call 1-800-318-2596 for more information on health insurance options and assistance.

If advance payments of the premium tax credit were paid on your behalf to help pay your health insurance premiums, you should report life changes, such

as, income, marital status or family size changes, to your Marketplace. Reporting changes will help to make sure you are getting the proper amount of

advance payments.

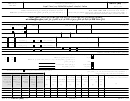

To be Completed by a Certified Volunteer Preparer (Use Publication 4012 and check the appropriate box(es) indicating Minimum Essential Coverage (MEC) for everyone listed on the return.)

Name (List dependents in the

MEC

Part Year MEC

Exemption (mark months

Exemption

No MEC

Notes

same order as in Part II)

Entire Year

(mark months with coverage)

exemptions applies)

All Year

Taxpayer

J F M A M J J A S O N D J F M A M J J A S O N D

J F M A M J J A S O N D J F M A M J J A S O N D

Spouse

Dependent

J F M A M J J A S O N D J F M A M J J A S O N D

Dependent

J F M A M J J A S O N D J F M A M J J A S O N D

J F M A M J J A S O N D J F M A M J J A S O N D

Dependent

J F M A M J J A S O N D J F M A M J J A S O N D

Dependent

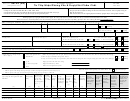

Part VII – Additional Information and Questions Related to the Preparation of Your Return

1. Provide an email address (optional) (this email address will not be used for contacts from the Internal Revenue Service)

2. Presidential Election Campaign Fund (If you check a box, your tax or refund will not change)

Check here if you, or your spouse if filing jointly, want $3 to go to this fund

You

Spouse

3. If you are due a refund, would you like:

a. Direct deposit

b. To purchase U.S. Savings Bonds

c. To split your refund between different accounts

Yes

No

Yes

No

Yes

No

4. If you have a balance due, would you like to make a payment directly from your bank account?

Yes

No

5. Have you or your spouse received any letters from the Internal Revenue Service?

Yes

No

Many free tax preparation sites operate by receiving grant money. The data from the following questions may be used by this site to apply for these grants.

Your answers will be used only for statistical purposes.

6. Other than English, what language is spoken in your home?

Prefer not to answer

7. Do you or any member of your household have a disability?

Yes

No

Prefer not to answer

8. Are you or your spouse a Veteran from the U.S. Armed Forces?

Yes

No

Prefer not to answer

Additional comments

13614-C

Catalog Number 52121E

Form

(Rev. 10-2017)

1

1 2

2 3

3 4

4