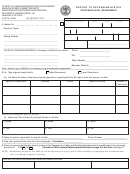

Department of the Treasury - Internal Revenue Service

14581-E

Form

Retirement Plan Coverage Compliance Self-Assessment

(June 2017)

For State and Local Government Entities

Retirement Plan Coverage – Publication 963

1.

Does the entity have a public retirement system that qualifies as a replacement for

Yes

No

Follow Up

Social Security coverage

Note: A governmental retirement plan must meet certain minimum benefit or contribution standards to qualify as a public retirement

system, and thereby serve as a “replacement” plan exempting the participants from mandatory Social Security coverage. These

standards are based solely on meeting a minimum benefit level either:

1) Provided to (defined benefit plan) the participant, or

2) Contributed by (defined contribution plan) the participant.

Any person working for a public employer after July 1, 1991, who is not covered in a public retirement plan that meets the requirements

discussed above and, if applicable, the defined benefit system safe harbor rules of Revenue Procedure (Rev. Proc.) 91-40, must be

covered by Social Security and Medicare under the mandatory coverage provisions of Section 210 of the Social Security Act, except for

exclusions from mandatory Social Security and Medicare.

For more information about public retirement systems (Social Security replacement plans), see Chapter 6 of Publication 963, Federal-

State Reference Guide.

Comments

2.

Is the public retirement plan offered to all employees

Yes

No

Follow Up

If not, specify categories of employees that are NOT covered. (Specify all that apply)

Note: Employees in these categories must be covered for Social Security either under mandatory coverage or under a Section 218

Agreement.

Comments

3.

Are the contributions to retirement plans subject to applicable employment taxes

Yes

No

Follow Up

Comments

a. Internal Revenue Code (IRC) Section 3121(b)(7)(F) retirement system

Yes

No

Follow Up

• Employee deferrals are exempt from federal income tax withholding but are subject to Social Security and Medicare taxes.

• Employer contributions are exempt from federal income tax withholding, Social Security and Medicare taxes. However, if the

retirement system is not an “exempt governmental deferred compensation plan,” employer contributions are subject to Social

Security and Medicare withholding as of the later of when the services are performed or when there is no substantial risk of

forfeiture.

Comments

b. IRC Section 401(a) and/or Section 403(b) plan

Yes

No

Follow Up

• Employee deferrals are exempt from federal Income tax withholding but are subject to Social Security and Medicare taxes.

• Employer contributions are exempt from federal Income tax withholding, Social Security and Medicare taxes.

Comments

14581-E

Catalog Number 69848Q

Form

(6-2017)

1

1 2

2 3

3