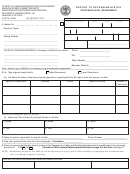

Department of the Treasury - Internal Revenue Service

14581-F

Form

Social Security Coverage Compliance Self-Assessment

(June 2017)

For State and Local Government Entities

Social Security – Publication 963

General Social Security information is available at the Social Security Administration's website and information specific to state and

local government employers is available at

The National Conference of State Social Security Administrators (NCSSSA) website includes contact information for the state

Social Security Administrators, who are responsible for maintaining and administering the states’ Section 218 Agreements and

Modifications with the Social Security Administration.

1.

Does the entity have Social Security coverage under a Section 218 Agreement and/or

Yes

No

Follow Up

Modification (a modification is an amendment to the state's Section 218 Agreement)

If no, SKIP to question 4.

Note: If an entity is uncertain whether it is covered by a Section 218 Agreement and/or a Modification and would like to obtain a copy of

its Section 218 Agreement and any related modifications, contact the State Social Security Administrator at

Comments

2.

Have there been any Modifications to the Section 218 Agreement or to the original

Yes

No

Follow Up

Modification that provided Section 218 coverage for the entity

It may be necessary to contact the State Social Security Administrator to answer this question. If “yes,” list all Modification numbers,

dates and a description of changes to the Section 218 Agreement made by each Modification. If there have been no modifications, skip

to Question 3.

List the modifications

Note: State Social Security Administrators prepare Section 218 Modifications to the states’ agreements to include additional coverage

groups, to correct errors in other Modifications, to identify additional political subdivisions joining a covered retirement system or to

obtain Medicare coverage for public employees whose employment relationship with a public employer has been continuous since

March 31, 1986.

To learn more, contact the State Social Security Administrator for the state.

Comments

14581-F

Catalog Number 69849B

Form

(6-2017)

1

1 2

2 3

3 4

4