Page 3

3.

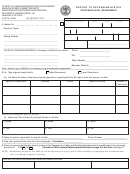

If the entity has a Section 218 Agreement and/or Modification, are services

Yes

No

Follow Up

performed by any employees excluded from Social Security and/or Medicare

coverage

Note: Federal law requires the exclusion of the following services from voluntary (Section 218) coverage under the Social Security Act

(Section 218(c)(6)):

• Services performed by individuals hired to be relieved from unemployment.

• Services performed in a hospital, home or other institution by a patient or inmate thereof as an employee of a state or local

government.

• Services performed by an employee hired on a temporary basis in case of fire, storm, snow, earthquake, flood or similar

emergency.

• Services performed by a nonresident alien temporarily residing in the U.S., holding an F-1, J-1, M-1 or Q-1 visa, when the services

are performed to carry out the purpose for which the alien was admitted to the U.S.

• Covered transportation service as defined in SSA 210(k).

Note: Federal law allows for the optional exclusion of the following services from voluntary (Section 218) coverage under the Social

Security Act:

• Services in positions compensated solely by fees received directly from the public are subject to SECA (Self-Employment

Contributions Act) taxes.

• Services performed by a student enrolled and regularly attending classes at the school, college or university for which they are

working.

• Services performed by election officials or election workers paid less than the calendar year threshold amount mandated by law.

• Services that would be excluded if performed for a private employer because they are not work defined as employment under

Section 210(a) of the Social Security Act.

Note: The categories of employees excluded from a Section 218 Agreement may still be subject to Social Security and Medicare

withholding under the mandatory Social Security provisions if they do not participate in a retirement plan that replaces Social Security.

List the categories of workers excluded from coverage under the Section 218 Agreement or Modification

See IRS Publication 963, Federal-State Reference Guide, for information on exclusions from Section 218 coverage.

Comments

14581-F

Catalog Number 69849B

Form

(6-2017)

1

1 2

2 3

3 4

4