Page 4

4.

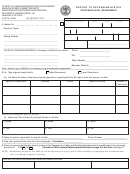

Is the entity subject to mandatory Social Security coverage

Yes

No

Follow Up

Note: After July 1, 1991, full-time, part-time, temporary and seasonal employees who are not participating in a qualifying retirement

system made available through their employer must be covered by Social Security, pursuant to Internal Revenue Code (IRC) Section

3121(b)(7)(F). The IRC, however, exempts employees performing the following services from mandatory Social Security and Medicare

taxes.

• Services performed by individuals hired to be relieved from unemployment.

• Services performed in a hospital, home or other institution by a patient or inmate thereof as an employee of a state or local

government.

• Services performed by an employee hired on a temporary basis in case of fire, storm, snow, earthquake, flood or similar

emergency.

• Services performed by a nonresident alien temporarily residing in the U.S. holding an F-1, J-1, M-1 or Q-1 visa, when the services

are performed to carry out the purpose for which the alien was admitted to the U.S.

• Services in positions compensated solely by fees received directly from the public are subject to SECA (Self-Employment

Contributions Act) taxes, unless a Section 218 Agreement covers these services.

• Services performed by a student enrolled and regularly attending classes at the school, college or university for which they are

working, unless a section 218 Agreement covers these services. Refer to

for the student exclusions for each state.

• Services performed by election officials or election workers paid less than the calendar year threshold amount mandated by law

unless a Section 218 Agreement covers election workers.

• Services that would be excluded if performed for a private employer because they are not work defined as employment under

Section 210(a) of the Social Security Act

See IRS Publication 963, Federal-State Reference Guide, for information on exclusions from mandatory Social Security coverage.

Comments

Notes/Follow-up

You have completed the Social Security Compliance Self-Assessment.

14581-F

Catalog Number 69849B

Form

(6-2017)

1

1 2

2 3

3 4

4