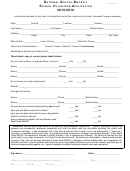

Volunteer:

By signing this form, I declare that I have completed Volunteer Standards of Conduct Certification and have read, understand, and will

comply with the volunteer standards of conduct. I also certify that I am a U.S. citizen, a legal resident, or otherwise reside in the U.S.

legally.

Full name

Volunteer position(s)

(please print)

Home address

(street, city, state and ZIP code)

Email address

Daytime telephone

Sponsoring partner name/site name

Number of years volunteered

Volunteer signature

Date

(including this year)

Volunteer Certification Levels (Add the letter "P" for all passing test scores)

Standards of

Intake/Interview

Federal Tax Law Update

Puerto Rico

Foreign

Conduct

& Quality

Basic Advanced

Test for Circular 230

Military International HSA

Students

(Required for ALL)

Review

Professionals*

1

2

*Federal Tax Law Update Test for Circular 230 Professionals: Only volunteers in good standing as an attorney, CPA, or Enrolled Agent can take this certification.

To qualify for this certification, the license information below must be completed by the volunteer and verified by the partner or site coordinator. Volunteers with this

certification level can prepare any tax returns that fall within the scope of the VITA/TCE Programs. (Advanced, HSA, Military, etc.) A Scope of Service Chart is located

in Publication 4012, VITA/TCE Volunteer Resource Guide. See

Publication

1084, Site Coordinator Handbook, for additional requirements and instructions.

Note: Advanced Certification is necessary for qualification for CE Credits, the Federal Tax Law Update Test does not qualify the volunteer to receive CE Credits. See

Publication 4396-A, Partner Resource Guide, for more information about requirements for CE Credits.

Professional designation

Licensing jurisdiction

Bar, license, registration, or

Effective or

Expiration date

(Attorney, CPA, or Enrolled Agent)

(state)

enrollment number

issue date

(if provided)

Note: SPEC established the minimum certification requirements for volunteers who are authorized under Circular 230; however, partners may establish

additional certification requirements for their volunteers. Volunteers should check with the sponsoring SPEC Partner.

Site Coordinator, Sponsoring Partner, Instructor or IRS: By signing this form, I declare that I have verified the required certification level(s) and photo

identification for this volunteer prior to allowing the volunteer to work at the VITA/TCE site.

Approving Official's (printed) name and title

Approving Official’s signature and date

(site coordinator, sponsoring partner, instructor, etc.)

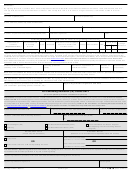

For Continuing Education (CE) Credits ONLY

(to be completed by the site coordinator or partner)

Instructions: Complete this section when an unpaid certified volunteer is requesting Continuing Education (CE) credits. CE credits will not be issued

without a PTIN for Enrolled Agents or Non-credentialed preparers. CPAs, attorneys, or CFPs do not require a PTIN; however, they must check with their

governing board requirements for obtaining CE Credits. The site coordinator, partner designated official, or instructor must sign and date this form and send

the completed form to the SPEC Territory Office/Relationship Manager for further processing. Refer to the Fact Sheet - Continuing Education Credits on

the

Site Coordinator Corner

or

Publication

4396-A, Partner Resource Guide, for additional requirements and instructions.

Volunteer Preparer's Tax Identification Number (PTIN)

CTEC ID number

Name as listed on PTIN card

(if applicable)

P -

A -

Address

Site Identification Number (SIDN)

(VITA/TCE Site or teaching location)

S -

Professional Status

(check only one box)

Enrolled Agent (EA)

Certified Public Accountant (CPA)

Non-credentialed Tax Return Preparer

(Participating in the Annual Filing Season

Attorney

Certified Financial Planner (CFP)

Program)

Certification Level

Volunteer Hours

(Check only one box below)

(Minimum of 10 volunteer hours required to issue CE Credits)

Total hours volunteered

Advanced

(qualifies for 14 CE credits)

OR

OR

Total hours volunteered

Advanced and One or More Specialty Courses

(qualifies for 18 CE credits)

Site Coordinator, Sponsoring Partner, or Instructor: By signing this form, I declare that I have validated that the reported volunteer hours are based on

the activities this volunteer performed in my site or training facility.

Approving Official's (printed) name and title

(site coordinator, sponsoring partner, instructor)

Approving Official’s signature

Date signed

13615

Catalog Number 38847H

Form

(Rev. 10-2017)

1

1 2

2