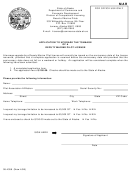

2. Each child that you claim must be related to you in

Then, send in copies of:

one of the ways listed below. If the child is

One or more birth certificates or other legal documents proving how you are related. For example, the child’s birth certificate, showing

your brother as the father, your brother’s birth certificate showing your mother’s name and your birth certificate showing your

Your niece or nephew

mother’s name.

If the names aren’t on the birth certificates, you need another type of document such as a court decree or paternity test.

One or more birth certificates or other legal documents proving how you are related. For example, If you are claiming your half-

brother, you need your brother’s birth certificate with the name of your mother or father and your birth certificate with the name of the

same mother or father.

Your brother, sister, half brother, or half sister

Both birth certificates must have the name of the parent in common. If not, you need another type of document, such as a

court decree or paternity test results.

One or more birth certificates or other legal documents, such as court papers or marriage licenses, proving how you are related.

Your stepson, stepdaughter, step-brother, step-sister,

If the birth certificate doesn’t have the name of the parent to prove how you are related, you need another type of

step-grandchild, or step-great grandchild

document, such as court decree or DNA test results.

A child pending adoption

If the adoption is not final, you need a statement on letterhead from an authorized adoption agency.

Your foster child placed with you by an authorized

A statement on the letterhead of the authorized placement agency or the court document placing the child with you during 2017.

placement agency

3. Age of each child that you claim is:

Then, send in copies of:

Under age 19 at the end of 2017 and younger than you (or your

Nothing at this time.

spouse if filing a joint return)

● age 19 but under age 24 at the end of 2017, and

● School records showing the child was considered a full-time student for any part of five months of the tax year.

● a full-time student for any part of 5 calendar months during

It can be any five months of the year. The months do not have to be consecutive.

2017, and

● The school records must show the child's name and the dates the child attended school during 2017.

● younger than you (or your spouse if filing a joint return)

A letter from a doctor, other health care provider, a social service program or government agency verifying the person is:

Any age and permanently and totally disabled at any time

permanently and totally disabled. To be permanently and totally disabled for EIC purposes, the condition must last or be expected to

during 2017

last continuously for at least a year or is expected to result in death; and the person can’t work or perform other substantial gainful

activities.

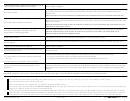

We must have proof for all three: you are related to the child, the child lived with you and the child's age. If you don't have or can't get the legal

documents that we ask for, you can't claim EITC with that child. But, you may still be eligible for EIC without a qualifying child.

Important things to check before sending copies of your documents to us:

Your records and documents prove all three; the child lived with you, is related to you and is a certain age. If not, we cannot allow your claim for EIC.

Your documents are for 2017 not the current year.

If your documents are not in English, you are sending a legally translated document.

We cannot accept documents signed by someone related to you for example, your sister takes care of the child while you work. You can’t send a statement signed by your

sister as the childcare provider to prove the child lived with you.

You are using the same record or document to prove different things. For example, you use a school record to show the child attended school from January to May and then another

record showing the same child attended from September to December during 2017. If the records show your address and list you as the parent, you can use the records to prove the

child lived with you for more than half the year in 2017 and that the child is related to you. If the child is age 19 but under age 24, the records also prove the child is the right age.

886-H-EIC

Form

(Rev. 10-2017)

Catalog Number 35113Q

1

1 2

2