Instructions For Form 1040-X - Amended U.s. Individual Income Tax Return

ADVERTISEMENT

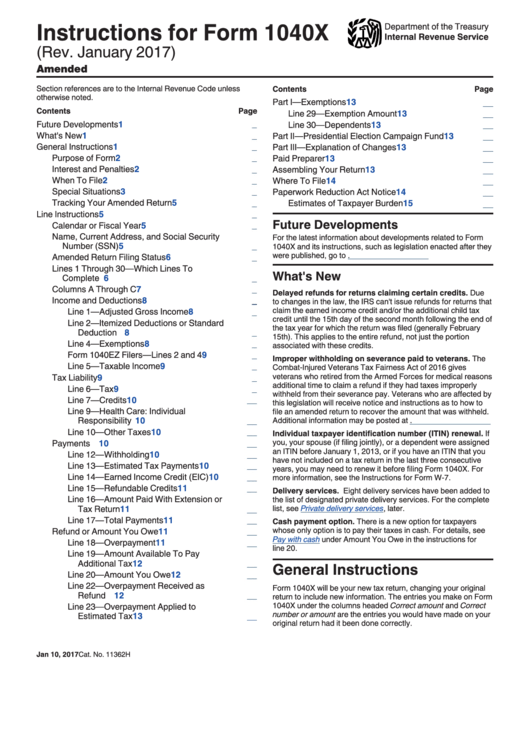

Instructions for Form 1040X

Department of the Treasury

Internal Revenue Service

(Rev. January 2017)

Amended U.S. Individual Income Tax Return

Section references are to the Internal Revenue Code unless

Contents

Page

otherwise noted.

Part I—Exemptions

13

. . . . . . . . . . . . . . . . . . . . . . . . .

Contents

Page

Line 29—Exemption Amount

13

. . . . . . . . . . . . . . .

Future Developments

1

Line 30—Dependents

13

. . . . . . . . . . . . . . . . . . . . . . . .

. . . . . . . . . . . . . . . . . . . .

What's New

1

Part II—Presidential Election Campaign Fund

13

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

. . . . . .

General Instructions

1

Part III—Explanation of Changes

13

. . . . . . . . . . . . . . . . . . . . . . . . .

. . . . . . . . . . . . . . .

Purpose of Form

2

Paid Preparer

13

. . . . . . . . . . . . . . . . . . . . . . . . .

. . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Interest and Penalties

2

Assembling Your Return

13

. . . . . . . . . . . . . . . . . . . . .

. . . . . . . . . . . . . . . . . . . . .

When To File

2

Where To File

14

. . . . . . . . . . . . . . . . . . . . . . . . . . .

. . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Special Situations

3

Paperwork Reduction Act Notice

14

. . . . . . . . . . . . . . . . . . . . . . . .

. . . . . . . . . . . . . . .

Tracking Your Amended Return

5

Estimates of Taxpayer Burden

15

. . . . . . . . . . . . . .

. . . . . . . . . . . . . .

Line Instructions

5

. . . . . . . . . . . . . . . . . . . . . . . . . . . .

Future Developments

Calendar or Fiscal Year

5

. . . . . . . . . . . . . . . . . . . .

Name, Current Address, and Social Security

For the latest information about developments related to Form

Number (SSN)

5

. . . . . . . . . . . . . . . . . . . . . . . .

1040X and its instructions, such as legislation enacted after they

were published, go to

Amended Return Filing Status

6

. . . . . . . . . . . . . . .

Lines 1 Through 30—Which Lines To

What's New

Complete

6

. . . . . . . . . . . . . . . . . . . . . . . . . . . .

Columns A Through C

7

. . . . . . . . . . . . . . . . . . . . .

Delayed refunds for returns claiming certain credits. Due

Income and Deductions

8

. . . . . . . . . . . . . . . . . . .

to changes in the law, the IRS can't issue refunds for returns that

claim the earned income credit and/or the additional child tax

Line 1—Adjusted Gross Income

8

. . . . . . . . . . .

credit until the 15th day of the second month following the end of

Line 2—Itemized Deductions or Standard

the tax year for which the return was filed (generally February

Deduction

8

. . . . . . . . . . . . . . . . . . . . . . . .

15th). This applies to the entire refund, not just the portion

Line 4—Exemptions

8

. . . . . . . . . . . . . . . . . . .

associated with these credits.

Form 1040EZ Filers—Lines 2 and 4

9

. . . . . . . .

Improper withholding on severance paid to veterans. The

Line 5—Taxable Income

9

. . . . . . . . . . . . . . . .

Combat-Injured Veterans Tax Fairness Act of 2016 gives

veterans who retired from the Armed Forces for medical reasons

Tax Liability

9

. . . . . . . . . . . . . . . . . . . . . . . . . . . .

additional time to claim a refund if they had taxes improperly

Line 6—Tax

9

. . . . . . . . . . . . . . . . . . . . . . . . .

withheld from their severance pay. Veterans who are affected by

Line 7—Credits

10

. . . . . . . . . . . . . . . . . . . . .

this legislation will receive notice and instructions as to how to

Line 9—Health Care: Individual

file an amended return to recover the amount that was withheld.

Responsibility

10

Additional information may be posted at

. . . . . . . . . . . . . . . . . . . . .

Line 10—Other Taxes

10

. . . . . . . . . . . . . . . . .

Individual taxpayer identification number (ITIN) renewal. If

you, your spouse (if filing jointly), or a dependent were assigned

Payments

10

. . . . . . . . . . . . . . . . . . . . . . . . . . . .

an ITIN before January 1, 2013, or if you have an ITIN that you

Line 12—Withholding

10

. . . . . . . . . . . . . . . . .

have not included on a tax return in the last three consecutive

Line 13—Estimated Tax Payments

10

. . . . . . .

years, you may need to renew it before filing Form 1040X. For

Line 14—Earned Income Credit (EIC)

10

. . . . .

more information, see the Instructions for Form W-7.

Line 15—Refundable Credits

11

. . . . . . . . . . . .

Delivery services. Eight delivery services have been added to

Line 16—Amount Paid With Extension or

the list of designated private delivery services. For the complete

Tax Return

11

list, see

Private delivery

services, later.

. . . . . . . . . . . . . . . . . . . . . . .

Line 17—Total Payments

11

. . . . . . . . . . . . . .

Cash payment option. There is a new option for taxpayers

Refund or Amount You Owe

11

whose only option is to pay their taxes in cash. For details, see

. . . . . . . . . . . . . . .

Pay with cash

under Amount You Owe in the instructions for

Line 18—Overpayment

11

. . . . . . . . . . . . . . . .

line 20.

Line 19—Amount Available To Pay

Additional Tax

12

. . . . . . . . . . . . . . . . . . . .

General Instructions

Line 20—Amount You Owe

12

. . . . . . . . . . . . .

Line 22—Overpayment Received as

Form 1040X will be your new tax return, changing your original

Refund

12

. . . . . . . . . . . . . . . . . . . . . . . . .

return to include new information. The entries you make on Form

1040X under the columns headed Correct amount and Correct

Line 23—Overpayment Applied to

number or amount are the entries you would have made on your

Estimated Tax

13

. . . . . . . . . . . . . . . . . . . .

original return had it been done correctly.

Jan 10, 2017

Cat. No. 11362H

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15