Instructions For Form 8862 - Information To Claim Earned Income Credit After Disallowance

ADVERTISEMENT

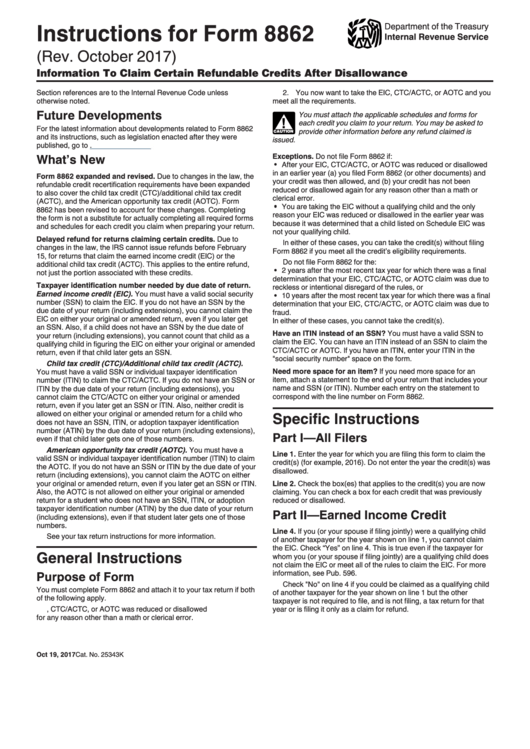

Instructions for Form 8862

Department of the Treasury

Internal Revenue Service

(Rev. October 2017)

Information To Claim Certain Refundable Credits After Disallowance

Section references are to the Internal Revenue Code unless

2. You now want to take the EIC, CTC/ACTC, or AOTC and you

otherwise noted.

meet all the requirements.

Future Developments

You must attach the applicable schedules and forms for

each credit you claim to your return. You may be asked to

!

For the latest information about developments related to Form 8862

provide other information before any refund claimed is

and its instructions, such as legislation enacted after they were

CAUTION

issued.

published, go to IRS.gov/Form8862.

What’s New

Exceptions. Do not file Form 8862 if:

After your EIC, CTC/ACTC, or AOTC was reduced or disallowed

in an earlier year (a) you filed Form 8862 (or other documents) and

Form 8862 expanded and revised. Due to changes in the law, the

your credit was then allowed, and (b) your credit has not been

refundable credit recertification requirements have been expanded

reduced or disallowed again for any reason other than a math or

to also cover the child tax credit (CTC)/additional child tax credit

clerical error.

(ACTC), and the American opportunity tax credit (AOTC). Form

You are taking the EIC without a qualifying child and the only

8862 has been revised to account for these changes. Completing

reason your EIC was reduced or disallowed in the earlier year was

the form is not a substitute for actually completing all required forms

because it was determined that a child listed on Schedule EIC was

and schedules for each credit you claim when preparing your return.

not your qualifying child.

Delayed refund for returns claiming certain credits. Due to

In either of these cases, you can take the credit(s) without filing

changes in the law, the IRS cannot issue refunds before February

Form 8862 if you meet all the credit’s eligibility requirements.

15, for returns that claim the earned income credit (EIC) or the

Do not file Form 8862 for the:

additional child tax credit (ACTC). This applies to the entire refund,

2 years after the most recent tax year for which there was a final

not just the portion associated with these credits.

determination that your EIC, CTC/ACTC, or AOTC claim was due to

Taxpayer identification number needed by due date of return.

reckless or intentional disregard of the rules, or

Earned income credit (EIC). You must have a valid social security

10 years after the most recent tax year for which there was a final

number (SSN) to claim the EIC. If you do not have an SSN by the

determination that your EIC, CTC/ACTC, or AOTC claim was due to

due date of your return (including extensions), you cannot claim the

fraud.

EIC on either your original or amended return, even if you later get

In either of these cases, you cannot take the credit(s).

an SSN. Also, if a child does not have an SSN by the due date of

Have an ITIN instead of an SSN? You must have a valid SSN to

your return (including extensions), you cannot count that child as a

claim the EIC. You can have an ITIN instead of an SSN to claim the

qualifying child in figuring the EIC on either your original or amended

CTC/ACTC or AOTC. If you have an ITIN, enter your ITIN in the

return, even if that child later gets an SSN.

"social security number" space on the form.

Child tax credit (CTC)/Additional child tax credit (ACTC).

Need more space for an item? If you need more space for an

You must have a valid SSN or individual taxpayer identification

item, attach a statement to the end of your return that includes your

number (ITIN) to claim the CTC/ACTC. If you do not have an SSN or

name and SSN (or ITIN). Number each entry on the statement to

ITIN by the due date of your return (including extensions), you

correspond with the line number on Form 8862.

cannot claim the CTC/ACTC on either your original or amended

return, even if you later get an SSN or ITIN. Also, neither credit is

Specific Instructions

allowed on either your original or amended return for a child who

does not have an SSN, ITIN, or adoption taxpayer identification

number (ATIN) by the due date of your return (including extensions),

Part I—All Filers

even if that child later gets one of those numbers.

American opportunity tax credit (AOTC). You must have a

Line 1. Enter the year for which you are filing this form to claim the

valid SSN or individual taxpayer identification number (ITIN) to claim

credit(s) (for example, 2016). Do not enter the year the credit(s) was

the AOTC. If you do not have an SSN or ITIN by the due date of your

disallowed.

return (including extensions), you cannot claim the AOTC on either

your original or amended return, even if you later get an SSN or ITIN.

Line 2. Check the box(es) that applies to the credit(s) you are now

Also, the AOTC is not allowed on either your original or amended

claiming. You can check a box for each credit that was previously

return for a student who does not have an SSN, ITIN, or adoption

reduced or disallowed.

taxpayer identification number (ATIN) by the due date of your return

Part II—Earned Income Credit

(including extensions), even if that student later gets one of those

numbers.

Line 4. If you (or your spouse if filing jointly) were a qualifying child

See your tax return instructions for more information.

of another taxpayer for the year shown on line 1, you cannot claim

the EIC. Check “Yes” on line 4. This is true even if the taxpayer for

General Instructions

whom you (or your spouse if filing jointly) are a qualifying child does

not claim the EIC or meet all of the rules to claim the EIC. For more

Purpose of Form

information, see Pub. 596.

Check "No" on line 4 if you could be claimed as a qualifying child

You must complete Form 8862 and attach it to your tax return if both

of another taxpayer for the year shown on line 1 but the other

of the following apply.

taxpayer is not required to file, and is not filing, a tax return for that

1. Your EIC, CTC/ACTC, or AOTC was reduced or disallowed

year or is filing it only as a claim for refund.

for any reason other than a math or clerical error.

Oct 19, 2017

Cat. No. 25343K

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3