Instructions For Application For Extension Of Time To File A City Income Tax Return

ADVERTISEMENT

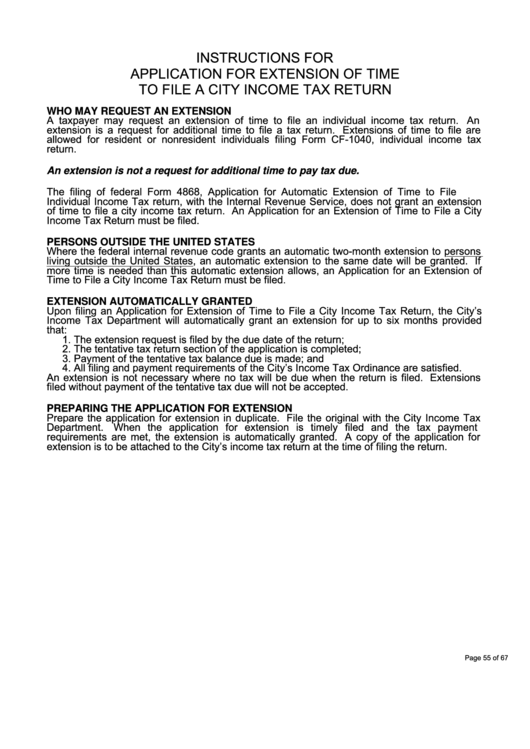

INSTRUCTIONS FOR

APPLICATION FOR EXTENSION OF TIME

TO FILE A CITY INCOME TAX RETURN

WHO MAY REQUEST AN EXTENSION

A taxpayer may request an extension of time to file an individual income tax return. An

extension is a request for additional time to file a tax return. Extensions of time to file are

allowed for resident or nonresident individuals filing Form CF-1040, individual income tax

return.

An extension is not a request for additional time to pay tax due.

The filing of federal Form 4868, Application for Automatic Extension of Time to File U.S.

Individual Income Tax return, with the Internal Revenue Service, does not grant an extension

of time to file a city income tax return. An Application for an Extension of Time to File a City

Income Tax Return must be filed.

PERSONS OUTSIDE THE UNITED STATES

Where the federal internal revenue code grants an automatic two-month extension to persons

living outside the United States, an automatic extension to the same date will be granted. If

more time is needed than this automatic extension allows, an Application for an Extension of

Time to File a City Income Tax Return must be filed.

EXTENSION AUTOMATICALLY GRANTED

Upon filing an Application for Extension of Time to File a City Income Tax Return, the City’s

Income Tax Department will automatically grant an extension for up to six months provided

that:

1. The extension request is filed by the due date of the return;

2. The tentative tax return section of the application is completed;

3. Payment of the tentative tax balance due is made; and

4. All filing and payment requirements of the City’s Income Tax Ordinance are satisfied.

An extension is not necessary where no tax will be due when the return is filed. Extensions

filed without payment of the tentative tax due will not be accepted.

PREPARING THE APPLICATION FOR EXTENSION

Prepare the application for extension in duplicate. File the original with the City Income Tax

Department.

When the application for extension is timely filed and the tax payment

requirements are met, the extension is automatically granted. A copy of the application for

extension is to be attached to the City’s income tax return at the time of filing the return.

Page 55 of 67

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1