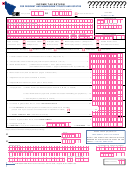

Individual Income Tax Returns Forms (Resident And Nonresident) - City Of Grayling - 2006

ADVERTISEMENT

CITY OF

2006 CITY OF GRAYLING

GRAYLING

Individual Income Tax Returns

(Resident and Nonresident)

This booklet contains the following forms and instructions:

• GR-1040 City of Grayling Individual Income Tax Return

• GR-1040ES City of Grayling year 2006 Estimated Individual Income Tax Voucher

• GR-4868 Application for Extension of Time to File City of Grayling Tax Returns - Extensions

NOTE: City of Grayling income tax returns cannot be filed electronically.

Some important reminders for Grayling taxpayers and tax preparers:

• The due date for filing your City of Grayling Individual Income Tax Return (GR-1040) is April 30, 2007.

• Your check or money order for payment of Grayling income tax must be made payable to: “City Treasurer”

• If you owe more than $100 on your 2006 GR-1040 you must make estimated income tax payments for the

year 2007. City of Grayling Estimated Individual Income Tax Vouchers (GR-1040ES) for the year 2007 are

included in this booklet.

For Help Call (989) 348-2131

• failing to include spouse’s social security number if

filing jointly

Call this number and ask for the Income Tax Division:

• transposing numbers in the Social Security number

Staff is available to take your call between 8:30 am and

• reporting the wrong amount of estimated tax

4:30 pm (Mon.-Fri.) year around. You may also visit

payments

the Income Tax Division at City Hall (1020 City Blvd.).

• failing to attach federal schedules to verify losses,

How to Get Forms…

subtractions and expenses

• failing to attach W-2 forms

You can pick up forms at City Hall (1020 City Blvd.)

• entering figures on the wrong lines

or you can call (989) 348-2131 and request them by

• computation errors

mail or log on to our website at

• failing to sign the return

and click on “Income Tax.”

Where to Mail Your 2006 Return

When You Have Finished

Mail your return and remittance to:

Please review your return for the following common

City of Grayling

errors that can delay processing of your return:

Income Tax Division

• illegible writing

P.O. Box 549

• failing to provide actual physical address

Grayling, MI 49738

• failing to provide verification of subtractions due to

disablements

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5