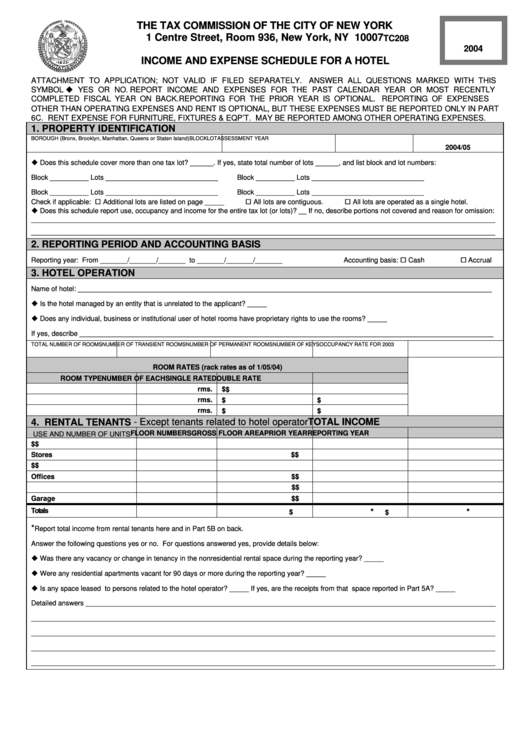

Form Tc208 - Income And Expense Schedule For A Hotel - 2004

ADVERTISEMENT

THE TAX COMMISSION OF THE CITY OF NEW YORK

1 Centre Street, Room 936, New York, NY 10007

TC208

2004

INCOME AND EXPENSE SCHEDULE FOR A HOTEL

ATTACHMENT TO APPLICATION; NOT VALID IF FILED SEPARATELY.

ANSWER ALL QUESTIONS MARKED WITH THIS

SYMBOL

YES OR NO

REPORT INCOME AND EXPENSES FOR THE PAST CALENDAR YEAR OR MOST RECENTLY

.

COMPLETED FISCAL YEAR ON BACK.

REPORTING FOR THE PRIOR YEAR IS OPTIONAL. REPORTING OF EXPENSES

OTHER THAN OPERATING EXPENSES AND RENT IS OPTIONAL, BUT THESE EXPENSES MUST BE REPORTED ONLY IN PART

6C. RENT EXPENSE FOR FURNITURE, FIXTURES & EQP’T. MAY BE REPORTED AMONG OTHER OPERATING EXPENSES.

1. PROPERTY IDENTIFICATION

BOROUGH (Bronx, Brooklyn, Manhattan, Queens or Staten Island)

BLOCK

LOT

ASSESSMENT YEAR

2004/05

Does this schedule cover more than one tax lot? ______. If yes, state total number of lots ______, and list block and lot numbers:

Block __________ Lots _____________________________

Block __________ Lots _____________________________

Block __________ Lots _____________________________

Block __________ Lots _____________________________

Check if applicable:

Additional lots are listed on page _____

All lots are contiguous.

All lots are operated as a single hotel.

Does this schedule report use, occupancy and income for the entire tax lot (or lots)? __ If no, describe portions not covered and reason for omission:

________________________________________________________________________________________________________________________

________________________________________________________________________________________________________________________

2. REPORTING PERIOD AND ACCOUNTING BASIS

Reporting year: From _______/_______/_______ to _______/_______/_______

Accounting basis:

Cash

Accrual

3. HOTEL OPERATION

Name of hotel: ___________________________________________________________________________________________________________

Is the hotel managed by an entity that is unrelated to the applicant? _____

Does any individual, business or institutional user of hotel rooms have proprietary rights to use the rooms? _____

If yes, describe ___________________________________________________________________________________________________________

TOTAL NUMBER OF ROOMS

NUMBER OF TRANSIENT ROOMS

NUMBER OF PERMANENT ROOMS

NUMBER OF KEYS

OCCUPANCY RATE FOR 2003

ROOM RATES (rack rates as of 1/05/04)

ROOM TYPE

NUMBER OF EACH

SINGLE RATE

DOUBLE RATE

rms.

$

$

rms.

$

$

rms.

$

$

4. RENTAL TENANTS - Except tenants related to hotel operator

TOTAL INCOME

FLOOR NUMBERS

GROSS FLOOR AREA

PRIOR YEAR

REPORTING YEAR

USE AND NUMBER OF UNITS

Apartments

sq.ft.

$

$

Stores

sq.ft.

$

$

Restaurants

sq.ft.

$

$

Offices

sq.ft.

$

$

sq.ft.

$

$

Garage

sq.ft.

$

$

Totals

sq.ft.

*

*

$

$

*

Report total income from rental tenants here and in Part 5B on back.

Answer the following questions yes or no. For questions answered yes, provide details below:

Was there any vacancy or change in tenancy in the nonresidential rental space during the reporting year? _____

Were any residential apartments vacant for 90 days or more during the reporting year? _____

Is any space leased to persons related to the hotel operator? _____ If yes, are the receipts from that space reported in Part 5A? _____

Detailed answers __________________________________________________________________________________________________________

________________________________________________________________________________________________________________________

________________________________________________________________________________________________________________________

________________________________________________________________________________________________________________________

________________________________________________________________________________________________________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2