Deputy Ii Cashier/clerk Job Description

ADVERTISEMENT

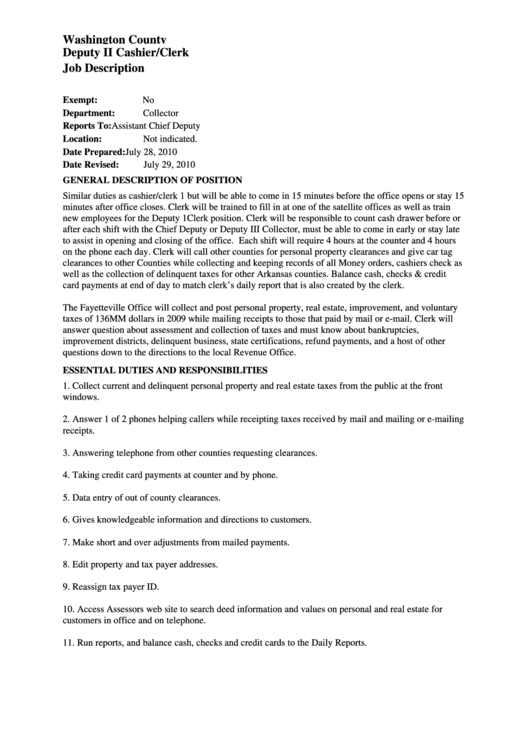

Washington County

Deputy II Cashier/Clerk

Job Description

No

Exempt:

Department:

Collector

Assistant Chief Deputy

Reports To:

Location:

Not indicated.

July 28, 2010

Date Prepared:

July 29, 2010

Date Revised:

GENERAL DESCRIPTION OF POSITION

Similar duties as cashier/clerk 1 but will be able to come in 15 minutes before the office opens or stay 15

minutes after office closes. Clerk will be trained to fill in at one of the satellite offices as well as train

new employees for the Deputy 1Clerk position. Clerk will be responsible to count cash drawer before or

after each shift with the Chief Deputy or Deputy III Collector, must be able to come in early or stay late

to assist in opening and closing of the office. Each shift will require 4 hours at the counter and 4 hours

on the phone each day. Clerk will call other counties for personal property clearances and give car tag

clearances to other Counties while collecting and keeping records of all Money orders, cashiers check as

well as the collection of delinquent taxes for other Arkansas counties. Balance cash, checks & credit

card payments at end of day to match clerk’s daily report that is also created by the clerk.

The Fayetteville Office will collect and post personal property, real estate, improvement, and voluntary

taxes of 136MM dollars in 2009 while mailing receipts to those that paid by mail or e-mail. Clerk will

answer question about assessment and collection of taxes and must know about bankruptcies,

improvement districts, delinquent business, state certifications, refund payments, and a host of other

questions down to the directions to the local Revenue Office.

ESSENTIAL DUTIES AND RESPONSIBILITIES

1. Collect current and delinquent personal property and real estate taxes from the public at the front

windows.

2. Answer 1 of 2 phones helping callers while receipting taxes received by mail and mailing or e-mailing

receipts.

3. Answering telephone from other counties requesting clearances.

4. Taking credit card payments at counter and by phone.

5. Data entry of out of county clearances.

6. Gives knowledgeable information and directions to customers.

7. Make short and over adjustments from mailed payments.

8. Edit property and tax payer addresses.

9. Reassign tax payer ID.

10. Access Assessors web site to search deed information and values on personal and real estate for

customers in office and on telephone.

11. Run reports, and balance cash, checks and credit cards to the Daily Reports.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3 4

4