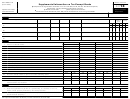

SCHEDULE J

Compensation Information

OMB No. 1545-0047

2017

(Form 990)

For certain Officers, Directors, Trustees, Key Employees, and Highest

Compensated Employees

Complete if the organization answered “Yes” on Form 990, Part IV, line 23.

▶

Open to Public

Attach to Form 990.

▶

Department of the Treasury

Inspection

Go to for instructions and the latest information.

Internal Revenue Service

▶

Name of the organization

Employer identification number

Part I

Questions Regarding Compensation

Yes

No

1a Check the appropriate box(es) if the organization provided any of the following to or for a person listed on Form

990, Part VII, Section A, line 1a. Complete Part III to provide any relevant information regarding these items.

First-class or charter travel

Housing allowance or residence for personal use

Travel for companions

Payments for business use of personal residence

Tax indemnification and gross-up payments

Health or social club dues or initiation fees

Discretionary spending account

Personal services (such as, maid, chauffeur, chef)

b If any of the boxes on line 1a are checked, did the organization follow a written policy regarding payment

or reimbursement or provision of all of the expenses described above? If “No,” complete Part III to

explain .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

1b

2

Did the organization require substantiation prior to reimbursing or allowing expenses incurred by all

directors, trustees, and officers, including the CEO/Executive Director, regarding the items checked on line

1a? .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

2

3

Indicate which, if any, of the following the filing organization used to establish the compensation of the

organization’s CEO/Executive Director. Check all that apply. Do not check any boxes for methods used by a

related organization to establish compensation of the CEO/Executive Director, but explain in Part III.

Compensation committee

Written employment contract

Independent compensation consultant

Compensation survey or study

Form 990 of other organizations

Approval by the board or compensation committee

4

During the year, did any person listed on Form 990, Part VII, Section A, line 1a, with respect to the filing

organization or a related organization:

a Receive a severance payment or change-of-control payment?

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

4a

b Participate in, or receive payment from, a supplemental nonqualified retirement plan?

4b

.

.

.

.

.

.

.

c Participate in, or receive payment from, an equity-based compensation arrangement?

4c

.

.

.

.

.

.

.

If “Yes” to any of lines 4a–c, list the persons and provide the applicable amounts for each item in Part III.

Only section 501(c)(3), 501(c)(4), and 501(c)(29) organizations must complete lines 5–9.

5

For persons listed on Form 990, Part VII, Section A, line 1a, did the organization pay or accrue any

compensation contingent on the revenues of:

a The organization? .

5a

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

b Any related organization?

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

5b

If “Yes” on line 5a or 5b, describe in Part III.

For persons listed on Form 990, Part VII, Section A, line 1a, did the organization pay or accrue any

6

compensation contingent on the net earnings of:

a

The organization? .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

6a

b Any related organization?

6b

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

If “Yes” on line 6a or 6b, describe in Part III.

7

For persons listed on Form 990, Part VII, Section A, line 1a, did the organization provide any nonfixed

payments not described on lines 5 and 6? If “Yes,” describe in Part III .

.

.

.

.

.

.

.

.

.

.

.

.

7

8

Were any amounts reported on Form 990, Part VII, paid or accrued pursuant to a contract that was subject

to the initial contract exception described in Regulations section 53.4958-4(a)(3)? If “Yes,” describe

in Part III .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

8

9

If “Yes” on line 8, did the organization also follow the rebuttable presumption procedure described in

Regulations section 53.4958-6(c)?

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

9

For Paperwork Reduction Act Notice, see the Instructions for Form 990.

Schedule J (Form 990) 2017

Cat. No. 50053T

1

1 2

2 3

3