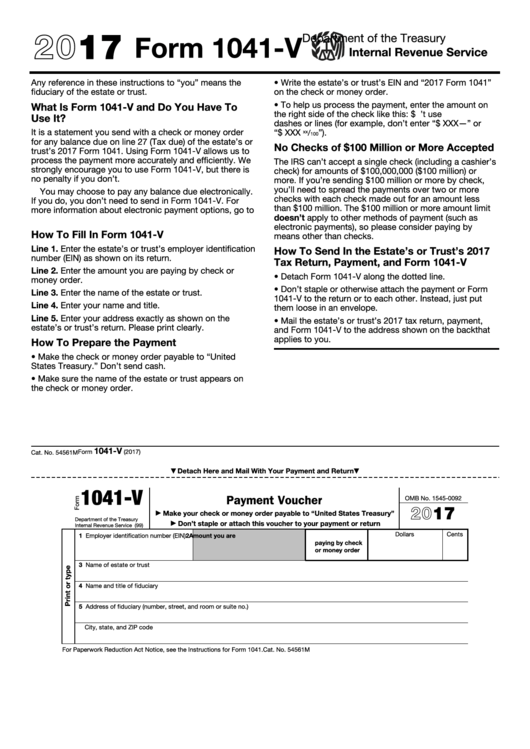

2017

Form 1041-V

Department of the Treasury

Internal Revenue Service

Any reference in these instructions to “you” means the

• Write the estate’s or trust’s EIN and “2017 Form 1041”

fiduciary of the estate or trust.

on the check or money order.

• To help us process the payment, enter the amount on

What Is Form 1041-V and Do You Have To

the right side of the check like this: $ XXX.XX. Don’t use

Use It?

dashes or lines (for example, don’t enter “$ XXX—” or

It is a statement you send with a check or money order

“$ XXX

”).

/

xx

100

for any balance due on line 27 (Tax due) of the estate’s or

No Checks of $100 Million or More Accepted

trust’s 2017 Form 1041. Using Form 1041-V allows us to

process the payment more accurately and efficiently. We

The IRS can’t accept a single check (including a cashier’s

strongly encourage you to use Form 1041-V, but there is

check) for amounts of $100,000,000 ($100 million) or

no penalty if you don’t.

more. If you’re sending $100 million or more by check,

you’ll need to spread the payments over two or more

You may choose to pay any balance due electronically.

checks with each check made out for an amount less

If you do, you don’t need to send in Form 1041-V. For

than $100 million. The $100 million or more amount limit

more information about electronic payment options, go to

doesn’t apply to other methods of payment (such as

electronic payments), so please consider paying by

How To Fill In Form 1041-V

means other than checks.

Line 1. Enter the estate’s or trust’s employer identification

How To Send In the Estate’s or Trust’s 2017

number (EIN) as shown on its return.

Tax Return, Payment, and Form 1041-V

Line 2. Enter the amount you are paying by check or

• Detach Form 1041-V along the dotted line.

money order.

• Don’t staple or otherwise attach the payment or Form

Line 3. Enter the name of the estate or trust.

1041-V to the return or to each other. Instead, just put

Line 4. Enter your name and title.

them loose in an envelope.

Line 5. Enter your address exactly as shown on the

• Mail the estate’s or trust’s 2017 tax return, payment,

estate’s or trust’s return. Please print clearly.

and Form 1041-V to the address shown on the back that

applies to you.

How To Prepare the Payment

• Make the check or money order payable to “United

States Treasury.” Don’t send cash.

• Make sure the name of the estate or trust appears on

the check or money order.

1041-V

Form

(2017)

Cat. No. 54561M

Detach Here and Mail With Your Payment and Return

▼

▼

1041-V

Payment Voucher

OMB No. 1545-0092

2017

Make your check or money order payable to “United States Treasury”

▶

Department of the Treasury

Don’t staple or attach this voucher to your payment or return

▶

Internal Revenue Service (99)

Dollars

Cents

1 Employer identification number (EIN)

2 Amount you are

paying by check

or money order

3 Name of estate or trust

4 Name and title of fiduciary

5 Address of fiduciary (number, street, and room or suite no.)

City, state, and ZIP code

For Paperwork Reduction Act Notice, see the Instructions for Form 1041.

Cat. No. 54561M

1

1 2

2