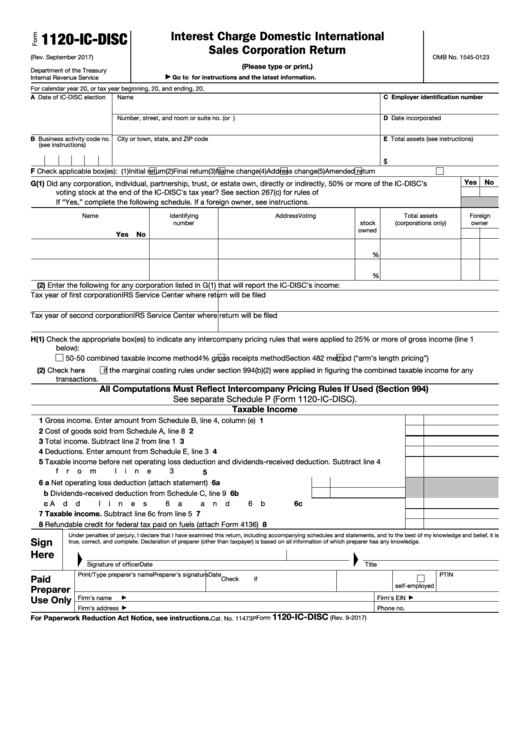

Interest Charge Domestic International

1120-IC-DISC

Sales Corporation Return

(Rev. September 2017)

OMB No. 1545-0123

(Please type or print.)

Department of the Treasury

Go to for instructions and the latest information.

Internal Revenue Service

▶

.

For calendar year 20

, or tax year beginning

, 20

, and ending

, 20

A Date of IC-DISC election

Name

C Employer identification number

D Date incorporated

Number, street, and room or suite no. (or P.O. box if mail is not delivered to street address)

B Business activity code no.

City or town, state, and ZIP code

E Total assets (see instructions)

(see instructions)

$

F

Check applicable box(es): (1)

Initial return

(2)

Final return (3)

Name change

(4)

Address change

(5)

Amended return

Yes

No

G(1)

Did any corporation, individual, partnership, trust, or estate own, directly or indirectly, 50% or more of the IC-DISC’s

voting stock at the end of the IC-DISC’s tax year? See section 267(c) for rules of attribution

.

.

.

.

.

.

.

.

.

If “Yes,” complete the following schedule. If a foreign owner, see instructions.

Name

Identifying

Address

Voting

Total assets

Foreign

number

stock

(corporations only)

owner

owned

Yes

No

%

%

(2)

Enter the following for any corporation listed in G(1) that will report the IC-DISC’s income:

Tax year of first corporation

IRS Service Center where return will be filed

Tax year of second corporation

IRS Service Center where return will be filed

H(1)

Check the appropriate box(es) to indicate any intercompany pricing rules that were applied to 25% or more of gross income (line 1

below):

50-50 combined taxable income method

4% gross receipts method

Section 482 method (“arm’s length pricing”)

(2)

Check here

if the marginal costing rules under section 994(b)(2) were applied in figuring the combined taxable income for any

transactions.

All Computations Must Reflect Intercompany Pricing Rules If Used (Section 994)

See separate Schedule P (Form 1120-IC-DISC).

Taxable Income

1

Gross income. Enter amount from Schedule B, line 4, column (e) .

.

.

.

.

.

.

.

.

.

.

.

.

1

2

2

Cost of goods sold from Schedule A, line 8

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

3

Total income. Subtract line 2 from line 1

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

3

4

Deductions. Enter amount from Schedule E, line 3

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

4

5

Taxable income before net operating loss deduction and dividends-received deduction. Subtract line 4

from line 3 .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

5

6 a

Net operating loss deduction (attach statement) .

.

.

.

.

.

.

.

.

6a

b

Dividends-received deduction from Schedule C, line 9 .

.

.

.

.

.

.

6b

c

6c

Add lines 6a and 6b .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

7

Taxable income. Subtract line 6c from line 5 .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

7

8

Refundable credit for federal tax paid on fuels (attach Form 4136)

.

.

.

.

.

.

.

.

.

.

.

.

8

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is

Sign

true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Here

Signature of officer

Date

Title

Print/Type preparer's name

Preparer's signature

Date

PTIN

Paid

Check

if

self-employed

Preparer

Use Only

Firm's name

Firm's EIN

▶

▶

Firm's address

Phone no.

▶

1120-IC-DISC

For Paperwork Reduction Act Notice, see instructions.

Form

(Rev. 9-2017)

Cat. No. 11473P

1

1 2

2 3

3 4

4 5

5 6

6