3

Form 8945 (Rev. 10-2017)

Page

If you submit an original valid passport (or a certified or

Lines 3a, b, and c. Enter your birth information as it

notarized copy of a valid passport), you do not need to

corresponds to your identification documents. Complete line 3c

submit any other documents. Otherwise, you must submit at

only if your name at birth is different from the name you entered

least two of the documents listed below. The documents must

on line 1.

be current, verify your name, and verify that you are a U.S.

Line 5. Check the box indicating the type of document(s) you

citizen. If you submit copies of documents that display

are submitting for identification. You must submit documents as

information on both sides, copies of both the front and back

explained earlier under How To Apply.

must be attached to the Form 8945. At least one document

Signatures. The completed Form 8945 must be signed and

must contain your photograph. At least one document must

dated by the applicant in Part I and by the authorized

verify both your identity and U.S. citizenship. Do not attach

representative of the religious group/district/congregation in

expired documents; expired documents will not be accepted.

Part II.

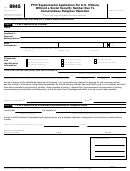

Can be used to establish:

Privacy Act and Paperwork Reduction Act Notice. We ask for

Supporting Documentation

Identity

U.S. Citizenship

the information on this form to carry out the Internal Revenue

laws of the United States. This information will be used to issue

U.S. Passport (the only stand-alone

a Preparer Tax Identification Number (PTIN). Our authority to

document)

X

X

collect this information is found in section 3710 of the Internal

Revenue Service Restructuring and Reform Act of 1998 and

Internal Revenue Code section 6109. Under section 6109, return

U.S. Passport card

X

X

preparers are required to provide their identification number on

what they prepare. Applying for a PTIN is mandatory if you

U.S. Driver's license

X

prepare U.S. tax returns for compensation. Providing

incomplete information may delay or prevent processing of this

application; providing false or fraudulent information may

U.S. Military ID card

X

subject you to penalties.

You are not required to provide the information requested on

X

Foreign Military ID card

a form that is subject to the Paperwork Reduction Act unless

the form displays a valid OMB control number. Books or

U.S. State ID card

X

records relating to a form or its instructions must be retained as

long as their contents may become material in the

administration of any Internal Revenue law. Generally, the

Voter's registration card

X

X

information you provide on this form is confidential pursuant to

the Privacy Act of 1974 and tax returns and return information

X

X

Civil birth certificate

are confidential pursuant to Code section 6103. However, we

are authorized to disclose this information to contractors to

Naturalization papers

X

X

perform the contract, to the Department of Justice for civil and

criminal litigation, and to cities, states, the District of Columbia,

Keep a copy of the application for your records.

and U.S. commonwealths and possessions for use in their

return preparer oversight activities and administration of their

You must submit the proper supporting

▲

!

documentation with Form 8945. If you do not provide

tax laws. We may also disclose this information to other

the proper supporting documentation, your

countries under a tax treaty, to federal and state agencies to

CAUTION

application will not be processed.

enforce federal nontax criminal laws, or to federal law

enforcement and intelligence agencies to combat terrorism.

Specific Instructions

The time needed to complete and file this form will vary

depending on individual circumstances. The estimated burden

Line 1. Enter your legal name on line 1 as it appears on your

for those who file this form is shown below.

documents. This entry should reflect your name as it will be

entered on tax returns that you are paid to prepare.

Recordkeeping

.

.

.

.

.

.

.

.

.

.

. 4 hr., 32 min.

Lines 2a and b. Enter your complete mailing address on line 2.

Learning about the law or the form .

.

.

.

. 0 hr., 40 min.

Your original documents will be returned to the address you

Preparing and sending the form .

.

.

.

.

. 1 hr., 58 min.

enter on line 2.

If you have comments concerning the accuracy of these time

Note: If the U.S. Postal Service will not deliver mail to your

estimates or suggestions for making this form simpler, we would

physical location, enter the U.S. Postal Service’s post office box

be happy to hear from you. You can send us comments from

number for your mailing address. Contact your local U.S. Post

Or you can send your comments

Office for more information. Do not use a post office box owned

to Internal Revenue Service, Tax Forms and Publications

by a private firm or company.

Division, 1111 Constitution Ave. NW, IR-6526, Washington, DC

20224. Do not send this form to this address. Instead, see

Applying by mail, earlier.

1

1 2

2 3

3