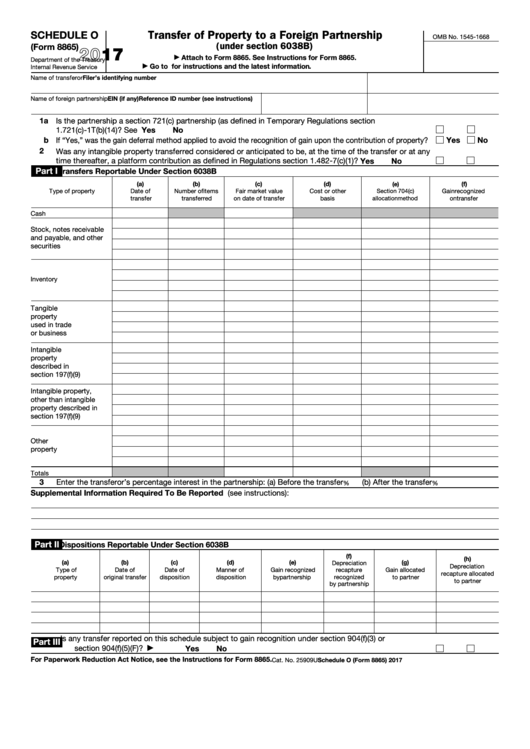

Transfer of Property to a Foreign Partnership

SCHEDULE O

OMB No. 1545-1668

(under section 6038B)

(Form 8865)

2017

Attach to Form 8865. See Instructions for Form 8865.

▶

Department of the Treasury

Go to for instructions and the latest information.

Internal Revenue Service

▶

Name of transferor

Filer’s identifying number

Name of foreign partnership

EIN (if any)

Reference ID number (see instructions)

1 a Is the partnership a section 721(c) partnership (as defined in Temporary Regulations section

Yes

No

1.721(c)-1T(b)(14)? See instructions .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

b If “Yes,” was the gain deferral method applied to avoid the recognition of gain upon the contribution of property?

Yes

No

2

Was any intangible property transferred considered or anticipated to be, at the time of the transfer or at any

time thereafter, a platform contribution as defined in Regulations section 1.482-7(c)(1)? .

.

.

.

.

.

.

Yes

No

Part I

Transfers Reportable Under Section 6038B

(a)

(b)

(c)

(d)

(e)

(f)

Type of property

Date of

Number of items

Fair market value

Cost or other

Section 704(c)

Gain recognized

allocation method

transfer

transferred

on date of transfer

basis

on transfer

Cash

Stock, notes receivable

and payable, and other

securities

Inventory

Tangible

property

used in trade

or business

Intangible

property

described in

section 197(f)(9)

Intangible property,

other than intangible

property described in

section 197(f)(9)

Other

property

Totals

3

Enter the transferor’s percentage interest in the partnership: (a) Before the transfer

(b) After the transfer

%

%

Supplemental Information Required To Be Reported (see instructions):

Part II

Dispositions Reportable Under Section 6038B

(f)

(h)

(a)

(b)

(c)

(d)

(e)

(g)

Depreciation

Depreciation

Type of

Date of

Date of

Manner of

Gain recognized

recapture

Gain allocated

recapture allocated

recognized

property

original transfer

disposition

disposition

by partnership

to partner

to partner

by partnership

Is any transfer reported on this schedule subject to gain recognition under section 904(f)(3) or

Part III

section 904(f)(5)(F)? .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

Yes

No

▶

For Paperwork Reduction Act Notice, see the Instructions for Form 8865.

Cat. No. 25909U

Schedule O (Form 8865) 2017

1

1