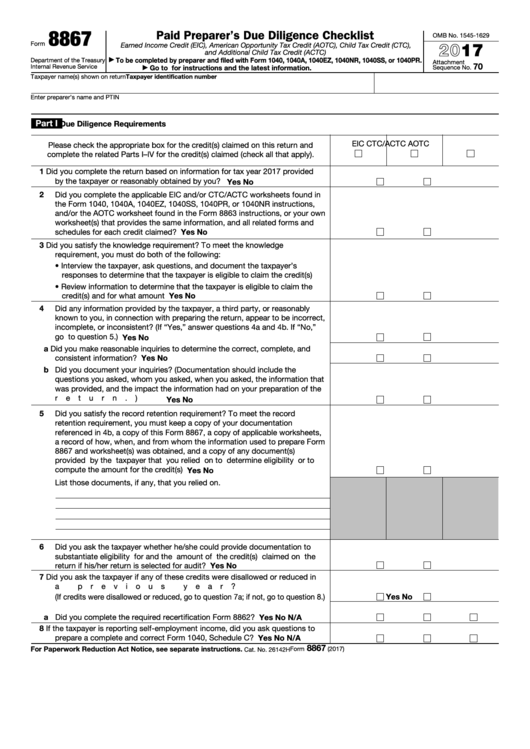

8867

Paid Preparer’s Due Diligence Checklist

OMB No. 1545-1629

2017

Form

Earned Income Credit (EIC), American Opportunity Tax Credit (AOTC), Child Tax Credit (CTC),

and Additional Child Tax Credit (ACTC)

To be completed by preparer and filed with Form 1040, 1040A, 1040EZ, 1040NR, 1040SS, or 1040PR.

Department of the Treasury

▶

Attachment

70

Internal Revenue Service

Go to for instructions and the latest information.

Sequence No.

▶

Taxpayer name(s) shown on return

Taxpayer identification number

Enter preparer’s name and PTIN

Part I

Due Diligence Requirements

EIC

CTC/ACTC

AOTC

Please check the appropriate box for the credit(s) claimed on this return and

complete the related Parts I–IV for the credit(s) claimed (check all that apply).

1

Did you complete the return based on information for tax year 2017 provided

by the taxpayer or reasonably obtained by you? .

.

.

.

.

.

.

.

.

.

Yes

No

2

Did you complete the applicable EIC and/or CTC/ACTC worksheets found in

the Form 1040, 1040A, 1040EZ, 1040SS, 1040PR, or 1040NR instructions,

and/or the AOTC worksheet found in the Form 8863 instructions, or your own

worksheet(s) that provides the same information, and all related forms and

schedules for each credit claimed?

.

.

.

.

.

.

.

.

.

.

.

.

.

.

Yes

No

3

Did you satisfy the knowledge requirement? To meet the knowledge

requirement, you must do both of the following:

• Interview the taxpayer, ask questions, and document the taxpayer’s

responses to determine that the taxpayer is eligible to claim the credit(s)

• Review information to determine that the taxpayer is eligible to claim the

Yes

No

credit(s) and for what amount .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

4

Did any information provided by the taxpayer, a third party, or reasonably

known to you, in connection with preparing the return, appear to be incorrect,

incomplete, or inconsistent? (If “Yes,” answer questions 4a and 4b. If “No,”

go to question 5.) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

Yes

No

a Did you make reasonable inquiries to determine the correct, complete, and

Yes

No

consistent information?

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

b Did you document your inquiries? (Documentation should include the

questions you asked, whom you asked, when you asked, the information that

was provided, and the impact the information had on your preparation of the

return.) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

Yes

No

5

Did you satisfy the record retention requirement? To meet the record

retention requirement, you must keep a copy of your documentation

referenced in 4b, a copy of this Form 8867, a copy of applicable worksheets,

a record of how, when, and from whom the information used to prepare Form

8867 and worksheet(s) was obtained, and a copy of any document(s)

provided by the taxpayer that you relied on to determine eligibility or to

compute the amount for the credit(s) .

.

.

.

.

.

.

.

.

.

.

.

.

.

Yes

No

List those documents, if any, that you relied on.

6

Did you ask the taxpayer whether he/she could provide documentation to

substantiate eligibility for and the amount of the credit(s) claimed on the

Yes

No

return if his/her return is selected for audit? .

.

.

.

.

.

.

.

.

.

.

.

7

Did you ask the taxpayer if any of these credits were disallowed or reduced in

a previous year?

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

Yes

No

(If credits were disallowed or reduced, go to question 7a; if not, go to question 8.)

a Did you complete the required recertification Form 8862? .

.

.

.

.

.

.

Yes

No

N/A

8

If the taxpayer is reporting self-employment income, did you ask questions to

prepare a complete and correct Form 1040, Schedule C? .

.

.

.

.

.

.

Yes

No

N/A

8867

For Paperwork Reduction Act Notice, see separate instructions.

Form

(2017)

Cat. No. 26142H

1

1 2

2