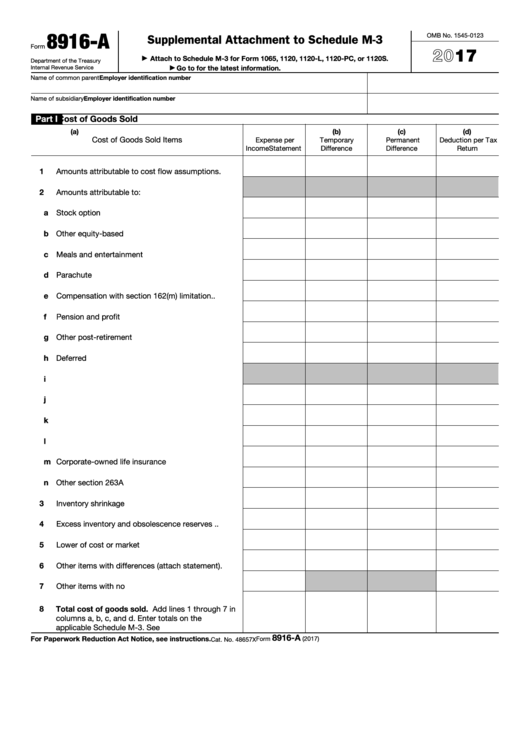

8916-A

OMB No. 1545-0123

Supplemental Attachment to Schedule M-3

Form

2017

Attach to Schedule M-3 for Form 1065, 1120, 1120-L, 1120-PC, or 1120S.

▶

Department of the Treasury

Go to for the latest information.

Internal Revenue Service

▶

Name of common parent

Employer identification number

Employer identification number

Name of subsidiary

Part I

Cost of Goods Sold

(a)

(b)

(c)

(d)

Cost of Goods Sold Items

Expense per

Temporary

Permanent

Deduction per Tax

Income Statement

Difference

Difference

Return

1

Amounts attributable to cost flow assumptions

.

2

Amounts attributable to:

a Stock option expense .

.

.

.

.

.

.

.

.

.

b Other equity-based compensation .

.

.

.

.

.

c Meals and entertainment .

.

.

.

.

.

.

.

.

d Parachute payments .

.

.

.

.

.

.

.

.

.

e Compensation with section 162(m) limitation .

.

f

Pension and profit sharing

.

.

.

.

.

.

.

.

g Other post-retirement benefits .

.

.

.

.

.

.

h Deferred compensation .

.

.

.

.

.

.

.

.

i

Reserved .

.

.

.

.

.

.

.

.

.

.

.

.

.

j

Amortization .

.

.

.

.

.

.

.

.

.

.

.

.

k Depletion .

.

.

.

.

.

.

.

.

.

.

.

.

.

l

Depreciation .

.

.

.

.

.

.

.

.

.

.

.

.

m Corporate-owned life insurance premiums .

.

.

n Other section 263A costs .

.

.

.

.

.

.

.

.

3

Inventory shrinkage accruals.

.

.

.

.

.

.

.

4

Excess inventory and obsolescence reserves .

.

5

Lower of cost or market write-downs .

.

.

.

.

6

Other items with differences (attach statement)

.

7

Other items with no differences .

.

.

.

.

.

.

8

Total cost of goods sold. Add lines 1 through 7 in

columns a, b, c, and d. Enter totals on the

applicable Schedule M-3. See instructions .

.

.

8916-A

For Paperwork Reduction Act Notice, see instructions.

Form

(2017)

Cat. No. 48657X

1

1 2

2 3

3 4

4