3

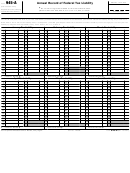

Form 8916-A (2017)

Page

Part I. Cost of Goods Sold

Section references are to the Internal Revenue Code unless

otherwise noted.

Line 1

Future Developments

Report differences attributable to cost flow assumptions, for

For the latest information about developments related to

example, differences between book and tax LIFO

computations. Generally, differences in the LIFO reserves for

Form 8916-A and its instructions, such as legislation

book and tax purposes should be reported on this line.

enacted after they were published, go to

Line 2n

General Instructions

Report differences attributable to section 263A. For example,

if book inventory costs do not equal section 471 inventory

Purpose of Form

costs, report differences between section 471 inventory

costs and section 263A inventory costs. This includes all

Use Form 8916-A to provide a detailed schedule of the

cost of goods sold differences, not just differences

amounts reported on the applicable Schedule M-3 for cost

attributable to additional section 263A cost adjustments to

of goods sold, interest income, and interest expense.

ending inventory. LIFO taxpayers using the simplified

Who Must File

production method or the simplified resale method should

report the amount of additional section 263A costs

Generally, Form 8916-A must be filed for each separate

computed after LIFO computations. LIFO taxpayers not

entity required to file a Schedule M-3 for Form 1065, Form

using a simplified section 263A method should report costs

1065-B, Form 1120, Form 1120-C, Form 1120-L, Form

attributable to additional section 263A prior to performing

1120-PC, or Form 1120S.

LIFO computation. Differences due to purchasing, and

However, certain separate entities that (a) are required to

storage and handling costs, should generally be reported on

file a Schedule M-3 and have less than $50 million in total

line 2n (to the extent not already included in lines 2a through

assets at the end of the tax year or (b) are not required to file

2m). Report the additional section 263A cost adjustments to

a Schedule M-3 and voluntarily file a Schedule M-3, are not

ending inventory on line 2n (and the reversal of the prior year

required to file Form 8916-A but may voluntarily do so. See

ending inventory, if applicable).

the instructions for the applicable Schedule M-3 for each

Lines 4 and 5

separate entity.

Note. Schedule M-3 (Form 1120) mixed group filers, all

If the taxpayer does not distinguish between obsolescence

Schedule M-3 (Form 1120-L) filers, and all Schedule M-3

and excess inventory reserves and lower of cost or market

(Form 1120-PC) filers must file Form 8916-A.

write-downs in its general ledger, report all amounts relating

to these reserves on line 4 for excess inventory and

Consolidated groups. In the case of a consolidated tax

obsolescence reserves.

group, a Form 8916-A must be filed as part of the Schedules

M-3 prepared for the parent company, each subsidiary, the

Line 6

eliminations Schedule M-3, and the consolidated Schedule

Attach a statement that separately states and adequately

M-3. It is not required that the supporting detail for Form

discloses the nature and amount of each expense reported

8916-A, Part I, line 6, be presented for the eliminations

on this line. See the instructions for the applicable Schedule

Schedule M-3 or the consolidated Schedule M-3.

M-3 for a definition of “separately stated and adequately

Mixed groups. In the case of a mixed group (as described in

disclosed.” It is not required that the supporting detail for

the instructions for Schedule M-3 for Form 1120, Form

Form 8916-A, Part I, line 6, be presented for the eliminations

1120-L, and Form 1120-PC), a Form 8916-A, if applicable, is

Schedule M-3 or the consolidated Schedule M-3. Report

required at the sub-consolidated level and the sub-

differences between book inventory costs and section 471

consolidated elimination level.

inventory costs on this line.

How To File

Line 7

Attach Form 8916-A to each applicable separate Schedule

Report all other items with no differences on this line. For

M-3.

example, if book inventory costs equal section 471 inventory

costs, this line should report total book inventory and section

Specific Instructions

471 inventory costs without regard to amounts reported on

lines 1 through 5.

Note. Any filer that completes Parts II and III of Schedule

Line 8

M-3 (Form 1120) and Form 8916-A, must complete all

columns, without exception. See the instructions for Parts II

Line 8 should equal the amount reported on Schedule M-3

(Form 1120), Part II, line 17; Schedule M-3 (Form 1120S),

and III of the applicable Schedule M-3.

Part II, line 15; or Schedule M-3 (Form 1065), Part II, line 15.

See the instructions for the applicable Schedule M-3.

1

1 2

2 3

3 4

4