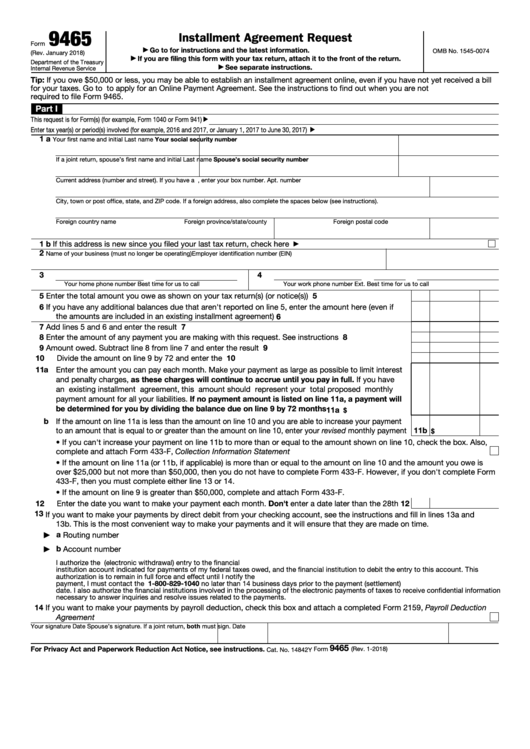

9465

Installment Agreement Request

Form

Go to for instructions and the latest information.

▶

OMB No. 1545-0074

(Rev. January 2018)

If you are filing this form with your tax return, attach it to the front of the return.

▶

Department of the Treasury

See separate instructions.

▶

Internal Revenue Service

Tip: If you owe $50,000 or less, you may be able to establish an installment agreement online, even if you have not yet received a bill

for your taxes. Go to to apply for an Online Payment Agreement. See the instructions to find out when you are not

required to file Form 9465.

Part I

This request is for Form(s) (for example, Form 1040 or Form 941)

▶

Enter tax year(s) or period(s) involved (for example, 2016 and 2017, or January 1, 2017 to June 30, 2017)

▶

1 a

Your first name and initial

Last name

Your social security number

Spouse’s social security number

If a joint return, spouse’s first name and initial

Last name

Current address (number and street). If you have a P.O. box and no home delivery, enter your box number.

Apt. number

City, town or post office, state, and ZIP code. If a foreign address, also complete the spaces below (see instructions).

Foreign country name

Foreign province/state/county

Foreign postal code

1 b If this address is new since you filed your last tax return, check here

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

▶

2

Name of your business (must no longer be operating)

Employer identification number (EIN)

3

4

Your home phone number

Best time for us to call

Your work phone number

Ext.

Best time for us to call

5

5

Enter the total amount you owe as shown on your tax return(s) (or notice(s)) .

.

.

.

.

.

.

.

6

If you have any additional balances due that aren't reported on line 5, enter the amount here (even if

the amounts are included in an existing installment agreement) .

.

.

.

.

.

.

.

.

.

.

.

6

7

Add lines 5 and 6 and enter the result

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

7

8

Enter the amount of any payment you are making with this request. See instructions .

.

.

.

.

8

9

Amount owed. Subtract line 8 from line 7 and enter the result

.

.

.

.

.

.

.

.

.

.

.

.

9

10

10

Divide the amount on line 9 by 72 and enter the result .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

11 a Enter the amount you can pay each month. Make your payment as large as possible to limit interest

and penalty charges, as these charges will continue to accrue until you pay in full. If you have

an existing installment agreement, this amount should represent your total proposed monthly

payment amount for all your liabilities. If no payment amount is listed on line 11a, a payment will

be determined for you by dividing the balance due on line 9 by 72 months .

.

.

.

.

.

.

11a

$

b If the amount on line 11a is less than the amount on line 10 and you are able to increase your payment

11b

to an amount that is equal to or greater than the amount on line 10, enter your revised monthly payment

$

• If you can't increase your payment on line 11b to more than or equal to the amount shown on line 10, check the box. Also,

complete and attach Form 433-F, Collection Information Statement .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

• If the amount on line 11a (or 11b, if applicable) is more than or equal to the amount on line 10 and the amount you owe is

over $25,000 but not more than $50,000, then you do not have to complete Form 433-F. However, if you don't complete Form

433-F, then you must complete either line 13 or 14.

• If the amount on line 9 is greater than $50,000, complete and attach Form 433-F.

12

Enter the date you want to make your payment each month. Don't enter a date later than the 28th

12

13

If you want to make your payments by direct debit from your checking account, see the instructions and fill in lines 13a and

13b. This is the most convenient way to make your payments and it will ensure that they are made on time.

a Routing number

▶

b Account number

▶

I authorize the U.S. Treasury and its designated Financial Agent to initiate a monthly ACH debit (electronic withdrawal) entry to the financial

institution account indicated for payments of my federal taxes owed, and the financial institution to debit the entry to this account. This

authorization is to remain in full force and effect until I notify the U.S. Treasury Financial Agent to terminate the authorization. To revoke

payment, I must contact the U.S. Treasury Financial Agent at 1-800-829-1040 no later than 14 business days prior to the payment (settlement)

date. I also authorize the financial institutions involved in the processing of the electronic payments of taxes to receive confidential information

necessary to answer inquiries and resolve issues related to the payments.

14

If you want to make your payments by payroll deduction, check this box and attach a completed Form 2159, Payroll Deduction

Agreement

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

Your signature

Date

Spouse’s signature. If a joint return, both must sign.

Date

9465

For Privacy Act and Paperwork Reduction Act Notice, see instructions.

Form

(Rev. 1-2018)

Cat. No. 14842Y

1

1 2

2