Nebraska And City Sales And Use Tax Return Form 10 Schedule Instructions

ADVERTISEMENT

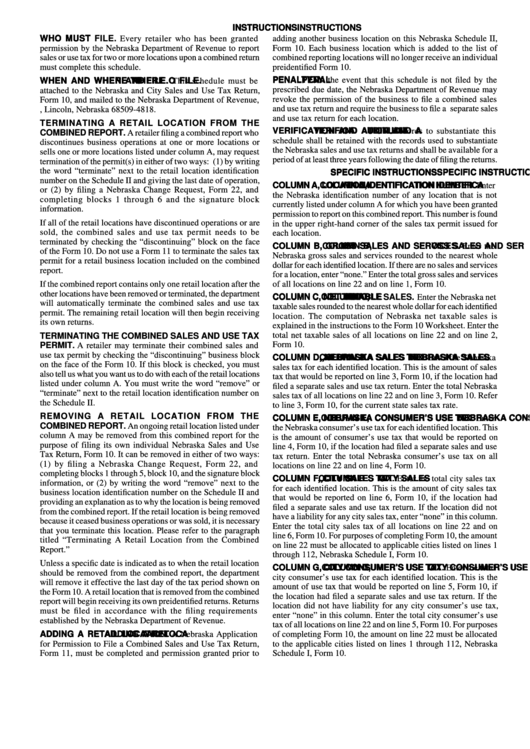

INSTRUCTIONS

INSTRUCTIONS

INSTRUCTIONS

INSTRUCTIONS

INSTRUCTIONS

WHO MUST FILE.

WHO MUST FILE.

WHO MUST FILE.

WHO MUST FILE.

WHO MUST FILE. Every retailer who has been granted

adding another business location on this Nebraska Schedule II,

permission by the Nebraska Department of Revenue to report

Form 10. Each business location which is added to the list of

sales or use tax for two or more locations upon a combined return

combined reporting locations will no longer receive an individual

must complete this schedule.

preidentified Form 10.

PENAL

PENAL

PENAL

PENAL

PENALTY

TY

TY

TY

TY. . . . . In the event that this schedule is not filed by the

WHEN AND

WHEN AND

WHEN AND

WHEN AND

WHEN AND WHERE

WHERE

WHERE

WHERE

WHERE T T T T T O FILE.

O FILE.

O FILE.

O FILE. This schedule must be

O FILE.

prescribed due date, the Nebraska Department of Revenue may

attached to the Nebraska and City Sales and Use Tax Return,

revoke the permission of the business to file a combined sales

Form 10, and mailed to the Nebraska Department of Revenue,

and use tax return and require the business to file a separate sales

P.O. Box 94818, Lincoln, Nebraska 68509-4818.

and use tax return for each location.

TERMINATING A RETAIL LOCATION FROM THE

VERIFICA

VERIFICA

TION AND A

TION AND A

UDIT

UDIT

UDIT. . . . . Records to substantiate this

VERIFICA

VERIFICA

VERIFICATION AND A

TION AND A

TION AND AUDIT

UDIT

COMBINED REPORT. A retailer filing a combined report who

schedule shall be retained with the records used to substantiate

discontinues business operations at one or more locations or

the Nebraska sales and use tax returns and shall be available for a

sells one or more locations listed under column A, may request

period of at least three years following the date of filing the returns.

termination of the permit(s) in either of two ways: (1) by writing

the word “terminate” next to the retail location identification

SPECIFIC INSTRUCTIONS

SPECIFIC INSTRUCTIONS

SPECIFIC INSTRUCTIONS

SPECIFIC INSTRUCTIONS

SPECIFIC INSTRUCTIONS

number on the Schedule II and giving the last date of operation,

COLUMN A,

COLUMN A,

COLUMN A,

COLUMN A,

COLUMN A, LOCA

LOCA

LOCA

LOCA

LOCATION IDENTIFICA

TION IDENTIFICA

TION IDENTIFICA

TION IDENTIFICA

TION IDENTIFICATION NUMBER.

TION NUMBER.

TION NUMBER.

TION NUMBER.

TION NUMBER. Enter

or (2) by filing a Nebraska Change Request, Form 22, and

the Nebraska identification number of any location that is not

completing blocks 1 through 6 and the signature block

currently listed under column A for which you have been granted

information.

permission to report on this combined report. This number is found

If all of the retail locations have discontinued operations or are

in the upper right-hand corner of the sales tax permit issued for

sold, the combined sales and use tax permit needs to be

each location.

terminated by checking the “discontinuing” block on the face

COLUMN B,

COLUMN B,

COLUMN B,

COLUMN B,

COLUMN B, GR

GR

GR

GR

GROSS SALES AND SER

OSS SALES AND SER

OSS SALES AND SER

OSS SALES AND SER

OSS SALES AND SERVICES.

VICES.

VICES.

VICES. Enter the

VICES.

of the Form 10. Do not use a Form 11 to terminate the sales tax

Nebraska gross sales and services rounded to the nearest whole

permit for a retail business location included on the combined

dollar for each identified location. If there are no sales and services

report.

for a location, enter “none.” Enter the total gross sales and services

If the combined report contains only one retail location after the

of all locations on line 22 and on line 1, Form 10.

other locations have been removed or terminated, the department

COLUMN C,

COLUMN C,

NET

NET T T T T T AXABLE SALES.

NET

AXABLE SALES.

AXABLE SALES.

COLUMN C,

COLUMN C,

COLUMN C, NET

NET

AXABLE SALES.

AXABLE SALES. Enter the Nebraska net

will automatically terminate the combined sales and use tax

taxable sales rounded to the nearest whole dollar for each identified

permit. The remaining retail location will then begin receiving

location. The computation of Nebraska net taxable sales is

its own returns.

explained in the instructions to the Form 10 Worksheet. Enter the

total net taxable sales of all locations on line 22 and on line 2,

TERMINATING THE COMBINED SALES AND USE TAX

Form 10.

PERMIT. A retailer may terminate their combined sales and

use tax permit by checking the “discontinuing” business block

COLUMN D

COLUMN D

COLUMN D

COLUMN D

COLUMN D, , , , , NEBRASKA SALES

NEBRASKA SALES

NEBRASKA SALES

NEBRASKA SALES

NEBRASKA SALES T T T T T AX.

AX.

AX.

AX.

AX. Enter the Nebraska

on the face of the Form 10. If this block is checked, you must

sales tax for each identified location. This is the amount of sales

also tell us what you want us to do with each of the retail locations

tax that would be reported on line 3, Form 10, if the location had

listed under column A. You must write the word “remove” or

filed a separate sales and use tax return. Enter the total Nebraska

“terminate” next to the retail location identification number on

sales tax of all locations on line 22 and on line 3, Form 10. Refer

the Schedule II.

to line 3, Form 10, for the current state sales tax rate.

REMOVING A RETAIL LOCATION FROM THE

COLUMN E,

COLUMN E,

COLUMN E,

COLUMN E,

COLUMN E, NEBRASKA CONSUMER’S USE

NEBRASKA CONSUMER’S USE

NEBRASKA CONSUMER’S USE

NEBRASKA CONSUMER’S USE

NEBRASKA CONSUMER’S USE T T T T T AX.

AX.

AX.

AX. Enter

AX.

COMBINED REPORT. An ongoing retail location listed under

the Nebraska consumer’s use tax for each identified location. This

column A may be removed from this combined report for the

is the amount of consumer’s use tax that would be reported on

purpose of filing its own individual Nebraska Sales and Use

line 4, Form 10, if the location had filed a separate sales and use

Tax Return, Form 10. It can be removed in either of two ways:

tax return. Enter the total Nebraska consumer’s use tax on all

(1) by filing a Nebraska Change Request, Form 22, and

locations on line 22 and on line 4, Form 10.

completing blocks 1 through 5, block 10, and the signature block

COLUMN F

COLUMN F

COLUMN F

COLUMN F

COLUMN F, , , , , CITY SALES

CITY SALES

CITY SALES

CITY SALES

CITY SALES T T T T T AX.

AX.

AX.

AX.

AX. Enter the total city sales tax

information, or (2) by writing the word “remove” next to the

for each identified location. This is the amount of city sales tax

business location identification number on the Schedule II and

that would be reported on line 6, Form 10, if the location had

providing an explanation as to why the location is being removed

filed a separate sales and use tax return. If the location did not

from the combined report. If the retail location is being removed

have a liability for any city sales tax, enter “none” in this column.

because it ceased business operations or was sold, it is necessary

Enter the total city sales tax of all locations on line 22 and on

that you terminate this location. Please refer to the paragraph

line 6, Form 10. For purposes of completing Form 10, the amount

titled “Terminating A Retail Location from the Combined

on line 22 must be allocated to applicable cities listed on lines 1

Report.”

through 112, Nebraska Schedule I, Form 10.

Unless a specific date is indicated as to when the retail location

COLUMN G,

COLUMN G,

COLUMN G,

COLUMN G,

COLUMN G, CITY CONSUMER’S USE

CITY CONSUMER’S USE

CITY CONSUMER’S USE

CITY CONSUMER’S USE

CITY CONSUMER’S USE T T T T T AX.

AX.

AX.

AX.

AX. Enter the total

should be removed from the combined report, the department

city consumer’s use tax for each identified location. This is the

will remove it effective the last day of the tax period shown on

amount of use tax that would be reported on line 5, Form 10, if

the Form 10. A retail location that is removed from the combined

the location had filed a separate sales and use tax return. If the

report will begin receiving its own preidentified returns. Returns

location did not have liability for any city consumer’s use tax,

must be filed in accordance with the filing requirements

enter “none” in this column. Enter the total city consumer’s use

established by the Nebraska Department of Revenue.

tax of all locations on line 22 and on line 5, Form 10. For purposes

ADDING A RET

ADDING A RET

AIL LOCA

AIL LOCA

TION.

TION.

ADDING A RET

ADDING A RET

ADDING A RETAIL LOCA

AIL LOCA

AIL LOCATION.

TION.

TION. A Nebraska Application

of completing Form 10, the amount on line 22 must be allocated

for Permission to File a Combined Sales and Use Tax Return,

to the applicable cities listed on lines 1 through 112, Nebraska

Form 11, must be completed and permission granted prior to

Schedule I, Form 10.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1