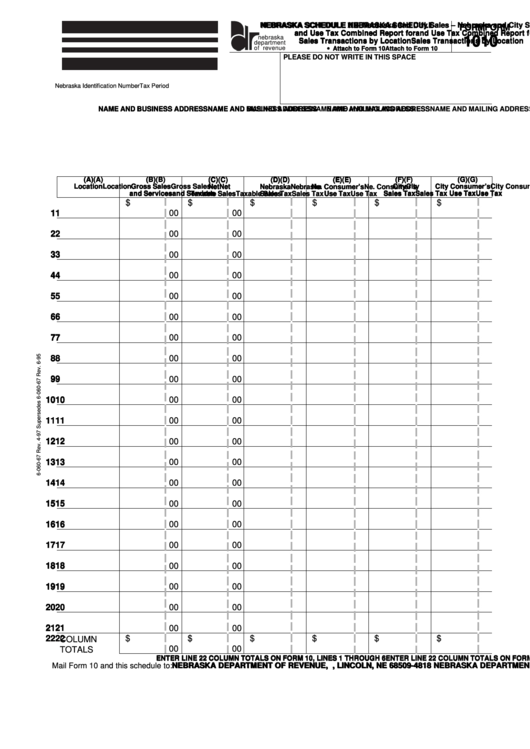

NEBRASKA SCHEDULE

NEBRASKA SCHEDULE

NEBRASKA SCHEDULE

NEBRASKA SCHEDULE

NEBRASKA SCHEDULE II II II II II – Nebraska and City Sales

– Nebraska and City Sales

– Nebraska and City Sales

– Nebraska and City Sales

– Nebraska and City Sales

FORM

FORM

FORM

FORM

FORM

and Use Tax Combined Report for

and Use Tax Combined Report for

and Use Tax Combined Report for

and Use Tax Combined Report for

and Use Tax Combined Report for

nebraska

10

10

10

10

10

Sales Transactions by Location

Sales Transactions by Location

Sales Transactions by Location

Sales Transactions by Location

Sales Transactions by Location

department

of revenue

Attach to Form 10

Attach to Form 10

Attach to Form 10

Attach to Form 10

Attach to Form 10

PLEASE DO NOT WRITE IN THIS SPACE

Nebraska Identification Number

Tax Period

NAME AND BUSINESS ADDRESS

NAME AND BUSINESS ADDRESS

NAME AND BUSINESS ADDRESS

NAME AND MAILING ADDRESS

NAME AND MAILING ADDRESS

NAME AND MAILING ADDRESS

NAME AND BUSINESS ADDRESS

NAME AND BUSINESS ADDRESS

NAME AND MAILING ADDRESS

NAME AND MAILING ADDRESS

(A)

(A)

(A)

(B)

(B)

(B)

(F)

(F)

(G)

(G)

(G)

(A)

(A)

(B)

(B)

(C)

(C)

(C)

(C)

(C)

(D)

(D)

(D)

(D)

(D)

(E)

(E)

(E)

(E)

(E)

(F)

(F)

(F)

(G)

(G)

Location

Location

Location

Gross Sales

Gross Sales

Gross Sales

City

City

City

City Consumer’s

City Consumer’s

City Consumer’s

Location

Location

Gross Sales

Gross Sales

Net

Net

Net

Net

Net

Nebraska

Nebraska

Nebraska

Nebraska

Nebraska

Ne. Consumer’s

Ne. Consumer’s

Ne. Consumer’s

Ne. Consumer’s

Ne. Consumer’s

City

City

City Consumer’s

City Consumer’s

I.D. Number

I.D. Number

I.D. Number

I.D. Number

I.D. Number

and Services

and Services

and Services

Sales Tax

Sales Tax

Sales Tax

Use Tax

Use Tax

Use Tax

Use Tax

Use Tax

and Services

and Services

Taxable Sales

Taxable Sales

Taxable Sales

Taxable Sales

Taxable Sales

Sales Tax

Sales Tax

Sales Tax

Sales Tax

Sales Tax

Use Tax

Use Tax

Use Tax

Use Tax

Use Tax

Sales Tax

Sales Tax

$

$

$

$

$

$

1 1 1 1 1

00

00

2 2 2 2 2

00

00

3 3 3 3 3

00

00

4 4 4 4 4

00

00

5 5 5 5 5

00

00

6 6 6 6 6

00

00

7 7 7 7 7

00

00

8 8 8 8 8

00

00

9 9 9 9 9

00

00

10

10

10

00

00

10

10

11

11

11

11

11

00

00

12

12

12

12

12

00

00

13

13

13

13

13

00

00

14

14

14

14

14

00

00

15

15

15

00

00

15

15

16

16

16

16

16

00

00

17

17

17

17

17

00

00

18

18

18

18

18

00

00

19

19

19

19

19

00

00

20

20

20

00

00

20

20

21

21

21

21

21

00

00

22

22

22

22

22

$

$

$

$

$

$

COLUMN

00

00

TOTALS

ENTER LINE 22 COLUMN TOTALS ON FORM 10, LINES 1 THROUGH 6

ENTER LINE 22 COLUMN TOTALS ON FORM 10, LINES 1 THROUGH 6

ENTER LINE 22 COLUMN TOTALS ON FORM 10, LINES 1 THROUGH 6

ENTER LINE 22 COLUMN TOTALS ON FORM 10, LINES 1 THROUGH 6

ENTER LINE 22 COLUMN TOTALS ON FORM 10, LINES 1 THROUGH 6

Mail Form 10 and this schedule to: NEBRASKA DEPARTMENT OF REVENUE, P.O. BOX 94818, LINCOLN, NE 68509-4818

NEBRASKA DEPARTMENT OF REVENUE, P.O. BOX 94818, LINCOLN, NE 68509-4818

NEBRASKA DEPARTMENT OF REVENUE, P.O. BOX 94818, LINCOLN, NE 68509-4818

NEBRASKA DEPARTMENT OF REVENUE, P.O. BOX 94818, LINCOLN, NE 68509-4818

NEBRASKA DEPARTMENT OF REVENUE, P.O. BOX 94818, LINCOLN, NE 68509-4818

1

1